Ethiopia Energy Situation

Capital:

Addis Ababa

Region:

Coordinates:

9.0167° N, 38.7500° E

Total Area (km²): It includes a country's total area, including areas under inland bodies of water and some coastal waterways.

XML error: Mismatched tag at line 6.

Population: It is based on the de facto definition of population, which counts all residents regardless of legal status or citizenship--except for refugees not permanently settled in the country of asylum, who are generally considered part of the population of their country of origin.

XML error: Mismatched tag at line 6. ()

Rural Population (% of total population): It refers to people living in rural areas as defined by national statistical offices. It is calculated as the difference between total population and urban population.

XML error: Mismatched tag at line 6. ()

GDP (current US$): It is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

XML error: Mismatched tag at line 6.2 ()

GDP Per Capita (current US$): It is gross domestic product divided by midyear population

XML error: Mismatched tag at line 6. ()

Access to Electricity (% of population): It is the percentage of population with access to electricity.

XML error: Mismatched tag at line 6.no data

Energy Imports Net (% of energy use): It is estimated as energy use less production, both measured in oil equivalents. A negative value indicates that the country is a net exporter. Energy use refers to use of primary energy before transformation to other end-use fuels, which is equal to indigenous production plus imports and stock changes, minus exports and fuels supplied to ships and aircraft engaged in international transport.

XML error: Mismatched tag at line 6.no data

Fossil Fuel Energy Consumption (% of total): It comprises coal, oil, petroleum, and natural gas products.

XML error: Mismatched tag at line 6.no data

Introduction

Ethiopia is one of the least developed countries in the world. Approximately 34% of its over 100 million inhabitants live below poverty line[1]. It has one of the lowest rates of access to modern energy services, whereby the energy supply is primarily based on biomass. With a share of 92.4% of Ethiopia’s energy supply, waste and biomass are the country’s primary energy sources, followed by oil (5.7%) and hydropower (1.6%)[2]. At the same time the economy is one of the fastest growing in the world, with an average growth of 10,8% since 2005[3]. Besides it has ambitious plans to achieve a climate resilient development till 2025[4]. It was the first developing country which submitted its NDC (Nationally Determined Contribution) at the UNFCCC (United Nations Framework Convention on Climate Change) and therefore takes a leading role in climate policy of the most vulnerable countries to climate change.

Energy Situation

Ethiopia has a final energy consumption of around 40,000 GWh, whereof 92% are consumed by domestic appliances, 4% by transport sector and 3% by industry. Most of the energy supply thereby is covered by bioenergy, which in case of domestic use is usually stemming from unsustainable sources. The produced electricity of ~ 9000 GWh/a is mainly generated by hydro energy (96%) followed by wind energy (4%), whereof in total 11% get exported. In contrast the major share of energy supply for transport is imported in forms of petroleum. [5]

Ethiopia is endowed with renewable energy sources. These include first of all hydro, but also wind, geothermal, solar as well as biomass. Only a small portion of the potential is harnessed today.

Due to its fast economic growth the energy demand is increasing enormous. Therefore it is expected to rise by a rate of 10 -14% per year till 2037. [6]

Today only 27% of the rural population have access to electricity grid. This share is increasing due to an extension of the national grid on the one hand, and an increasing number of Stand-alone-systems and Mini-grids on the other hand.

Hydropower

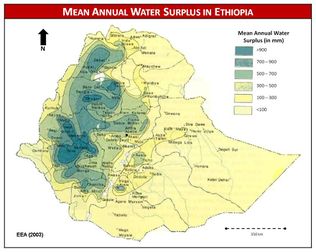

Ethiopia's hydropower potential is estimated up to 45,000 MW and is the 2nd highest in Africa (only DR. Congo has a higher potential). Approximately 30,000 MW is estimated to be economically feasible which is equivalent to an electricity generation of 162 TWh[7][8]. The current production of 3.98 TWh thus equals to an exploitation of only 2.5%. In general, Ethiopia’s terrain is advantageous for hydropower projects. With 10 river basins (of which the Blue Nile, Omo and Wabi Shebelle, and Genale-Dawa are international rivers), hundreds of streams flowing into the major rivers dissecting the mountainous landscape in every direction; and each river basin covering massive catchment areas with adequate rainfall, Ethiopia is said to be the “Water Tower of Eastern Africa”. This is no exaggeration given the fact that Ethiopia alone contributes to about 86% of the waters in the Blue Nile. Moreover, studies conducted by the Ministry of Water Resources (MoWR) estimated that the annual run-off from the major river basins is in the order of 122 billion cubic meters[9].

Besides, the mountainous landscape in the western half and some southern parts of the country makes many of the nation’s hydro resources suitable for hydro-electricity generation of varying sizes, i.e., ranging from pico hydro to small and large hydropower plants. Small-scale hydro schemes are particularly suitable in remote areas, which are not connected to the national grid. The total theoretical potential for micro hydropower schemes is 100 MW[10].

Like all other natural resources, Ethiopia’s hydro resources are unevenly distributed over its land mass. Generally speaking, the amount of rainfall and topographic conditions suitable to hydro-electricity generation, i.e., head decrease as one moves away from west to east until it gets totally arid, flat desert-type in the Ogaden lowlands. While rainfall is in relative abundance in the western and southern parts of the country, it gets moderate in the northern highlands and central plateau (see fig. 6). Thus, it could be argued that the distribution of Ethiopia’s hydro resource is in contrast with that of its wind energy resource, since the former decreases while the latter increases as we descend to the eastern lowlands. And the opposite is true in the western, central and south western highlands[9].

Ethiopia’s hydropower potential has an important contribution to make to its immediate neighbours. Sudan, Kenya, Djibouti, Somalia and Eritrea, as they constitute a readily available market for hydro-electric power within the region. Some of these countries are already facing power shortages and hence are in dire need of electricity to power their economies. As of 2007, EEPCo was undertaking small projects aimed at exporting hydro-electric power to neighbouring Sudan and Djibouti[9].

Since Ethiopia uses a classification of hydropower systems which differs from other countries, the Ethiopian definitions are shown in fig. 5 [11].

Fig. 5[8]:

| Terminology | Capacity limits | Unit |

| Large | >30 | MW |

| Medium | 10 - 30 | MW |

| Small | 1 - 10 | MW |

| Mini | 501 - 1,000 | kW |

| Micro | 11 - 500 | kW |

| Pico | ≤10 | kW |

The costs to explore hydropower potential are relatively low. In fact, hydro installation in Ethiopia costs about US$1,200 per installed kW, or about half the cost of most other plants being built in eastern Africa. Thus, unit generation costs of planned hydropower plants are calculated to be below USD 0.05 per kWh. The levelized cost for transmission is estimated to be 0.007 USD per kWh. This figure for the distribution system is estimated to be 0.014 USD per kWh. Therefore, the levelized cost of power supply for planed power plants is estimated at 0.067 USD per kWh, one of the lowest in the World. The additional power shall serve both the domestic and export demands, since most of Ethiopia’s neighbors will use mainly conventional thermal generations having average generation costs ranging between USD 0.15 and USD 0.24 per kWh. However, power export is expected to be limited by the limited capacity of the interconnector lines. (SREP 4 Investment Plan).

The largest project in the pipeline is the controversial dam and hydropower plant Gilgel Gibe III (MW 1870), which recently came close to financial closure with an agreement between Ethiopia and China. Another big hydro project is the renaissance Dam, formerly known as Great Millennium Dam. This Hydro project shall have a maximum capacity of 5.25 GW, starting with 700 MW in 2015.

For information on challenges and issues affecting the exploitation of hydropower in Ethiopia, click here.

Pico and Micro Hydropower

As mentioned above, the Ethiopian definition of hydropower schemes differ from the ones of other countries. Typically pico hydropower (PHP) plants have a capacity of up to 3 kW. They are characterized by the absence of a distribution grid and supply to one or two households. Nonetheless the pico hydropower range in Ethiopia is extended up to 10 kW which makes sense considering that widely-used injera cookers with capacities of up to 5 kW need to be supplied. Thus two households with one injera cooker each fully absorb the plant’s capacity, without requiring a distribution network. While defining micro hydropower schemes from a range between 11 – 500 kW, it makes sense to distinguish between a lower range (≤30 kW), supplying individual villages without high voltage (HV) transmission and an upper range (31 – 500 kW) for small towns or several villages which are interconnected by HV lines and a low voltage (LV) distribution grid[12]. According to EEA, the specific yield of Ethiopian highlands with a moisture surplus of at least 300 mm/a is 500 W/km² (Given that average pressure heads for potential pico and micro hydro power sites are 45 m, using a 60% system efficiency and a specific minimum flow of 2 l/s/km²).

Since the maximum of micro hydropower (MHP) schemes is defined with 500 kW, the largest catchment area for MHP development is thus 1000 km². Subtracting the catchments >1000 km² from the total of 315,000 km² with perennial flows and a respective moisture surplus, that leaves a land area of 200,000 km² suitable for MHP development. As mentioned above, Ethiopia has thus a theoretical MHP potential of 100 MW[12][8]. Most promising sites can be found in the western part of the country, since suitable topographic conditions and constant flows are prevailing (see fig. 6) [13]. Taken the same data set as a basis for PHP development, a PHP catchment must at least have an area of 15 km². Since a catchment of that size is rarely available to individual farmers, PHP potential is rather limited and allows respective plants only in sparsely populated areas[8]. Apart from the large EEPCo hydropower schemes, small scale hydropower potential has hardly been exploited so far. In the period between 1950 and 1970, EEPCo installed several MHP schemes with a total capacity of 1.5 MW. All of them are not operational anymore: once the areas were connected to ICS, the MHP plants were shut down. Nonetheless, some of the plants are still in good condition and it would be technically feasible to rehabilitate them[8]. The same holds true for the Yaye MHP. The 170 kW off-grid plant was commissioned in 2002 by the Irish Development Aid and the Sidama Development Program but already suffered from low river flow during the 2002/2003 dry season. After only having operated for two years, EEPCo connected Yaye to its ICS and the MHP plant was shut down completely[13].

The GIZ Energising Development (EnDev) Ethiopia is planning to rehabilitate the Yaye plant and to feed the generated power into the national grid, once the scheme is operational again. Furthermore, EnDev implemented four pilot MHP sites (cross-flow turbines) in the Sidama Zone/SNNPR with a capacity of 7 kW (Gobecho I), 30 kW (Gobecho II), 33 kW (Ererte) and 55 kW (Hagara Sodicha) respectively and upgraded a watermill in Jimma Zone/Oromia (Leku) into a 20 kW MHP, further a 10 kW MHP plant in Kersa. Other than that, several pico hydro schemes as well as 32 cross flow turbines exist, which power flour mills with outputs ranging between 5 and 22 kW. The latter were commissioned by Ethiopian Evangelical Church Mekane Yesus (EECMY). Nonetheless 35-40% of those plants are not operational anymore due to a lack of water during dry season and management as well as technical problems[14]. EECMY and REF are planning the installation of further MHP plants such as a 55 kW scheme on the Bege River and a 5.5 kW scheme in Sire[8]. In 1994 the Ethiopian NGO Ethiopian Rural Self-Help Association (ERSHA) implemented another hydro powered grain mill near Ambo, which is said to be still operational[14]. Additionally, the current GTP (2010 – 2015) includes the installation of 65 MHP plants[15]. No further details regarding capacity and location of latter are available at the time[11].

Furthermore, GIZ Energizing Development (EnDev) Ethiopia is conducting inclusive survey for the conversion of 30 traditional watermills into micro hydro-power schemes. The studies are undertaken jointly with established Centers of Excellence for Hydropower at inter alia Arba Minch & Jimma Universities.

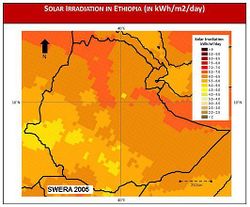

Solar Energy

Ethiopia receives a solar irradiation of 5000 – 7000 Wh/m² according to region and season and thus has great potential for the use of solar energy[8]. The average solar radiation is more or less uniform, around 5.2 kWh/m2/day. The values vary seasonally, from 4.55-5.55 kWh/m2/day and with a location from 4.25 kWh/m2/day in the extreme western lowlands to 6.25 kWh/m2/day in Adigrat area, Northern Ethiopia [9]is still at its early stage.

Until recent times use of PV for meeting off-grid power needs was confined to projects funded by donors. UN organizations such as UNICEF and WHO are few examples that had supported projects that use PV based technologies (distance-education radios and vaccine fridges) in remote rural areas. Moreover, the Government of Ethiopia (GoE) with technical as well as financial assistance from Italian government had executed a PV-based rural electrification project in the . The rural electrification project was later abandoned and looted, during the change of government in 1991, by the very people it was intended to serve. Such donor-driven projects proved unsuccessful or at least unsustainable primarily because the requisite commercial infrastructure (awareness, skilled technicians, financing mechanism, market linkages, and supportive policies) was lacking.

Ethiopian telecom is the major user of PV solar in the country. It uses PV solar to power its remote rural telecom installations and this application has grown several times in recent years. As of 2007, there were about a dozen PV dealers in the capital. Almost all of them do PV as a side business; and the majority of them do everything from import down to installation. Efforts made under the EU financed IGAD PV project, GEF-supported off-grid rural electrification project and UNEP/GEF PV Commercialization project proved useful in removing some of the key barriers (awareness, skills training, finance) that had hindered the development of the commercial PV market in the country[9].

With an installed capacity of approximately 5 MW and an estimated PV market potential of 52 MW, with a majority in the solar home system (SHS) market and a further expansion of the telecommunication sector, not even 10% of the potential is exploited. Costs for SHS are relatively high and unlike costs for MHP systems, cannot be reduced by connecting more costumers. In the near future, larger and particularly grid-connected solar energy systems will thus compete with small-scale hydropower systems .Next, to the PV SHSs, there is also a market for solar water heating (SWH) systems that use solar irradiation to heat up water, which can significantly reduce fuel wood and electricity consumption. Solar thermal is another application with considerable potential in Ethiopia. Although of more recent, phenomenon compared to PV, SWH is an application that is growing steadily in Addis in recent years. There are both imported locally manufactured models of SWHs in the market. Currently, however, cheap Chinese models are likely to drive other models out of the market[9]. Unlike PV systems, SWH systems have not been monitored in the past and thus accurate data is missing. Nevertheless, it is estimated that 5,000 units are installed, which is equivalent to an area of 10,000 m² [16][8]. The 2010 – 2015 GTP of the Ethiopian government furthermore includes the dissemination of 153,000 SHSs and 3 million solar lanterns[17][11].

- For information on challenges and issues affecting the exploitation of solar energy in Ethiopia, click here.

Photovoltaic: Best Practice Case Study[18]

In 1988, the Ethiopian Ministry of Agriculture had installed PV-powered community water supply scheme. The scheme, in addition to reducing the drudgery of women who are solely responsible for fetching water, had also improved community’s health at large by providing access to clean drinking water. After nearly two decades of almost un-interrupted service to the community, however, the water supply scheme broke down due to aging in 2002.

MEKETA, a local not-for-profit environmental organization, visited Sirba-gudeti village in 2004 to consult the community members on how they can collaborate in the reinstatement of water supply service and introduction of PV Solar Home Systems (PV SHS) for powering entertainment electronic appliance and for lighting. Strategically, MEKETA intended to use the village as a Rural Sustainable Energy Demonstration site, therefore, the overall objectives of the project was to rehabilitate the community water supply unit and to pilot and promote the adoption of 12VDC battery based systems (BBS), to meet small power requirements of rural consumers.

- To learn more about the project, click here.

Biomass

Biomass resources include wood, agro-industrial residue, municipal waste and bio fuels. Wood and agricultural as well as livestock residue are used beyond sustainable yield with negative environmental impacts.

According to estimates made by a recent study, at the national level, there appears to be a surplus of woody biomass supply. However, the same study revealed that there is a severe deficit of supply when the data is disaggregated to lower local levels. According to this same study, 307 Woredas (districts) out of the total number of 500 Woredas are consuming woody biomass in excess of sustainable yield.

Among the key issues that characterize the Ethiopian energy sector, the following are some that stand out:

- The energy sector relies heavily on biomass energy resources,

- The household sector is the major consumer of energy (which comes almost entirely from biomass) and,

- Biomass energy supplies are coming mainly from unsustainable resource base (which has catastrophic environmental implications).

- For more information, also see section problem situation at the top of this page.

Ethiopia’s biomass energy resource potential is considerable. According to estimates by Woody Biomass Inventory and Strategic Planning Project (WBISPP), national woody biomass stock was 1,149 million tons with annual yield of 50 million tons in the year 2000. These figures exclude biomass fuels such as branches/leaves/twigs (BLT), dead wood and homestead tree yields. Owing to rapidly growing population, however, the nation’s limited biomass energy resource is believed to have been depleting at an increasingly faster rate. Regarding the regional distribution of biomass energy resources, the northern highlands and eastern lowlands have lower woody biomass cover. The spatial distribution of the "deficit" indicated that areas with severe woody biomass deficit are located in eastern Tigray, East and West Harerghe, East Shewa and East Wellega Zones of Oromiya and Jigjiga Zone of Somali Region. Most of Amhara Region has a moderate deficit but a small number of Woredas along the crest of the Eastern Escarpment have a severe deficit[9].

There is however an energy production potential from agro-processing industries (processing sugar cane bagasse, cotton stalk, coffee hull and oil seed shells)[19]. Up to date, no grid-connected biomass power plants exist. Several sugar factories have however been using sugar cane bagasse for station supply since the 1950s. A total of 30 MW of capacity surplus could be fed in the grid by sugar factories[20]. Municipal waste and bio fuels on the other hand are barely used as energy resources. No estimation of municipal waste power production potential is available at the time, power production potential of landfill gas is estimated to be 24 MW [19]. The current GTP plans to disseminate 25,000 domestic biogas plants, 10,000 vegetable oil stoves and 9.4 million improved stoves by 2015[17][11].

- For information on challenges and issues affecting the exploitation of biomass in Ethiopia, click here.

Biomass Stoves: Best Practice Case Study[18]

Various energy sector studies conducted in the mid 1980s identified the rising cost of domestic energy supplies on household consumers, unsustainable consumption of fuel wood, increasing deforestation and soil erosion as major environmental and economic problems facing Ethiopia. Demand side management was one among various strategies adopted by the Government of Ethiopia to address the issue and was aimed at reducing households demand for biomass and hence relieving the pressure on the remaining woody biomass resources. This was done through the Ethiopian improved stoves programme, whose objective was to reduce cost and improve the supply of household (biomass) fuels for domestic consumers.

Innovative approaches adopted by the project were:

- A limited and gradually declining subsidy to cover costs including design, testing and development, technical training to private sector artisans, and market support and promotion,

- Use of revolving loan funds to provide newly trained artisans with badly needed working capital and some basic hand tools,

- Training many producers to encourage competition while keeping an eye on quality of products,

- Creating linkages between metal clad producers and potters who produce ceramic liners in the outskirts of Addis,

- Close supervision, monitoring and follow up of production and sales,

- Placing consumer needs and preferences at the centre of all operations.

- To learn more about the project, click here.

Wind Energy

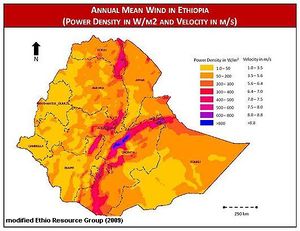

Ethiopia has good wind resources with velocities ranging from 7 to 9 m/s[21]. Its wind energy potential is estimated to be 10,000 MW[20] (see fig. 8). The Ethiopian National Meteorological Services Agency (NMSA) began work on wind data collection in 1971 using some 39 recording stations located in selected locations. Ever since the establishment of these stations, wind velocity is measured and data made available to consumers. However, the number of stations established, quality of data (in terms of comprehensiveness) and the distribution of the stations leaves much to be desired.

On the basis of data obtained from existing wind measurement stations two important conclusions can be drawn:

- First and foremost, Ethiopia’s wind energy potential is considerable.

- Secondly, wind energy is highly variable over the terrain mainly as a function of topography of the country. Pockets of areas with high wind velocities of up to 10 m/s are distributed throughout the Eastern half of the country, including the western escarpment of the Rift Valley.

Seasonal and daily variation in wind velocity is also considerable; wind velocity is higher between early morning and mid-day and in terms of seasonal variation, in the highland plateau zone there are two peak seasons – March to May and September to November; and in the eastern lowlands wind velocity reaches its maximum between May and August. In most of these places, maximum wind velocities are 3 to 4 times greater than the minimum. Medium to high wind speed of 3.5 to 6 m/s exists in most Eastern parts and central Rift Valley areas of the country. Perhaps due to their mountainous terrain and land use/land-cover type, most western and north-western parts of the country have generally low wind velocity (see fig. 8)[9].

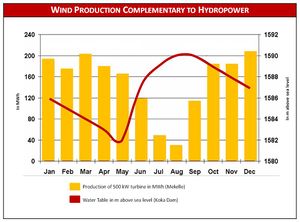

Up till now, no commercial wind energy power plants exist, nevertheless EEPCo is planning to develop seven wind sites that are in close proximity to the ICS by 2015, ranging between 50 and 300 MW. In sum, the installed wind power capacity would be approximately 720 MW [22]. Wind energy is considered a promising complementation to hydropower, since the two resources unfold their potential anti-cyclic: in rainy seasons the hydropower potential is high whereas low winds prevail. Vice versa hydropower potential is low in the dry season whereas the wind potential is high (see fig. 9). Unlike large hydropower plants, wind energy plants do not have any negative environmental impacts[21][11]. More about the planned wind farm can be seen here.

For information on challenges and issues affecting the exploitation of wind energy in Ethiopia, click here.

Geothermal Energy

Ethiopia’s geothermal resources are estimated to be 5 GW of which 700 MW are suitable for electric power generation[19][20]. Geothermal resources are primarily located in the Rift Valley area, where temperatures of 50 – 300°C prevail in a depth of 1,300 – 2,500 m. Only one 7.3 MW geothermal power plant has been commissioned so far, which started operating in 1998/1999 but was shut down due to lacking technical maintenance in 2002 [23][19][20]. Operation was taken up again, but only at a much reduced generation rate. Exploration of geothermal resources is still ongoing[11].

Recommendations for Renewable Sector

In looking at the possible future uses of these sources, three potential types of applications can be considered: in conventional rural electrification; in complementary rural electrification; and in the provision of non-electrical energy. One of the most important weaknesses in the work carried out to date is an almost complete lack of analysis of the economic viability of renewable energy applications and their competitiveness relative to their conventional alternatives. Nor has there been any significant amount of investigation into whether potential markets exist for the technologies or how such markets might be developed. Hence it is very important to consider facilitating for proper and sustained mechanisms for data collection, analysis and knowledge management to establish the feasibility and market potentials of different RE applications.

Fossil Fuels

Ethiopia is not an oil producing country as yet. Nevertheless, prospecting and exploration studies conducted since 1960s indicate that there are proven reserves of oil and gas that can be exploited at a commercial scale. The energy resource potential of the country includes several hundred million tons of coal and oil shale, and over 70 billion cubic meters of natural gas[9].More fossil fuels prospecting and exploration studies are currently underway by certain international petroleum companies in some parts of the country.

Based on study findings thus far, the eastern lowlands of Ogaden desert, has the highest potential for oil and natural gas development in Ethiopia. These included Kalub gas and Hilala oil fields. In fact, currently, development and infrastructural works are thoroughly underway in some of these fields, heralding the-much-awaited-news that Ethiopia’s long dream of exploiting some of its fossil fuel resources is going to become a ‘reality’ sooner than later.

Extreme west of the country, more specifically the Gambella region, is another area where potential for fossil fuel reserves are often said to be significant. Unlike the Ogaden region where exploration started some four decades ago, the Gambella region is a more recent entry (less tan 10 years) to the list of potential sites to be studied in detail. The official stand of the government and the exploration companies regarding the outcomes of their exploration works is that the wells that have been dug up thus far turned out to be dry. However, despite some political disturbances that persisted in the area; and causing several hick-ups to the initiative, the exploration work has continued in localities adjacent to the Sudanese border. For issues and chalenges affecting the fossil fuel sector in Ethiopia click here.

Market Situation

Improved Cookstove (ICS)

ICS are gaining attention worldwide for its positive impact on health of users and the environment at large. In spite of this, customer demand and awareness of the personal benefits of ICS (such as reducing indoor air pollution) remain low in Ethiopia. Moreover, the private sector consists mostly of artisans and small-scale producers who are unable to promote their own products and / or significantly influence the market. Most awareness creation and promotion of clean cooking energy is therefore done mainly by the Ethiopian government and EnDev. In a drive towards a sustainable market path and growth, EnDev focuses on promoting higher quality ICS with minimum criterion efficiency, such as reduced indoor air pollution.

Because potential users of ICS are not a homogenous group, the market is segmented. For example, the acceptance of the Mirt Stove, which is used for baking injera, is higher in urban and peri–urban areas – as consumption of injera is lower in rural areas. In SNNPR, the Gonziye Stove is more widely accepted than the Mirt Stove, while in Tigray, the traditional enclosed mud stoves with chimneys, called the Mogogo and the Tehesh, compete with the Mirt Stove. These varieties reflect that local cooking habits need to be carefully considered when supporting market development.

Charcoal production is prohibited in all regions of Ethiopia except for Amhara Region. Despite that, charcoal is being produced in a widely uncontrolled manner and with highly inefficient methods across the country. Its use is a major cause of forest degradation and emissions. While wood is mainly collected from forests by the consumers themselves, charcoal is sold on large markets as well as along roadsides. Alternatives to charcoal such as carbonised briquettes or sustainably produced charcoal are rarely found. Carbonised briquettes from sustainable biomass can be a real competitor to the inefficient and unsustainably produced charcoal in Ethiopia. This is recognised in the second GTP, and it has duly been planned to set up 250 briquetting plants and improved charcoal-making stations around the country.

Various organisations, both governmental and non-governmental, have been working on the promotion of briquette technologies using biomass in the form of sesame straw, coffee husks, bamboo and Prosopis juliflora.

Efforts by governmental institutions include Addis Ababa City Environmental Protection is providing technical training, production materials, working spaces and market linkages for biomass briquetting. Similarly, the Alternative Energy Development and Promotion Directorate (AEDPD) is working on various briquetting technologies and dissemination, while the energy laboratory of MoWIE has established a briquetting test facility.

Lagging behind these government-led initiatives, the private sector’s role in production and sales of carbonised briquettes is still limited: there are currently only six active medium-scale charcoal-briquette production companies in Ethiopia, as well as some small-scale hand-press briquette producers. On a national scale, then, carbonised briquettes still represent a negligible share of the household bioenergy market.

More than 840,000 refugees in Ethiopia use primarily solid biomass / wood for cooking (approx. 90%), almost all of which cook on open fires. This is obviously further contributing to the degradation of natural forests in the vicinity of camps, which are partly located in already deforested and degraded lands. This contributes to conflicts arising with the host communities. As firewood resources diminish, ethanol and charcoal briquettes made from biomass waste seem to be the only solution to provide cooking fuel for refugees. The camps are densely populated, and the majority of inhabitants do not usually have access to other cooking fuels. This therefore presents a potentially high demand, easy market niche for briquette-making entrepreneurs.

As with briquettes, use of improved wood-fuel stoves for productive use is also still very scarce in Ethiopia. In peri-urban and urban areas, few professional injera and bread bakers use efficient baking stoves (institutional Mirt stoves specifically produced for that purpose), while cooking is mostly done on traditional wood or charcoal stoves. Between 2012 and 2017, producers supported by EnDev sold more than 10,000 stoves for productive use, although awareness of the economic benefits of improved stoves for productive uses remains low.

Recent developments

In recent years, cooking and baking on electrical stoves has gained popularity in Ethiopian households connected to the national grid. Local markets offer a variety of electrical baking and cooking devices locally manufactured as well as imported; whereas charcoal and even fuelwood (for injera baking) are used as a backup in case of power outages. Even in rural settlements connected to the grid (12% in 2014), the uptake of electric stoves (as well as other electric appliances) is increasing with growing national-grid coverage. The trend is intensified by the very low, subsidised electricity tariff[24] in Ethiopia.

Nevertheless, the majority of rural households in Ethiopia still rely solely on open fires for cooking and baking. Even in urban and peri-urban areas, biomass remains a common source of energy for cooking and baking. As per Central Statistical Agency (CSA) reports, firewood in urban areas continues to be the predominant source of energy for cooking and baking – accounting for 64% of the urban population while only 6% use electricity and 18% use charcoal. According to data from the National Improved Cookstove Programme (NICSP), more than 15 million improved cookstoves were disseminated between 2005 and 2016. Of these, 27% were closed mud stoves such as the Awramba, while 21% were Mirt Stoves, 14% Lakech, 6% Tikikil , 5% Upesi and 1% other stoves.

The main competitor to the high-quality ICS that EnDev promotes are low-quality charcoal and wood stoves, which are found at low prices in local markets. Awareness on the benefits of investing in a better product, which may require a higher initial investment but which lasts longer and saves fuel, is still low, as is reflected in the small adoption rates. The government-supported Lakech Stove is manufactured en masse and sold widely in urban and peri-urban areas of the country. However, standardisation of quality in manufacture of the Lakech remains a challenge. Inefficient metal charcoal stoves without insulated combustion chamber are also widely used.

Ethiopia’s regulatory framework for performance requirements and test methods for household biomass-stove standards (ES 6085) is in its final stage of development. EnDev is actively participating in the technical committee and contributing to the establishment of the standards.

There is a wide range of actors in the stove market in Ethiopia. The main one remains the Ethiopian government – specifically, the various ministries responsible for energy, environmental and climate-related issues. The distribution of ICS in Ethiopia is mainly based on direct sales from the producer through normal market mechanisms, free or subsidised delivery through NGOs, and promotion and dissemination through governmental structures such as health extension workers, development agents, kebele leaders, women groups and the Safety Net Programme.

Most stove producers in Ethiopia are artisans with small scales of production and thus low capacity to promote their own products and / or establish distribution networks. Their participation in trade fairs is a good and easily accessible opportunity to promote their products. Similarly, stove, liner and briquette producers seldom maintain strong business linkages to aid their sales and strengthen markets.

There are few medium-scale producers in Ethiopia, although their higher production and promotion capacities allow them to deliver bulk orders. Imported stoves generally have low market penetration rates in Ethiopia, being sparsely available due to shortages in foreign currency or too expensive.

The American organisation EZY Life has established an assembly for a stainless steel woodstove in Mekelle (Tigray Region). The stove reportedly sells well in Tigray and amongst pastoralist communities in Afar Region. On the other hand, Gaia Project, an international NGO, has established a production of ethanol and a market for ethanol stoves. The stoves are well accepted but the production of ethanol in Ethiopia is still far too low to constitute a significant market share.

Persisting Challenges

The absence of retail networks for ICS, as well as the lack of awareness about their benefits, is the main factors impeding growth of the ICS market. Furthermore, inhabitants of rural areas with sufficient biomass resources show little willingness to pay for an improved cook stove when they can access firewood without paying. Although in many areas, scarcity of firewood is prompting greater willingness to pay for an efficient cooking device.

In order to try and increase uptake, EnDev is promoting the health benefits of ICS through reducing indoor air pollution. However, in order to develop a self-sustaining market, an integrated approach with multiple stakeholders is needed. NGOs, for instance, must be encouraged to find ways to reduce the costs of clean cookstoves for those who cannot afford the market price, rather than subsidising ICS in areas where demand has been created and thereby undermining the market.

Production of ICS currently relies on artisan producers, but through semi-industrial production by private entrepreneurs, the supply and quality of ICS can be scaled up, and product price reduces.

Transportation of ICS to remote areas (in the sense of product distribution channels) presents another barrier. Transportation infrastructure in rural areas is limited and ICS composed of clay or concrete may break easily if not packed well and transported on rough roads. Appropriate packaging as well as transport subsidies to selected areas could be a solution here.

Outlook

The organisation of ICS enterprises into industry associations that champion quality will enhance their capacity to establish sustainable business and service networks. This will duly contribute to overcoming some of the distribution challenges mentioned above; it will also improve regulation of the market and will reduce poor-quality products, services and business malpractice which otherwise spoil market development.

The process of including Component Programmes of Activities (CPAs) in the existing Programme of Activities (PoA) of the Development Bank of Ethiopia will bring together the regional energy agencies of Amhara and Oromia with the ICS enterprises, boosting their overall capacity in quality management and thereby laying strong foundation for sustainability.

Solar

Ethiopia’s huge market potential with a population of more than 100 million people and a national grid connection rate of only 20% stands in sharp contrast to the installed solar PV capacity of the country. The latter stood at only 5 MWp in 2014 and has only slowly increased since then. The market can be considered to be at an early development stage. A major share of an estimated market potential of more than 50 MWp is situated at household level, where most of the solar PV systems in demand range between picoPV systems such as solar lights and solar home systems that power light bulbs, phone chargers and other appliances such as televisions and radios. At the community and institutional levels, solar PV demand is estimated to be around 10 MWp, depending on grid extension plans and grid performance. The demand in institutions is usually for powering lights and electric appliances, especially in the health and education sectors.

Even though more solar PV wholesalers and retailers have entered the market in recent years, their number is still insufficient to satisfy the demand which continues to grow among the Ethiopian population as awareness grows for the possibilities solar PV products offer. Market competition is currently characterised by price not by quality, resulting in a very low market share of high quality products. So, despite an increasing number of active entrepreneurs, many of them are engaged in selling low quality products. The absence of quality standards for products and a poor regulatory framework further contribute to the dissemination of sub-standard products. Product certification schemes such as the World Bank-funded Lighting Global initiative so far have limited impact on the Ethiopian market. One of the consequences is that product life spans are relatively short which results in damaging the reputation of solar PV products and the market as a whole.

At the same time, retailers lack the financial means to purchase quality products via regulated channels and so sub-standard products of poor quality and often unclear origin flood both the regular and the informal markets.

Due to a lack of adequate knowledge, retailers are not able to provide professional product advice, customer care or product maintenance to their clients. Also, end users are often not professionally advised on how to meet their specific energy needs. Instead, they are often provided with bigger-than-necessary products or systems at higher-than-market prices.

Recent Developments

The political framework has shown some incentivising developments for the solar market in Ethiopia. The national Climate Resilient Green Economy (CRGE) Strategy, launched in 2011, highlights solar PV technology as a key technology for rural electrification. In the same direction points the National Electrification Program (NEP) of 2017, which intends to avail 5.7 million households with off-grid electricity, mostly through solar PV. A distinct emphasis of the NEP is the key role of the Ethiopian private sector as well as the potential of public-private partnerships in achieving these ambitious goals.

The ambition of both the CRGE and the NEP was manifested in the first competitive tender for a large-scale solar power plant of 100 MWp. This was won by a private investor. Assistance for similar tender initiatives is provided by the Scaling Solar programme of the International Finance Corporation (IFC), which advises the Ethiopian government in targeting investments for 500 MWp solar PV generation capacity through strong private-sector involvement. This political re-orientation has had positive impacts on the public perception of solar PV technology in general and the important role of the private sector on this regard. It has also given additional momentum to EnDev’s engagement in solar-market development. In addition, the exemption of quality solar products from import duties and surtaxes in Ethiopia, as well as a general decrease of global market prices for key components such as solar PV panels and batteries, has helped to lower the costs for wholesalers, retailers and, ultimately, consumers.

Since 2006, EnDev has been promoting and installing picoPV systems as well as SHS and larger PV systems for social institutions. Installations are accompanied with training for retailers and installers of solar PV products, capacitating them to promote safe, quality solar products in both urban and rural areas. EnDev has undertaken operations in all major regions of the country in close cooperation with national, regional and local stakeholders, including the private sector. The Solar Energy Development Association of Ethiopia (SEDA-E) was founded with support from EnDev and is committed to providing quality solar products and services under one common label.

Persisting Challenges

In spite of the positive developments outlined above, Ethiopia’s solar sector still faces multiple barriers overall which hamper what could be rapid and sustainable growth of the off-grid solar market. The market is characterised by three major challenges: low quality of products (and services), lack of consumer awareness about additional benefits of quality products as well as lacking access to finance for end users.

Lacking financial means to purchase quality products represent a bottleneck, especially in rural areas. Even though private micro-finance institutions have been starting up end user financing, micro loan schemes for solar products – known as ‘solar loans’ – do not yet exist on a large scale. A World Bank-funded micro-loan scheme which is implemented by the Development Bank of Ethiopia is a first and promising step in the right direction but its outreach is by no means sufficient, especially in rural areas. A clear indicator is the very low rate of demand by end users even in those regions where the scheme offers micro-loans. Next to lacking public awareness, a major reason for this low demand is the very slow and lengthy handling process of micro-loans by MFIs.

One other impediment to implementation of financing measures placed with MFIs is that most loans are earmarked for SHS, as defined by the MoWIE, which is intending to encourage the promotion of higher energy access levels in rural areas. However, the private sector is rather reluctant to provide SHS compliant with MoWIE definitions, claiming that there are plug-and-play systems which deliver the same service level and can be easily installed by users.

On the supply side, retailers and wholesalers often lack sufficient working capital to purchase quality solar PV products and/or to advertise them appropriately in urban (and especially in rural) areas. The chronic foreign currency shortage in the country, combined with very long waiting times to open letters of credit, has severely hampered the import of quality products. Furthermore, capacity gaps in product knowledge, marketing and customer care further limit the success of many solar PV retailers trying to operate and grow the Ethiopian market for quality solar.

Sustainability of solar PV systems installed in social institutions is greatly affected by the relatively low level of technical knowledge and experience of electricians regarding installation and maintenance of solar PV. Failure to allocate the required budgets for maintenance and spare parts, and to assign responsible personnel are additional factors which contribute to system failures. These shortcomings reduce the lifespan of installed systems, pose risks to its users and lower the reputation of solar PV as customers may blame system failures to the technology itself not the lack of proper operation and maintenance.

Sustaining PV systems is directly linked to long-term maintenance and repair capacities. This concerns, first and foremost, the replacement of batteries after they exceed their regular lifespan. This is a problem for most social institutions as they are publicly funded and need to go through lengthy, multi-level budget request procedures that may not be timely or even successful.

Outlook

Considering the prevailing obstacles for a steady and dynamic solar market development, interventions have to tackle key constraints along the whole solar product value chain. This requires to fill the information gap on quality products on both the supply and demand side. Quality standards and product labels need to be developed in cooperation with the private sector. Governmental bodies have to be supported to enforce regulation on quality standards.

Another key aspect to address is to set up functioning warranty and guarantee schemes for solar products and services. Training in business development, marketing, installation and maintenance of solar products are of need in order to capacitate solar PV shopkeepers and installers to disseminate quality products among target groups.

The development of innovative financing instruments will, in turn, enable people to purchase quality solar products that do not only enhance their living quality but also the enable them to save money in the long run. One such instrument, which is currently in a pilot phase in Ethiopia, is the so-called pay as you go (PAYGO) system. PAYGO allows users to pay for their products via embedded consumer financing. A customer makes a down payment, followed by regular payments for a specified term. Payments are usually through mobile money, scratch cards, mobile airtime or cash.

Micro Hydropower (MHP)

The mountainous topography of Ethiopia, combined with its relatively high rainfall averages (of 1,200mm per year) reflect high potential for hydrological power in the country. More than 90% of national power production comes from hydrological schemes. The government mainly focuses on large hydro projects as opposed to the hugely unexploited MHP market.

Energy distributed across the national grid is highly subsidised and can be purchased at a very low price. This situation leads to low willingness to pay higher, cost-reflective tariffs for off-grid electricity. The lack of regulations on what will happen when (or if) the national grid reaches the isolated grid, rules for consumer protection, grid codes, quality of electricity, environmental assessment and investor protection make private investment in the sector generally unattractive.

For isolated mini-grids there are currently no financial support mechanisms, such as concessionary loans or results-based subsidies from a rural electrification fund, in place; nor are there transparent, public databases on grid infrastructure, grid extension plans, hydrological power sites or non-electrified settlements against which to identify possible mini-grid sites. The mini-grid market is, therefore, 100% grant funded by donors and the Ethiopian government. There exists a Micro Hydro Power Association, but it is in a state of hibernation.

Recent Developments

In the context of the previous GTP (2010-2015), the erection of 65 MHP plants was foreseen. To date, however, only a very small (unverified) number have been built. Under the current GTP (2015-2020), meanwhile, 135 MHP schemes are planned, with the aim of supplying 35% of the population with electricity through decentralised mini-grids. There is no public list of the planned 135 MHPs, but as geographical information system (GIS) mapping becomes increasingly integrated into electrification planning in Ethiopia, EnDev will encourage governmental partners to include MHP sites in GIS databases. If both governmental institutions and the private sector have access to good and reliable data, they can more accurately identify sites and can more effectively replicate successful models.

Besides the governmental efforts, there are international and national organisations active in rural electrification through MHP powered mini-grids. Some activities are limited to pre-feasibility studies, while MHP mini-grids have been realised through others. To date, there are no databases on developed sites and no overall coordination. Organisations engaged in this sector follow different implementation and business models for mini-grids and there is not yet a common understanding about what to achieve.

Although it is not profitable for the private sector to build and run mini-grids, the sector has nonetheless developed widespread skills in sectors including civil construction, manufacturing of metal components, manufacturing of turbines (although there is a lack of tools to make efficient runners for the turbines), electro-mechanical equipment and electric grid installation. as well as service and maintenance of these elements. A clear and structured assessment of the true capacities of the sector has yet to be carried out.

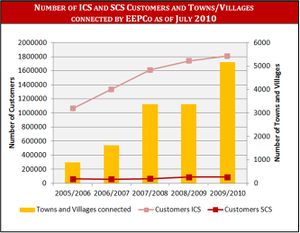

Electricity Sector

According to the Ethiopian Electric Power Corporation (EEPCo), Ethiopia’s total electricity generation in 2010 was 3,981.07 GWh>. Although hydropower contributes only 0.9% to the total energy supply, it generates 88% of electricity and is thus the country’s dominating electricity resource, followed by Diesel (11%) and geothermal (1%) electricity generation (see fig. 2). In the ICS (interconnected system) EEPCo currently operates 11, primarily large, hydropower-, one geothermal- and 15 diesel grid-connected power plants with a total capacity of 1842.6 MW, 7.3 MW and 172.3 MW respectively. Another three hydropower- and several diesel off-grid power plants with a capacity of 6.15 MW and 31.34 MW respectively operate as self-contained systems (SCS). The ICS is expanding whereas the SCS is shrinking due to the interconnection of previously SCS served towns to the ICS. As of July 2010, a total of 5163 towns and villages and a total of 1,896,265 customers were connected to the ICS and SCS by EEPCo (see fig. 3).

System losses are calculated to be 23%. This figure represents both technical and non-technical losses and the major share is attributable to the distribution network poor design.

Approx. 87% of costumers are domestic consuming roughly 40% of the electricity, 12% commercial and 1.1% industrial whereas only 0.1% is used for street lightning[25]. Average consumption per connected household is rather low (kWh/a 747) or roughly 50 kWh/year per capita compared to 510 kWh for Subsaharan Africa, leaving a lot of potential for further growth by deepening the current network and by increasing the level of power consumption.

EEPCo charges a connection fee of at least 500 ETB (36,6 €). The fee can go up to 100 US$. The amount is sometimes

recovered through the customer’s bill over a 24 month or an even longer period. The fee includes wiring to the house and the instalation of an electric meter. It is assumed that poor household have difficulties to pay the connection costs, so that a lot of them are not connected to the grid in electrified villages. The tariffs for electricity depend on the energy consumption. Customers with a monthly consumption up to 50 kWh pay a flat rate of 0,273 ETB per month (0,02 €) plus a service charge of either 1,4 ETB/month (0,10 €) for 0-25 kWh or 3,4 ETB/month (0,24 €) for 26-50 kWh). As such, the average estimated monthly electricity bill is expected to be in the order of ETB 7 - 16 per month (0,51 – 1,17 €). This represents less than two percent of average monthly expenditure of an average rural household, as the price paid by those households to buy kerosene for lighting is much higher than the relevant EEPCo tariff. It is estimated that a rural household spents around 1,6 US$ per month for kerosene. Consequently, the risk is low that household cannot pay the bill and are disconnected once they are electrified through grid densification.

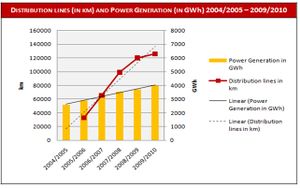

In 2005 EEPCo launched the Universal Electrification Access Program (UEAP), with the goal to connect a total of 6878 towns and villages to the grid and to increase the energy generation capability to 6386 GWh by 2010. Although the aspired target was not fully met, electricity generation increased 53% from 2,587.2 GWh in 2005 to 3,981.07 GWh in 2010 EEPCo (2005): Universal Electrification Access Program.[25]. However, the production increase does not keep pace with the grid extension activities. Transmission lines increased from a total length of 8,003.93 km in 2006 to 10,884.24 km in 2010, distribution lines’ total length even quadrupled from 33,000 km in 2005 to 126,038 km in 2010 (see fig.4)[11].

Although electricity generation is steadily increasing this creates a bias between the grid extension and the load of power generated, which results in a shortage of electricity and thus frequent power cuts. Furthermore, transmission and distribution losses of the ICS are high: 20% were lost in the period between 2001 and 2005. Most of the loss happens during distribution from the national grid to end users. Due to the hence limited electricity service, people’s willingness to pay might decrease significantly and makes more reliable power supply in isolated systems more attractive[25][8][19].

The current 5-year Growth and Transformation Plan (GTP), launched in 2010 and running until 2015, targets to increase Ethiopia’s total generating capacity to 8,000 to 10,000 MW by 2015[26]. This would quadruple or even quintuple the country’s current capacity of approximately 2000 MW. To this effect, the plan includes the installation of 8 large hydropower schemes (8737 MW total capacity), 7 wind plants (866 MW total capacity) and a 70 MW geothermal power plant[15]. The number of connected costumers is planned to be more than doubled: the target is to connect 4 million costumers by 2015[26]. This would represent an increase of the general access rate from 41% to 75% based on the ratio of the total households in electrified towns and villages to the total households in the country . Moreover the plan includes further development of the renewable energy sector[11].

Key Cross-cutting Issues in the Energy Sector

There are number of key cross-cutting issues in the Ethiopian energy sector. The most fundamental among these are[27]:

- Environment: Ethiopia’s national energy balance is dominated by traditional (biomass) fuels. The fact that the majority of biomass supplies are coming from an unsustainable resource base coupled with the use of very low efficiency household cooking appliances poses serious environmental concerns.

- In-door Air Pollution (IAP): Domestic cooking appliances in use in rural Ethiopia are not only inefficient but also produce large quantities of smoke due to incomplete combustion. In rural areas, where cooking places are poorly ventilated, this smoke is the main cause of IAP, which is a serious health problem among women and children.

- Gender: Women are not only energy users, but also major suppliers of traditional fuels in Ethiopia. More than two-thirds of traditional fuels are supplied by poor urban and rural women in Addis. Therefore, all interventions in the energy sector need to pay attention to the gender aspects as well.

- Sustainable Livelihoods: Traditional fuels sector, though extremely vulnerable, is a major employer, only next to agriculture, in Ethiopia. Recently, there are indications that jobs are being lost due to fuel-switching. Therefore, while fuel-switching should continue for environmental reasons, the issue of loss of sustainable livelihoods by traditional fuels suppliers should not be ignored.

Key Problems of the Energy Sector

The following aspects are crutial for the development of the energy sector:[28]

- Limited experiences in IPP-based generation (small scale power producer)

- Overlapping mandates of key institutions

- Only short term electrification planning (1-2 year periods); 5-10 years are needed for private sector involvement

- Generation capacity is limited, but demand will grow

- Heavily subsidised national flat-rate tariff (less than USD 3c/kWh); while marginal costs to grid supply is 7c/kWh.

- Major export of power should re-finance own energy projects (7-8c/kWh paid by Kenya and Tanzania)

- Focus on village rather than household connections: potential future lack of domestic demand for installed generation capacity

- In remote areas, low per capita consumption hinders mini-grid development (even for PU in community-owned mini-hydro schemes established by EnDev).

Three major barriers for SHS market:[28]

- Poor quality of import products

- Lack of off-grid friendly legislation

- Capacity deficit of conformity Assessment Enterprise (testing and approving)

Moreover, Power Africa outlines these particular three issues as the biggest for Ethiopia's energy sector[29]:

- Macroeconomic forces, particularly hard currency shortages needed to pay IPP tariffs

- Generation planning and procurements synchronized with demand

- New connections increased to prevent over-generation with take-or-pay IPPs

Electrification efforts are hampered by the following aspects: Scaling up electrification capacity to levels unachieved to-date; Dealing with electricity supply sources outside the national grid; Scaling up connectivity in the rural areas to get electricity to the nearly 14 million rural homes that are currently without any supply; Tackling technical challenges associated with the proliferation of long lines in the grid that carry very small loads into the rural areas.[30]

Policy Framework, Laws and Regulations

The government’s declared aim is a huge expansion of the infrastructure in the energy sector. Based on the national Universal Electricity Access Program (UEAP) the Government owned utility "EEPCo" has started to extend the national electricity grid to towns and villages preferably with minimum of 5000 households. Villages and towns with less households are often only considered for grid extension if the central or provincial governments cover the costs. The grid extension is carried out by the construction of 33 kV transmission lines. Local departments of EEPCo are in charge of the grid connection and operation within the towns and villages. The costs for the UEAP are estimated at one billion US$. Twenty percent of that sum will be financed by EEPCo via credits, another 80% by the government or international donors. The high contribution of the government is due to the fact that the extension of the grid to villages with less than 5,000 inhabitants is economically not feasible for EEPCo. The first two years of the program are partly financed by World Bank, which covers about US$ 100 Mio of the initial US$ 180 Mio budget.

Once a town is having access to the grid, the connection of households, social institutions and enterprises is within their own responsibility. The connection of the individual customers to the grid is generally not subsidized and 100% covered by the respective customer. The connection fee ranges from US$50 to US$100 (average 75 US$) including the cost for the electricity meter. There are different figures about the share of households connected to the grid. In some documents a rate of 30-40% is mentioned. Another document from the World Bank says that up to 70% are reached due to instalment payment of the connection fee. The connection rate may drop if EEPCo will try to meet the ambitious political goal of 50% coverage via fast rollout to many villages without taking to much care of household connections. The current average electricity tariff is about US$0.056 (0,04 €) per kWh, equivalent to about 62% of the long-run marginal cost of supply. Thus, the current electricity tariffs are not cost covering.

The improvement of efficiency of the existing energy resources is another target. The energy loss is to be reduced from 20% (2005) to the international average, 13%, during the same period of time. In the last years, the government tried to pave the way for more private investors to generate electricity and feed it into the grid. Proclamation 37/1997 opens domestic investors the possibility to invest in plant capacities of up to 25MW. Only foreign organisations are permitted to invest in power stations with a capacity of over 25 MW. Council of Ministers Regulations No. 7/1996 and No. 36/1998 introduced additional tax relief and improved import regulations as incentives for private investment. Nonetheless, the electricity sector is still controlled by the state.

In November 2013 the Ethiopian parliament approved the Energy Proclamation to liberalize the energy sector. An Ethiopian Energy Authority (EEA) will be founded, where foreign companies can register and obtain licences to produce electricity and get a fixed feed-in tariff for the generated power. The feed-in tariffs will be fixed by the board of directors of EEA and approved by the Ministry of Energy.

EEPCo presented end of 2013 a new energy masterplan for the next 25 years. 28 projects with total investments of 156 billion USD shall be realized by 2038 assuming an electricity demand of 37.000 kW. By 2016 EEPCo plans to increase the power production by 2000 MW to 10000 MW.Also the transmission and distribution grid shall be extended significantly. It is planned to install 13.560 km of 250kV lines with 114 transformer stations and 9.257 km of 400kV line with 41 transformer stations by 2020.

Policy and Strategy

Following are some of the major highlights from the policies and strategies of the country.

National Electrification Strategy

National electrification strategy outlines the plan to electrify the villages without energy access. The Off-grid Master Plan (by Power Africa) will be integrated. The Strategy is currently under internal review (2017). Coordinator should be a Directorate of Energy, electrification fund should be financed via a levy on power sales, “realistic tariff regime”, off-grid electrification for 100,000 businesses and households/year.[28]

Energy Development

- Fuel wood plantation: encouragement of the private sector and different communities to be involved in plantation schemes,

- Conversion of biomass in different forms of energy purposes: enhancing conversion efficiency in charcoal making, encourage and promote the modern use of agricultural residues and dung (Biogas etc.),

- Hydro power development: utilization of the vast hydropower potentials (of which only about 2% is currently utilized),

- Other Energy sources: the policy states that whenever the economic potential is realized geothermal, coal, solar, wind and other sources of energy shall be used to generate electricity or other energy services,

- Oil exploration and development of the natural gas potential.

Energy Conservation and Efficiency

- Improving the energy efficiency in the transport sector, the agriculture sector, the industry and at household level is to be enhanced,

- Regarding the household sector, enhancing the supply of fuelwood, encouraging fuelwood substitution and taking other measures to narrow the gap between energy demand and supply, such as the promotion of fuel efficient stoves.

Encouragement of Private Sector to be Involved in Energy Sector

The Energy policy also dedicates a special section for the encouragement of the private sector to be involved in the development of the Energy resources of the country specially by being involved in the construction of energy structures, a field that has been and still is seen to be mainly the responsibility of the government.

Environmental Policy of Ethiopia

The policies are:

- To adopt an inter-sectoral process of planning and development which integrates energy development with energy conservation, environmental protection and sustainable utilization of renewable resources,

- To promote the development of renewable energy sources and reduce the use of fossil energy resources both for ensuring sustainability and for protecting the environment, as well as for their continuation into the future.

Forest, Woodland and Tree Resources

The policies are:

- To ensure that forestry development strategies integrate the development, management and conservation of forest resources with those of land and water resources, energy resources, ecosystems and genetic resources, as well as with crop and livestock production,

- To find substitutes for construction and fuelwood whenever capabilities and other conditions allow, in order to reduce pressure on forests.

Conservation Strategy of Ethiopia

- Boost technical and social research on the design of improved cooking stoves,

- Promote local manufacture and distribution of improved charcoal and biomass stoves,and

- Locate, develop, adopt or adapt energy sources and technologies to replace biomass fuels.

Development of Alternative Energy Resources and their utilization are to: Acquire, develop, test and disseminate appropriate and improved energy use technologies (e.g. improved stoves, charcoal kilns, solar powered cookers and heaters).

Capacity Building and Institutional Strengthening are to:

- Strengthen research, planning and project implementation capability of the federal and regional energy agencies,

- Establish a centre for testing alternative and efficient energy sources, technologies and appliances,

- Promote and assist the private sector to assemble and manufacture energy development facilities and end-use appliances.

Institutional Set-up in the Energy Sector

Until a change of government in 1991, there were neither energy sector policies nor institutional arrangements that separated policy making organs from those of operations. Ever since the mid 1990s, in a bid to enhance efficiency and harmonize operations in the energy sector, policy making organs were separated from operation organs[31].

At the Federal Government level, there exists a number of institutions involved in the energy sector in the Country. The Ministry of Water Irrigation and Electricity (MoWIE) is responsible for the overall development of the energy sector in the country. The the MoWIE also is responsible for the protection and utilisation of the nation’s water resources.

Current institutional setup of the energy sector in Ethiopia Ministries and main agencies and departments that deal with energy issues:

- Ministry of Water, Irrigation and Electricity (MoWIE) - Regulatory policy and decision making, energy operations, implementation and supervising other governmental agencies and enterprises. a) Energy study and development follow-up Directorate (ESD) is responsible for sector and policy level strategy in the energy sector. It is directly involved in planning for electrification and was working on the National Electrification Strategy and Off-Grid Master Plan. ESD is the source of energy related data and information. b) Alternative energy technology development and promotion directorate (AETDPD): is responsible for manufacturing, laboratory and training support for alternative energies (biomass, solar, wind, mini-hydro and others). Via the Rural Electrification Fund (REF) over 45,000 SHS were disseminated. Future responsibility is unclear; therefore, the responsibility of off-grid project implementation is not clear among various actors. c)Hydro Power Study and Dam Administration Directorate

- Ministry of Environment, Forest and Climate Change (MoEFCC) - Regulatory policy and decision making, environmental, climate related operations and implementing ICS and climate change mitigation.

- Ethiopia Energy Authority (EEA) - Regulating energy efficiency and conservation, Regulate the electricity sector, Issue technical codes standards and directives, commission programs and projects on Energy Efficiency, Delegate its mandates to state governments to better deliver regulatory services to and to promote energy efficiency and conservation services in the economy. Other preparation works such as: organizational structure of the Authority, various directives and codes are under development.

- Ethiopian Electric Utility (EEU) -Engage in the construct, maintain electric distribution networks, Purchase of bulk electric power , selling electrical energy to customers, Initiate electric tariff amendments approval and implement and Carry out any other related activities that would enable it achieve its purpose in accordance with economic and social development policies and priorities of the government.

- Ethiopian Electric Power (EEP) - Undertake feasibility studies, design and survey of electric generation, transmission and substation construction and upgrading, handle electricity generation and transmission operational and maintenance activities, lease electricity transmission lines, sell bulk electric power and undertake universal electric access works, carry out any other related activities that would enable it achieve its purpose in accordance with economic and social development policies and priorities of the government.

- Ethiopian Rural Energy Development and Promotion Centre (EREDPC) – with the mandate to carry out national energy resources studies, data collection and analysis, rural energy policy formulation, technology research and development and to promote appropriate renewable energy technologies in rural areas; the Centre also serves as the Executive arm of the Rural Electrification Fund (REF). To assess and implement projects under the REF the EREDPC has established a core team as the Rural Electrification Executive Secretariat REES. The REES being responsible for project appraisal shall also provide advisory services, capacity building, and training to Regional Energy Bureaus and cooperatives.

- Rural Electrification Fund (REF) - to enable the private and cooperative engagement in rural electrification activities through loan based finance and technical support. Among other REF shall also prepare an off-grid rural electrification master plan which shall be updated annually and conduct feasibility studies to identify suitable RE projects, which will be implemented by the private sector (which includes NGOs, CBOs, co-operatives, municipalities/local governments and other entities).The REF received US$ 15 million in funding from the World Bank and GEF under the Energy Access Program. This allowed the granting of loans and the promotion of energy projects in rural areas in collaboration with private actors and local authorities. In formal terms it is administered by the Rural Electrification Board (REB) and the Rural Electrification Executive Secretariat (REES). The REB determines the criteria for project promotion and coordinates cooperation with other programmes. The Board also decides on whether to proceed with the submitted project proposals. The REB’s members are employees of the Ministry of Water Resources, the Ministry of Mines and Energy, the EEA and the EREDPC and representatives of the private sector. The resources available to the REF are used to subsidise 85% of the cost of rural electrification projects. Renewable energy sources are entitled to a higher subsidy of 95%. Most of the projects that receive assistance, however, are based on electricity generation with diesel generators.

- Petroleum Operation Department – for petroleum exploration and development, licensing, and project coordination;

MoWIE is working closely with two public enterprises: the Ethiopian Electric Utility (EEU) and the Ethiopian Electric Power (EEP) for the electricity sub-sector, and the Ethiopian Petroleum Enterprise (EPE) for the petroleum sub-sector. EPE is an operational wing of government entrusted with the responsibility of exclusively importing petroleum products in to the country. The petroleum products market, with the exception of LPG, is still regulated in Ethiopia and importation is the monopoly of EPE[31]. Based on the decision of the parliament in December 2013 EEPCo restructured into two companies: a) the Ethiopian Electric Utility (EEU) and the Ethiopian Electric Power (EEP) and they are mandated to generate, transmit, distribute, and sell electricity. The corporation disseminates electricity through two different power supply systems: the Interconnected System (ICS) and the Self-Contained System (SCS). The ICS, which is largely generated by hydropower plants, is the major source of electric power generation. The SCS is mainly based on diesel generators and to a minor portion on small and medium hydropower plants. EEPCo’s financial situation is considered to be weak. In 2006, electricity tariffs were increased by 22 percent across the board, except for the life-line tariff (consumption up to 50kWh/month) which remained unchanged. The weighted average tariff is estimated at 0.06US$/kWh. The overall billing collection rate at present is estimated at around 98 percent. Electricity revenue increased to US$150 million. Operating profit after depreciation was US$35.2 million. Operating profit per kWh sales to end-use customers was at 0.014US$/kWh. According to the World Bank,11 EEPCo has a strong technical and stable management team, and is operating profitably with an internal cash generation of about US$50 million per year. Its operating costs are low since generation is predominantly hydro, which also reduces exposure to oil price volatility. Further operation and implementation organs are[31]:

- Ministry of Trade (MoT): The MoTI sets retail prices and regulates the distribution of petroleum products by oil distribution companies.

- National Strategic Petroleum Reserve Administration: This is an arm of government that manages and administers strategic reserve depots located throughout the country to ensure sustained supply at times of sudden shocks.

At a regional level, energy activities are mainly supported by regional energy bureaus, which are part of regional governments, and by regional energy institutions, such as the Oromia Mines & Energy Agency and the Regional Rural Electrification Executive Secretariat Offices with support and advice from the EREDPC. There are only few private companies active in the energy sector.

Mini-grid practitioners and product developers:[28]

- Stiftung Solar Energy Foundation

- Beshah International Solar and Information Technology (MISIT)

- Green Light Planet

- Lydetco Plc

- Niwa Solar

- Solartech

- Azuri Technologies

- Ethio Resource Group

Donor Activities

- WB: GIS-based planning tool (based on UNDESA Universal Electrification Access Tool un-desa-modelling.github.io/Electrification_Paths/index.html)

- USAID PowerAfrica: informal coordination of donors in Ethiopia. Feasibility studies for five hydro sites, 37 diesel mini-grids operating legally in Ethiopia; irrigation projects; tariff structure for mini-grids.

- Green mini-grid market development programme (GMG MDP) SE4ALL Hub (hosted by AfDB): Market intelligence, business development services, policy development, access to finance, technical standardization.

- EnDev: pico and micro hydropower plant, technical assistance, low-cost designs; training local scouts.

- EU: grant funding; support for Master Plan, community hydro under EnDev and biogas digester project with SNV; refugee camps; solar kiosk programme.

- UNDP: Growth and poverty reduction, climate change and environment vulnerability