Improved Cook Stoves Consumer Insights in Mozambique

Introduction

This article provides a snapshot of the ICS market in Mozambique particularly the consumer insights i.e awareness level, willingness to pay, access to finance and affordability. For information about market size, actors active in the market and other market insights, click here.

In this article, the term improved cookstoves (ICS) includes efficient cookstoves that burn different solid biomass such as firewood, charcoal, agricultural residues, animal dung and other solid biomass products. Advanced or high tier cookstoves (ACS) are fuelled by LPG, biogas, solar energy or electricity and are mentioned in some sections of this article. ACS are not included in the term ICS, however they are included in the terms clean cooking solutions and clean cooking technologies.

Consumer Insights

For successful market penetration and sale of cookstoves, it is important to take several factors into consideration. The consumer preference for a certain stove design, preference for fuel type, and the willingness and affordability of the consumer to pay for the ICS is influenced by:

- Household Economics

- Household Income

- Household expenditure

- Willingness to pay

- Non-economic

- Household size

- Household age

- Education

- Behavioural and Cultural

- Food preferences

- Cooking practices

- Enabling factors

- Government supported policies and interventions

- End-user financing

- Product diversity and availability

The type of stove a customer is willing to buy also depends on geographical factors which influences the availability of fuel resources, and the household fuel preferences. Regarding fuel availability, the cookstove model that is being introduced should use the available fuel. Regarding household preferences, the cookstoves design has to be adopted to the local cuisine and in many areas, cookstoves are also used as a space heater during night. Thus, ICS market development should incooperate these considerations to reach end-consumers and increase adaptability of cookstoves[1].

Consumer Cooking Practices

Based on the cooking exercise conducted by the MECS and EnDev programme in Mozambique, a typical household has the following cooking needs in an average week[2]:

- Staple dishes such as rice, sweet potatoes, cassava: 12x per week

- Hot drinks such as tea: 7x per week

- Lighter stews and curries like vegetable curry, fish curry: 5x per week

- Shallow fried dishes such as eggs, potatoes: 4x per week

- Dishes that need longer cooking time like beans:. 1x per week

- Dishes that needs roasting: 1x per week

A typical daily food profile will include the following:

Breakfast: Tea, bread, or cassava or sweet potato

Lunch and dinner: Rice, beans, meat or fish stew, lentils and yangana

Usage of ICS and Cooking Fuel

Mozambique has a patriarchal society where man is the head of the household and is mainly responsible for making all household financial decision. However, women are the ones responsible for cooking and thus play a key role in shaping the demand for ICS[1]. Thus, the awareness and sensitisation campaigns should target both men and women.

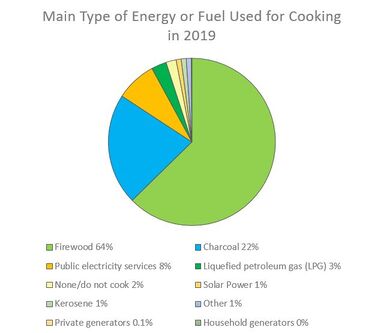

Survey data from 2019 shows that solid biomass (firewood and charcoal) are the preferred fuels for cooking in the whole country. In 2019, the total charcoal production for cooking was 3,064 ktoe[3]. The preferences for either firewood or charcoal is influenced by location, income and education level.

In urban areas 44% of the adult population uses charcoal for cooking, and 29% firewood, while in rural areas, 84% rely on firewood and only 8% use charcoal for cooking. Other forms of energy for cooking, such as electricity also differ considerably depending on location. 17% of adults in urban areas use electricity to cook, and only 2% in rural areas; LPG and solar power is used by 7% and 0.5% of urban population respectively. Solar power has a slightly greater presence in the rural areas, where 1% of the adult population use it for cooking[5].

The use of different cooking fuels is also strongly influenced by income and level of education[1]. In terms of income, survey information from 2019 shows that firewood is preferred by 74% of people with low income, and 71% of people with no income. In terms of education, 82% of the adult population with no education use firewood for cooking, as opposed to 4% of adults with tertiary education. 94% of adults with tertiary education use either charcoal, grid electricity or LPG[5].

Fuel stacking

Fuel stacking refers to the concept that instead of completely transitioning from one stove/fuel to another, households are likely to keep different sources of fuel/stove for different uses. Fuel stacking also can be seen in Mozambique. For e.g. In Maputo, households might have both charcoal as well as LPG stoves. Since LPG is expensive as compared to charcoal, it is used for food that requires less time and need to be prepared fast whereas charcoal stoves are used for cooking food like beans and meat that require a longer time. Some middle and upper middle class families might also have electric appliances like water boiler, microwave etc.

ICS Ownership and Affordability

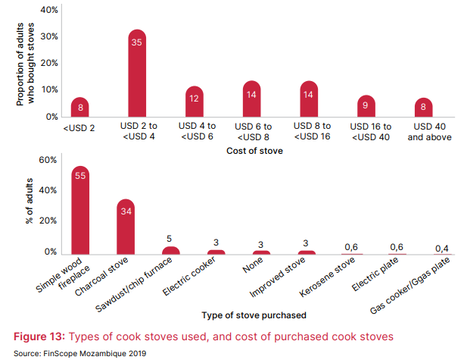

Based on the 2019 survey, only 37% of the surveyed population stated to have purchased their cookstove, while more than half claimed to have made their stoves themselves[5]. The next figures from UNDP-UNCDF show the types of stoves used in Mozambique in 2019 and the costs distribution for cooking stoves purchased by users'. The most common stoves are simple firewood and charcoal stoves and the cost for the most popular stoves ranges between USD 2-4[5].

Survey from Endev in 2019 also shows that households prefer paying in instalments as compared to one-time investment[6].

Repair and Replacement

Since there are no official standards or certification for cookstoves, the warranty/guarantee offered by the companies vary a lot. For eg, the warranty can range anywhere from 3 months for local artisanal stoves (eg. Mbaulas) to 2-3 years for imported stoves (Envirofit, Jikokoa, Smart Stove offered by Pamoja...).

Donor programmes such as EnDev and AVSI have also linked ICS suppliers with the carbon trading programmes. Thus, the businesses are incentivised to offer regular repair and replacement services to adhere to the carbon credit regulations. For the ICS consumers, the replacement rate after the product life cycle has ended is also high. For e.g., some ICS business reported as high as 75% of earlier consumers buying a replacement[6]. Some companies like Carbonsink do not repair the stoves but provide spare parts for their imported stoves (Envirofit and Zama Zama), while others, like MozCarbon and KULIMA, provide repair services.

Consumer Awareness

The consumer awareness about the ICS technology is generally low[7] and there are also no government led awareness campaigns so far[6]. Thus, there is a need for sensitisation and awareness programmes for ICS end-users.

Access to Finance

Overall, access to financial services is increasing largely due to mobile money but still varies greatly from one province to another. As of 2019, 21% of Mozambicans had access to formal institutions such as banks; 22% had access to other non-bank institutes such as micro finance, saving and credit cooperatives, mobile money and pension funds; 11% to informal savings groups called Xitiques and 46% did not have access to any[8]. For more information about access to consumer finance, please refer to this chapter.

Many ICS companies offer subsidised stoves via carbon financing, grant or RBF funding. The end-users can also buy the stoves in installments over a period of months. MozCarbon and Carbonsink offer installment payment of 2 and 3 months respectively while Pamoja offers a 18 month repayment plan (with an initial 10% down-payment). They can use a variety of channels to payback like mobile money, Xitiques and cash payment (collector comes to their home to collect the payment).[9]

Savings Potential

In general, the average monthly expenditure on cooking fuel in Mozambique is 350 MZN (survey from 2016)[10].

In rural areas, firewood is collected free of charge. Only 38% of all Mozambicans households using firewood actually purchased their wood fuel (based on dataset from 2004-2014)[11]. A survey from 2009 calculated that a family of 5 buys around 70 kg of charcoal monthly to meet their fuel demand in Maputo[12]. In 2022, 70 kg of charcoal cost between MZN 2240-2380 (USD 35-37) in Maputo, which is a significant amount that a family has to spend on fuel cost (minimum wage in Mozambique is 10,200 and fuel cost comprises almost 23% of the total salary[13]) . With an improved cookstove, the charcoal usage can drastically be reduced, resulting in increased savings for the family. Thus, in urban areas, where the cooking fuel has to be purchased, there is a strong financial incentive for savings from ICS. However, since households buy cooking fuels in small quantity, sensitization is needed to make them aware of this savings benefit . For eg, on average, a family of five would buy 2 kg of charcoal daily instead of the 70 kg bag[14], thus they might not be aware of the accumulated fuel cost over the month. Offering cookstoves on installment also eases the financial burden on the families who are otherwise unable to afford it upfront.

In rural areas where firewood is collected free of cost, the savings potential (financial aspect) is not of most importance and thus, the awareness program should focus on other aspects of the ICS such as

less fuelwood used means less travel for firewood collection, health impact from less smoke generation etc.

For a list of different cookstoves and their fuel savings potential, click here.

Further Information

- Energy Access Situation in Mozambique

- ICS in Mozambique: Market Landscape

- ICS in Mozambique: Market Size

- ICS in Mozambique: Challenges and Recommendations for the Private Sector

- Webinar: Clean Cooking in Mozambique: Market Status and Opportunities for Private Sector

- Case studies from the sector

References

- ↑ 1.0 1.1 1.2 BERF, ‘Business Environment Constraints in Mozambique’s Renewable Energy Sector: Solar PV Systems and Improved Cook Stoves’,

- ↑ Sakyi-Nyarka.C(2022). Mozambique eCooking Market Assessment. https://mecs.org.uk/wp-content/uploads/2022/02/MECS-EnDev-Mozambique-eCooking-Market-Assessment.pdf

- ↑ ‘Mozambique - Countries & Regions’, IEA, https://www.iea.org/countries/mozambique

- ↑ FinScope Consumer Survey Mozambique 2019 Pocket Guide (English) : FinMark Trust’, http://finmark.org.za.dedi517.jnb2.host-h.net/finscope-consumer-survey-mozambique-2019-pocket-guide-english/

- ↑ 5.0 5.1 5.2 5.3 5.4 Naidoo and Loots, ‘Mozambique / Energy and the Poor – Unpacking the Investment Case for Clean Energy’, https://sun-connect-news.org/fileadmin/DATEIEN/Dateien/New/2021-01-29_UNDP-UNCDF-Mozambique-Energy-and-the-Poor.pdf

- ↑ 6.0 6.1 6.2 EnDev, ‘Workshop Energy Market Scorecard Mozambique ICS 2020’

- ↑ ‘Energy Africa Compact for Mozambique’, https://brilhomoz.com/assets/documents/1_Energy-Africa-Compact-for-Mozambique.pdf

- ↑ Finscope, ‘Mozambique: Finscope Consumer Survey Report 2019’, 2020, https://finmark.org.za/system/documents/files/000/000/155/original/Mozambique_Survey-2020-07-311.pdf?1597303567

- ↑ Clean Cooking in Mozambique : Deep Dive with Experts

- ↑ ‘Mkopa, Market Attractiveness Analysis and Demand Assessment for m-Kopa Solar Systems in Mozambique’, 2016, https://sun-connect-news.org/fileadmin/DATEIEN/Dateien/New/mkopa_2016_oct_market-attractiveness-analysis-and-demand-assessment-for-m-kopa-solar-systems-in-mozambique.pdf

- ↑ ESMAP, ‘Clean and Improved Cooking in Sub-Saharan Africa’, 2015, https://documents1.worldbank.org/curated/en/164241468178757464/pdf/98664-REVISED-WP-P146621-PUBLIC-Box393185B.pdf

- ↑ Takeshi Takama et al., ‘Will African Consumers Buy Cleaner Fuels and Stoves’, 2011, https://mediamanager.sei.org/documents/Publications/SEI-ResearchReport-Takama-WillAfricanConsumersBuyCleanerFuelsAndStoves-2011.pdf

- ↑ Average Salary in Mozambique 2022. http://www.salaryexplorer.com/salary-survey.php?loc=147&loctype=1

- ↑ Takama et al., ‘Will African Consumers Buy Cleaner Fuels and Stoves’. https://mediamanager.sei.org/documents/Publications/SEI-ResearchReport-Takama-WillAfricanConsumersBuyCleanerFuelsAndStoves-2011.pdf