Pakistan Energy Situation

Capital:

Islamabad

Region:

Coordinates:

30.0000° N, 70.0000° E

Total Area (km²): It includes a country's total area, including areas under inland bodies of water and some coastal waterways.

XML error: Mismatched tag at line 6.

Population: It is based on the de facto definition of population, which counts all residents regardless of legal status or citizenship--except for refugees not permanently settled in the country of asylum, who are generally considered part of the population of their country of origin.

XML error: Mismatched tag at line 6. ()

Rural Population (% of total population): It refers to people living in rural areas as defined by national statistical offices. It is calculated as the difference between total population and urban population.

XML error: Mismatched tag at line 6. ()

GDP (current US$): It is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

XML error: Mismatched tag at line 6.2 ()

GDP Per Capita (current US$): It is gross domestic product divided by midyear population

XML error: Mismatched tag at line 6. ()

Access to Electricity (% of population): It is the percentage of population with access to electricity.

XML error: Mismatched tag at line 6.no data

Energy Imports Net (% of energy use): It is estimated as energy use less production, both measured in oil equivalents. A negative value indicates that the country is a net exporter. Energy use refers to use of primary energy before transformation to other end-use fuels, which is equal to indigenous production plus imports and stock changes, minus exports and fuels supplied to ships and aircraft engaged in international transport.

XML error: Mismatched tag at line 6.no data

Fossil Fuel Energy Consumption (% of total): It comprises coal, oil, petroleum, and natural gas products.

XML error: Mismatched tag at line 6.no data

Overview

This article gives a short overview of the energy situation in Pakistan. It outlines the main sources of energy and states the main problems for the energy sector regarding micro hydropower, solar energy products and cooking technologies for energy access. Furthermore, the institutional set-up, the policy framework and international programmes regarding energy access are portrayed.

Energy Sector Overview

The Islamic Republic of Pakistan which became an independent state in 1947 is governed by a federal parliamentary constitution. It is globally the sixth most populous country with a population of approximately 200.000 million people and a comparatively high population growth rate of 1.5%.[1] Pakistan is a semi-industrialized economy with a presentable textile, food processing and agriculture base and a per capita GDP of 1561 USD. According to the World Bank, Pakistan has important strategic endowments and development potentials. Its labour market is the 10th largest globally and Pakistan is number 67 amongst the global exporters.[2] Yet, there is a large inequality within the society (Gini: 30 as per World Bank) and still 21% of the population lives under the poverty line.[3]

Pakistan’s Energy Mix

The primary energy supply amounts to over 70 million Tonnes of Oil Equivalent (TOE). Oil and gas are by far the dominating sources with a share of 80%. Oil is imported from the Middle East mainly Saudi Arabia, gas from Iran. In addition, Pakistan is consuming Liquefied National Gas (LNG), Liquefied Petroleum Gas (LPG) and coal. Pakistan has currently, 4 power plants with a total capacity of 755 MW; additional 3 are under construction.[4] Nuclear power accounts for around 1.9% of the total installed capacity in Pakistan.[5] Hydropower has a share of 13% whereas other renewable energies only play a minor role.

The government is supporting the use of LPG for cooking resulting in rapid investment in production, storage and establishment of auto stations of LPG. During the FY 2016, an approximate investment of PKR 2.38 billion has been made in the LPG supply infrastructure whereas total investment in the sector until Feb 2016 is estimated at about PKR 22.33 billion. During the FY 2016, the regulatory body OGRA has issued 12 licenses for operational marketing of storage and filling plants, 37 licenses for construction of LPG storage and filling plants, 20 licenses for Construction of LPG auto-refuelling stations and one license for storage and refuelling of LPG was issued. Further, one license for construction of production and storage of LPG facility is also issued by OGRA which shall result in improving supply and distribution of LPG as well as create job opportunities in the sector.[4]

Energy Sources

Historically, Pakistan has always been an energy importer and is highly dependent on fossil fuels. With the rising fossil fuel prices, the cost of oil importing is creating a dent on Pakistan’s foreign exchange reserves. The rising oil price along, withe the rising demand for uninterrupted power, is creating additional pressure on the already fragile electricity grid of Pakistan. Therefore, to met this increasing demand, the Government of Pakistan, in its new budget for the fiscal year 2014-2015,has allocated $340 million to its energy development portfolio. About 80% of this budget will be spent on generating power from solar, biomass and biogas.[6][7]

About USD 2.3 billion is spend annually on candles, kerosene lamps and battery-powered flashlights by Pakistanis.[8]

Renewable Energy Sources

Pakistan aims at achieving 5-6% of its total on-grid electricity supply from renewables (excluding large hydropower) by 2030. Total installed power capacity stood at 26 GW at year-end 2016, of which 4.2 % was renewable energy.[9]

Pakistan is blessed with a high potential of renewable energy resources, but so far, only large hydroelectric projects and few wind and solar projects have harnessed this potential. Renewable Energy accounts for 1136 MW presently installed capacity of solar PV, wind and biomass based power projects. Possibilities also exist in promoting greater use of wind, solar and biomass project.[5]

Previously Government of Pakistan (GoP) had announced various policies and enabling environments such as feed-in tariff/upfront tariff, tax incentives, net metering, long term refinancing facility and micro-financing schemes for promoting corporate sector investment in the renewable energy (RE) sector. Taking the market growth, technological developments, recent cost reductions and new financial mechanisms into account, the GoP decided to liberate the market and instigate more competition amongst the private sector players for delivering electricity from RE resources (i.e. wind/solar) at optimal tariff rates. Accordingly, the GoP introduced tenders to call for competitive/reverse bidding for the RE power projects and the first phase of bidding for wind power projects has been initiated.

- For wind power project, the regulator recently has announced a benchmark levelized tariff as:

- for 100% foreign financing US cents 6.7467/kWh

- on 100% local financing, US cents 7.7342/kWh. - For solar power projects there is no benchmark tariff announced by the regulator as yet, however the last upfront tariff is provided below.

Figure 1: Revised tariffs for solar projects in 2016[10]

Wind Energy

Pakistan has a potential for wind energy specially in the southern coast and coastal Balochistan. The wind speed is on average 7-8 m/s at some sites along the Keti Bandar- Gharo corridor.[11]

Particularly in the southern regions of Sindh and Balochistan, the technical potential of wind power is high along the 1,000 km of coastline where wind speeds range between 5 and 7 m/s.[12] The potential capacity for wind energy is estimated at 122.6 GW per year, more than double of the country’s current power generation level.[13] A newly completed wind farm in Gharo, Sindh Province, is one of a series under construction in Pakistan to reduce the country's serious energy deficit.

For more information about wind energy in pakistan, see Wind Energy Country Analyses Pakistan

Solar PV

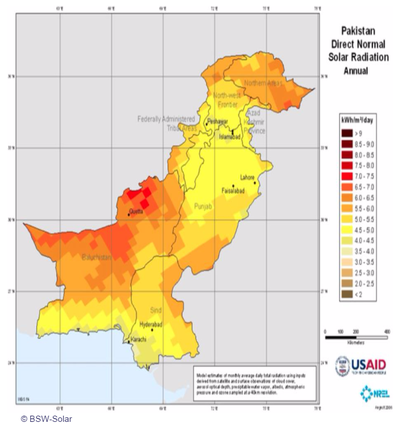

The solar potential is estimated to be over 100,000 MW.[5] Pakistan has a high solar potential. Irradiation across the country is around 4.5-7.0 kWh/m²/day.[14]

Figure 2: Direct solar radiation in Pakistan.[14]

- Solar Village Electrification: More than 40,000 villages which are so far from the grid that it becomes costly and uneconomic to extend the grid to these locations are prime candidates for village electrification using Solar Home Systems (SHS).[5]

- Solar Water Heaters and Geothermal Heat Pumps: There is a big market for investors for SWH and GHP in domestic and industrial sectors. Only 22% of the population has access to piped natural gas.[5]

- Productive use in agriculture: Solar Powered Efficient Pumps could replace the 260,000 water pumps (tube -wells) with a sanctioned load of over 2,500 MW operated with electricity, and another 850,000 Diesel Water Pumps that consume 72,000 TOE of Diesel annually. [5]

- Street Lights: Pakistan has over 500,000 Street Lights with a sanctioned load of over 400 MW. Most of these Street Lights are based on 80W, 125W and 250W Sodium Lights. They offer opportunities to be replaced with Efficient Solar Lighting. [5]

Biomass

Out of the total area of 79.6 million hectares, 21.2 million hectares are cultivated; Almost 80 percent of the cultivated area is irrigated. The country has the world’s largest contiguous irrigation system. Forests cover 4.21 million hectares[15], 5% of Pakistan’s total area.[16] According to the FAO data, this number has dropped continuously since the 1990s to only 1.9% in 2015.[17]

“Biomass availability in Pakistan is also widespread. Approximately 50,000 tonnes of solid waste, 225,000 tonnes of crop residue and over 1 million tonnes of animal manure are produced daily. It is estimated that potential production of biogas from livestock residues is 8.8 to 17.2 billion meters3 of gas per year (equivalent to 55 to 106 TWh of energy). Large sugar industry in Pakistan also generates electricity from biomass energy for utilization in sugar mills. Annual electricity production from bagasse is estimated at 5,700 GWh – about 6% of Pakistan’s current power generation level. In the present electricity crisis recently government allowed sugar mills to supply their surplus power up to a limit of 700 MW to the national grid. It is estimated that sugarcane bagasse can potentially be used to generate 2000 MW of electric power. However presently it is difficult to obtain more electricity from sugar mills due to grid limitations because most of the sugar mills are located in remote rural areas which are not even connected to the national grid. Integration of electricity generated from biomass energy to the national grid can ease the electricity shortage in the country.”[18] A large number of people in rural areas in Pakistan depend on forests for their livelihood, fuelwood and shelter. Many use the forests in unsustainable ways to satisfy their domestic energy needs. Therefore, forest depletion and degradation are a major challenge.[16]

Almost all of Pakistan’s Biomass power generation is done in steam power plants, since biomass gasification and newest fermentation technology has not been introduced in the country. The Sugar industry has the highest utilization of biomass, with every singly sugar mill being equipped with a biomass boiler for the production of electricity. Some even incorporate high pressure boilers to increase efficiencies. The “Framework for Power Co-generation’ for bagasse and biomass-based sugar industry projects”, introduced in 2013, is expected to attract 1,500 MW to 2,000 MW in generation in the short term, between 2016 and 2018.[19]

Hydropower

Large Hydropower has proved to be the cheapest source of electricity. Despite the high availability of hydro power resources low investments in this sector hamper the utilization of this potential source.[5]

Smaller (less than 50 MW) sites are available throughout the country. The micro - hydropower sector has been relatively well established yet. Since the mid-80s micro-hydro power plants supply electricity to some 40,000 rural families. Most of the plants are community-based and situated in the Northern Areas and Chitral.[20] Small Hydropower is considered as another promising option for off-grid generation of electricity. Provincial governments mainly handled the small hydropower sector: in 2014, 128 MW has been operational in the country, 877 MW is under installation and around 1500 MW is available for further development.[5] The potential for micro hydro (up to 100 kW) is estimated at 350 MW in Punjab and 300 MW in northern Pakistan.[21]

Main Problems of the Energy Sector

According to the World Energy Outlook (2016) statistics, at least 51 million people in Pakistan or representing 27% of the population live without access to electricity.[22] According to IFC, the rate of energy for poor people is even higher with approximately 36% or 67 million out of 185 million without access to electricity.[23] The National Electric Power Regulatory Authority, in its annual State of the Industry Report, concludes that approximately 20% of all villages, 32,889 out of 161,969, are not connected to the grid. Even those households that are statistically connected experience daily blackouts so that it is estimated that more than 144 million people across the country do not have reliable access to electricity. As a result, Pakistani households use a mix of technologies to power their homes and businesses.

More than 50 % of the population, mainly in rural Pakistan, relies on traditional biomass for cooking. Common cooking fuels include firewood, agricultural waste and dung cakes. According to a study about Balochistan and Sindh region in April 2007, it was appraised that households use on average 920 kg of wood in winter and 560 kg of wood in summer while in Sindh the numbers are 640 kg and 400 kg respectively. In Balochistan, around half of the population collects their own firewood, while in Sindh most households need to buy their wood. The burning of biomass in inefficient stoves and without proper venting or air exhaust causes serious health problems. According to WHO estimates indoor air pollution is responsible for more than 50,000 premature death per year in Pakistan. Especially women and children are affected as they are most exposed to the smoke and soot from cooking. In addition the burning of wood is contributing to deforestation which is progressing at a rate of more than 2% per year.

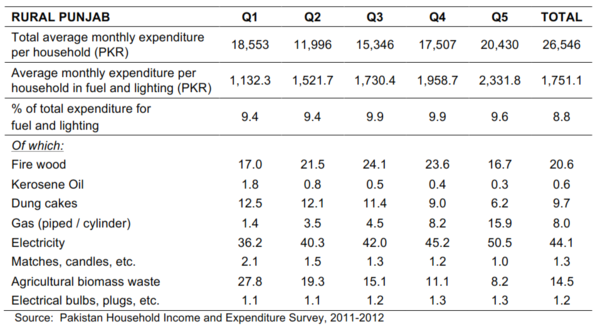

A survey revealed that rural households in Punjab spent on average about 9 % of the total household income for fuel and lighting. However, poor households are forced to invest up to 25% of their monthly income in fuel, kerosene and batteries due to the dysfunctional market.[24] In general, non-electrified households spend USD 5 to USD 8 per month or an estimated USD 2.3 billion a year on everything from candles, to kerosene lamps, to battery-powered torches.[25]

Due to poor distribution networks, households in rural areas using LPG as fuel pay up to 10 times more than urban households that benefit from subsidised natural gas for residential use.[26]

Access to electricity is varying from more than 90 % electrified households in urban areas down to only 61% in remote rural area.[22]

Figure 3: Average Monthly Fuel and Lighting Expenditure in Rural Punjab, by income level. [19]

The main factors which are preventing the rollout of rural electrification are the increasingly high distribution costs and the shortage of power generation which results in breakouts as well as load shedding. Furthermore, due to the currently very low electricity consumption/demand in rural areas the expansion of the grid into these areas is merely not economical and hence not feasible. Utilities and distribution companies are reluctant to roll out the grid since the “revenues from tariffs would never be able to provide the returns needed to recover the investment.”[19]

The main factors which are preventing the rollout of rural electrification are the increasingly high distribution costs and the shortage of power generation which results in breakouts as well as load shedding. Furthermore, due to the currently very low electricity consumption/demand in rural areas the expansion of the grid into these areas is merely not economical and hence not feasible. Utilities and distribution companies are reluctant to roll out the grid since the “revenues from tariffs would never be able to provide the returns needed to recover the investment.”[19] The main factors which are preventing the rollout of rural electrification are the increasingly high distribution costs and the shortage of power generation which results in breakouts as well as load shedding. Furthermore, due to the currently very low electricity consumption/demand in rural areas the expansion of the grid into these areas is merely not economical and hence not feasible. Utilities and distribution companies are reluctant to roll out the grid since the “revenues from tariffs would never be able to provide the returns needed to recover the investment.”[19]

Figure 4: Electricity access in Pakistan, 2016 and Traditional use of biomass for cooking - 2014.[22]

Population without electricity |

National electrification rate |

Urban |

Rural |

Population relying on traditional use of biomass |

Percentage of population relying on traditional use of biomass |

51 million |

73% |

90% |

61% |

105 million |

56% |

The demand for electricity in Pakistan has increased dramatically within the last 5 years. Over half of this demand originates from the Punjab province where the majority of the population resides. Households are mainly responsible the increase of demand. The high demand of industry and local entrepreneurs in turn cannot be met either. The recent rise in demand is, in part, due to the large-scale instalment of cooling and air-conditioning systems, particularly in urban areas. As a result, the demand is especially high in the summer months. In the Punjab electricity demand often exceeds the available supply by 2 to 3 GW, which makes up around 30% of the total installed capacity. Therefore, many businesses and industries, as well as private households, have resorted to installing diesel generators as back-up which has led to a substantial increase in the cost of electricity in cities across Pakistan.[19] The main factors which are preventing the rollout of rural electrification are the increasingly high distribution costs and the shortage of power generation which results in breakouts as well as load shedding. Furthermore, due to the currently very low electricity consumption/demand in rural areas the expansion of the grid into these areas is merely not economical and hence not feasible. Utilities and distribution companies are reluctant to roll out the grid since the “revenues from tariffs would never be able to provide the returns needed to recover the investment.”[19]

Overall Pakistan is struggling with a large gap between electricity supply and a demand of about 5 GW. Main reasons for low investments in power generation are tariffs below cost recovery levels, power theft, insufficient collection rates, and technical losses of around 23-25%. As a result, power generation companies face serious financial problems, making investments in the sector very difficult. In addition, costs of power generation, which is mainly based on fossil fuels, are very high averaging at around 12PKR/kWh and up to 15PKP/kWh if technical losses are included.[19] The main factors which are preventing the rollout of rural electrification are the increasingly high distribution costs and the shortage of power generation which results in breakouts as well as load shedding. Furthermore, due to the currently very low electricity consumption/demand in rural areas the expansion of the grid into these areas is merely not economical and hence not feasible. Utilities and distribution companies are reluctant to roll out the grid since the “revenues from tariffs would never be able to provide the returns needed to recover the investment.”[19] Due to high costs, the government subsidises electricity tariffs, in order to make them more affordable for consumers. In 2013, government subsidies for electricity reached 1.3 billion USD, however, this did not recover the costs of generation, transition and distribution. “This creates a budget gap that curtails public investment in primary infrastructures, essential for the economic development of the country.”[19] The main factors which are preventing the rollout of rural electrification are the increasingly high distribution costs and the shortage of power generation which results in breakouts as well as load shedding. Furthermore, due to the currently very low electricity consumption/demand in rural areas the expansion of the grid into these areas is merely not economical and hence not feasible. Utilities and distribution companies are reluctant to roll out the grid since the “revenues from tariffs would never be able to provide the returns needed to recover the investment.”[19]

The growth of power generation capacities is slow. The declining availability of natural gas in Pakistan often results that existing power plants operating below capacity. Gas has increasingly to be substituted with oil, which is mainly imported (75%).[27] Nevertheless, the country’s reliance on its internal natural gas resources has even increased in the last years, mainly due to rising international oil prices which in turn has led to increase in cost of businesses, pressure on household budgets, especially of lower middle income groups and burden on national exchequer in terms of subsidies.[19] The main factors which are preventing the rollout of rural electrification are the increasingly high distribution costs and the shortage of power generation which results in breakouts as well as load shedding. Furthermore, due to the currently very low electricity consumption/demand in rural areas the expansion of the grid into these areas is merely not economical and hence not feasible. Utilities and distribution companies are reluctant to roll out the grid since the “revenues from tariffs would never be able to provide the returns needed to recover the investment.”[19]

As a result of the insufficient power supply, the unused capacities, and the power losses, Pakistan is facing serious power blackouts on average 10-12 hours a day.[27][28] The substantial load shedding affects enterprises, social institutions and even individual households, and thus hampers considerably the economic and social development of the country.

Policymakers neglect in energy planning and energy policies non-commercial/traditional energy sources which are not even represented in national statistics (only electricity and mining). This means that almost 50 % of the consumers which are mainly rural households are ignored in energy planning and the public investments for supply of power.[26]

Moreover, Pakistanis also among the Top 10+1 countries with largest number of people using solid fuels for cooking as shown below in graph.[5]

Figure 5: Number of people using solid biomass for cooking.[5]

According to the International Energy Agency, in 2011, Pakistan’s population will rise to over 100 million people by 2030, with Pakistan rising from among the top 10 to being among top 5 countries with the highest proportion of population without access to modern energy.[5]

Institutional Set-Up in the Energy Sector

Electricity sector

The electricity market of Pakistan in unbundled at the generation and distribution but is bundled at the Transmission point. The National Transmission and Dispatch Company (NTDC) is only responsible for transmission and dispatch of electricity. As of December 2006, there are 16 IPPs investing in Pakistan. [29]

Generation: Electricity is generated by the state owned Water and Power Development Authority (WAPDA) as well as by several private power produces, all of which operate within one system under the Pakistan Electric Power Company.

Transmission: The state owned National Transmission Distribution Company (NTDC) is responsible for electricity transmission in the Country.

Distribution: Electricity distribution is handled by 10 distribution companies (discos).[19]

General government institutions in the electricity sector are:[5]

- The Ministry of Water and Power: responsible for the overall sector development and policy regulation

- Alternative Energy Development Board (AEDB)

- Water and Power Development Authority (WAPDA)

- National Energy Conversation Centre (Enercon), has now transformed into National Energy Efficiency & Conservation Authority (NEECA)

- Cabinet Committee on Energy (CCE)

- National Power Control Centre: Responsible for managing the national grid and load shedding.

- National Electricity Power Regulatory Authority (NEPRA): Responsible for listing and regulating the generation, transmission and distribution of electricity

- Central Power Purchase Agency: The clearing house for the purchase and sale of electricity

- Private Power Infrastructure Board (PPIB): A public private partnership in power generation

Public sector relevant for energy access

Most relevant institutions for energy access are the Alternative Energy Development Board (http://www.aedb.org) and the Pakistan Poverty Alleviation Fund (PPAF).

The Alternative Energy Development Board (AEDB) is an autonomous agency under administrative control of the Ministry of Water and Power (MoW&P). It was established in May 2003 with the main objective to facilitate, promote and encourage development (policies, programs and projects) of Renewable Energy in Pakistan and with a mission to introduce Alternative and Renewable Energies (AREs) at an accelerated rate. AEDB is also in charge to evaluate, monitor and certify RE products. Thus, AEDB has been the main national actor in defining quality standards for photovoltaic systems. In addition, it is surveying commercial application and investments in power generation, and it assists the private and NGO sector in planning and implementing renewable energy projects. Last but not the least, it conducts feasibility studies and undertakes technical, financial and economic evaluations. Under the remote village electrification program, AEDB has been directed to electrify 7,874 remote villages in Sindh and Balochistan provinces through ARE technologies.

The Pakistan Poverty Alleviation Fund (PPAF) was established as an autonomous institution with the main goal to alleviate poverty through empowering poor people and increasing their access to income and job opportunities, ensuring a focus on the most vulnerable and marginalized groups. The PPAF was established by the government in 1997 and started its operation in 2000 as a contribution to the MDGs.[30]

The core objectives are:

- To strengthen the institutional capacity of civil society organizations, and support the creation of organizations of the poor, that can work together to alleviate poverty and achieve MDGs and now SDGs

- To build public-private partnerships with the purpose of increasing market access and market share for poor communities.

- To ensure that public services for poor communities are available and adhere to identified quality standards

The fields of activities include health, education, basic infrastructure – including rural electrification – small scale renewable energies (PV-sets and biogas digesters) and micro-finance. The PPAF does not implement projects on its own, but through a network of over 120 implementing organisations (NGOs, MFIs etc.). PPAF has worked on various micro-finance schemes and has a long partnership with the WB and KfW. Energy access has not been its main task but PPAF has financed many stand-alone solar PV solutions on the southern side of the country and mini-grids based on mini and micro-hydro plants in the northern areas. In addition, PPAF conducted various trainings of communities affected by disaster, including among other sustainable procedures smokeless fuel-efficient cooking. PPAF employs more than 200 people. However, the renewable energy department comprises only few experts. PPAF may undergo a major institutional restructuring.[30] Among other things, a spin-off for lending has been established, called Pakistan Microfinance Investment Company. The PPAF would then concentrate its activities on providing grants for poverty alleviation projects.[31]

Furthermore, the following institutions are also relevant of energy access activities:

- SEC: A department of the Pakistan Council of Scientific and Industrial Research (PCSIR), concentrating on designing solar thermal appliances.[5]

- PCRET: Conducting research into various renewable energy technologies (PV, solar thermal, wind, biogas and biomass, micro hydro and fuel saving technologies.)[32]

Enterprises

Major energy service companies involved in off-grid areas are:

- Shariff International (http://sharifinternational.net/); which comprises different companies active in the energy sector. Shariff International is selling and installing products from stand-alone systems (solar home systems, street lights) to mini-grids and grid connected systems (solar, wind, waste). It is also providing services like energy audits and consultancies.

- Buksh Group, consisting of the Buksh Energy Pvt. Ltd and the Buksh Foundation (http://www.bukshfoundation.org/); The Buksh company is offering similar products and services as Shariff International. The Buksh Foundation works with local and international grants and supports partner organisations. It provides business loans to small and medium enterprises and to households. The foundation also offers insurance and maintenance/repair services as well as training. Buksh Foundation is cooperating with the IFC Lighting Pakistan programme and TERI from India.

- Nizam Energy Pvt. Ltd (http://www.nizamenergy.com/); Nizam Energy is a wholesaler, distributor and installer of solar products for households and enterprises. It is also offering services like operation of medium and large scale solar energy assets, management of mini-grids and financing. Nizam is also operating a pay-as-you-go scheme. Nizam is considered the leading solar energy company in Pakistan.

- Trillium Pakistan Pvt. Ltd. (http://www.trillium-pakistan.com/solarpower.php) is a distributor and installer of renewable energy products from solar lanterns to wind and hydropower turbines up to mini-grids and grid connected power plants.

- Soltec Solar Solutions Ltd. (http://www.soltec.com.pk/); is a distributor and installer of solar products, mainly stand-alone products (solar home systems, solar water pumps) but has also experience in the installation of mini-grids.

Five companies locally assemble PV panels. However, they currently still have lower reliabilities and are generally not as trusted as foreign brand.

Local manufacturing of batteries is also expected to commence soon in Pakistan. Factories are currently being setup by four different industrial groups in the city of Karachi. These companies are:[14]

- Daewoo Group

- Treet Group

- Eco Star (DWP & GREE Groups)

- Homage

Solar companies are organised in the Pakistan Solar Association, which supports trade and promotes PV businesses in the country.

Three companies are operating Pay-as-you-go schemes:

- BrighterLite: a Norwegian company that offers solar products in Pakistan for rent since 2015. Consumers pay a subscription fee of PKR 1,000-2,000 and a monthly fee (depending on the package between PKR 490 – 1,090 via easypaisa. BrighterLite aims to make its products available in entire Pakistan, however, they have started with Jehlum and Rawalpindi district. In the first year, they were able to serve around 6,000 individuals within 9 districts.

- EcoEnergy Finance works in off-grid areas in interior Sindh, the southern province of the country since some years. It sells BBOX systems on both ownership and rental models. However, they have a very small market share due to unavailability of funding. The organization is in contact with many microfinance banks and investors for funding of its products. EcoEnergy Finance hires its own employees. The organization is using IFC’s services to market its product in Pakistan and is a direct client of IFC from Pakistan.

- Nizam Energy operates with its off-grid venture ‘Nizam Bijli’ a pay as you go scheme in 14 different districts in 3 provinces of Pakistan since 2015. Nizam Bijli has developed its own network of employees. They have assembled their own plug-n-play systems for off-grid areas; however, IFC has doubts about the quality of the systems that they are selling. They have good remote monitoring though, and are the only big organization with both money and network to work in the off-grid areas and they are aggressively pursuing to grow in this market. Moreover, Nizam has also recently joined hands with the Alliance for Rural Electrification to electrify one million people in off-grid areas of Pakistan by the end of 2020.

Micro finance organisations

Several microfinance institutions are offering loans to enterprises and households for purchasing renewable energy technologies. The most important are:

- The First Microfinance Bank (FMFB) which is part of the Agha Khan Development Network; the focus is on loans for solar products for lanterns and SHS; but identified poor marketing by the technical partners/ vendors. https://www.fmfb.com.pk/

- Kashf Foundation, which has around 300.000 clients mainly in urban and peri-urban areas; Kashf Foundation is providing loans for a broad spectrum of purposes. Energy technologies are not a focus of the organisation. http://kashf.org

- Khushhali Bbank Limited (KBL), which is testing loans for renewable energy technologies (lighting and SHS); is considering to found a subsidiary specialised on energy like Grameen Shakti. https://khushhalibank.com.pk/

- National Rural Support Program (NRSP); 2001; 165,000 community organisations; pv lamp experiments: PPAF pilot on solar PV lamps; 6 year pilot biogas programme (challenges: large space requirements and 20% end-user subsidy) www.nrsp.org.pk

NGOs

A list of Alternative Renewable Energy NGOs in Pakistan is available under:

Most important are:[14]

- the NGO REAP (Renewable Energy Association of Pakistan) representing 400 members with the aim to promote renewable energy sources in Pakistan. REAP offers trainings in solar water and off-grid solar PV panels. Furthermore they organised international conferences to promote RE technology to the public[33]. and

- the National Rural Support Programme, which was established in 1991.

In some regions of Pakistan, the Aga Khan Foundation is playing a major role in development activities. The foundation has implemented several micro hydropower projects as part of the Aga Khan Rural Support Programme (AKRSP) with 147 MHPs[34] and the Sarhad Rural Support Programme (SRSP) with 191 MHPs (2004-2015).[35]

In the field of cooking, there are a few CBOs/NGOs registered in the database of the Global Alliance for Clean Cooking; either in a really early stage or with only a small number of ICS disseminated in Pakistan: ThinkGreen.org (biochar), NIDA-Pakistan (300 ICS), Escorts Foundation (approx. 12,000 between 1995-2005).[36] They are cooperating with three Pakistani companies: Jaan Pakistan, Atif and Atif Associates and Harness Energy.[37] Furthermore, the Aga Khan Foundation (although not registered as a partner with GACC), has several activities in the field of ICS: The Building and Construction Improvement Programme (BACIP) started in 1997. BACIP focused on eight thermally efficient appliances that help to improve quality of lives in remote areas while saving 100,000 tons of CO2 annually. Until 2012, the programme has produced over 50,000 fuel-efficient products (including ICS, number unknown), which have been installed in 27,000 households. The programme has benefitted 240,000 people in over 300 villages of the Gilgit-Baltistan and Chitral provinces in northern Pakistan.[38] They received the Ashden Award for Sustainable Energy 2011.[39] With the ‘Supporting Civil Society Initiatives’ project, AGKN introduced around 200 energy efficient stoves in 30 villages in Thatta, Sindh until 2015.[40]

Policy Framework, Laws and Regulations Regarding Energy Access

Government of Pakistan and provincial governments are aware of the need to improve the energy situation in the country through various policies and projects. In this regard, relevant organizations have been developing and implementing policies from time to time to bring clarity to their future approach towards the energy crisis situation in the country.

The Government of Pakistan only in 2013 mentioned the universal access as a goal in the “Vision 2025”. Before that, rural electrification was not a priority and also renewable energy policies were only introduced in 2006 and did not include biomass regulations until 2013.

The relevant policies for Pakistan are mentioned below (order: newest first).

Pakistan's nationally determined contribution (PAK-NDC), 2016

Pakistan handed in its first NDC in November 2016. Among the Mitigation Options in Energy Demand Sector with high priority, the NDC lists also improved cookstoves and solar water heaters: Efficient stoves are considered as cheap option to provides tangible and visible benefits to a very large portion of population and and simultaneously harness the mitigation potentials since the cost per device of ICS is low.[41]

While it acknowledges the fact that “solar photovoltaic and thermal technologies for power generation, water pumping, solar geysers and other renewable energy-uses can curtail GHG missions”[41], it does not refer specifically to off-grid solar or mini-grids. It only refers to “Large scale and distributed grid connected solar, wind and hydroelectricity, as “these three options represent the three distinct renewable energy options believed to be viable for Pakistan. Their potential as low-carbon sources of energy and their perceived cost-effectiveness warranted their inclusion in the analysis”[41].

Among the climate-related activities for the budget year 2016-2017, planned “key initiatives include interest-free loans to farmers for installation of solar tube wells; abolishing tax duty for import of solar equipment, promoting other renewable technologies in meeting the energy needs of the country and ambitious plans of afforestation.” [41]

National Energy Efficiency and Conservation Act, 2016

The law mandates the creation of authorities to improve energy efficiency and conservation mechanisms. The authorities created under this bill are the National Energy Efficiency & Conservation Authority (NEECA); the Fund of NEECA; and the Pakistan Energy Conservation Council. http://www.senate.gov.pk/uploads/documents/1457086008_484.pdf

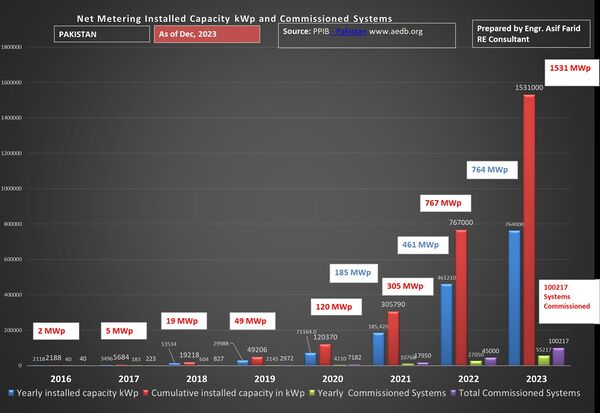

Pakistan Net Metering Policy for Solar PV and Wind Projects, September 2015

Solar PV and wind generators under 1 MW of capacity are allowed to sell back produced electricity to the national grid. The payment for purchase of electricity from distributed solar and wind generation units shall be the same as the off-peak electricity rate charged by utility companies for electricity sold to distributed solar and wind generation units. Residential, commercial and industry scale owners of the eligible generators can participate in the scheme. As of today September 30, 2021 more than 15,000 licenses on net metering issued with total capacity 251MWp.

Link: Net Metering Policy Pakistan SRO 892 -2015.PDF

Power Generation Policy, 2015

This policy addresses the hydropower projects and the thermal power projects. Under this policy, the GOP encourages public-private partnership and in scope of this policy, the incentives/concessions available to private power projects will also be available to projects implemented under PPP mode in accordance with the applicable laws.

The main objectives of this policy are to provide sufficient power generation capacity at the least cost; to encourage and ensure exploitation of indigenous resource; to ensure that all stakeholders are looked after in the process; a win-win situation; and to be attuned to safeguarding the environment.

National Power Policy 2013, 2013

Central part of the government’s plan to support the current and future energy needs of the country. With the three focus points Efficiency, Competition, Sustainability, it outlines incentives to attract more private investments and infrastructure development, and schemes that will allow public-private partnership. Further, it aims to diversify the energy mix, and the role of renewable energy is gaining significance in achieving sustainability and energy security.[19] Among 9 other major aspects – it gives the directive to “ensure the generation of inexpensive and affordable electricity for domestic, commercial, and industrial use by using indigenous resources” and to “align the ministries involved in the energy sector and improve the governance of all related federal and provincial departments as well as regulators”.[5]

Link: Power Policy 2013.pdf http://www.ppib.gov.pk/National Power Policy 2013.pdf

Pakistan 2025: One Nation, one Vision, 2013

It sets out 25 goals in accordance to 7 pillars. Among them, Pillar IV: Energy, Water & Food Security, with the following goals concerning energy:

- Energy: double power generation to over 45,000 MW to provide uninterrupted and affordable electricity, and increase electricity access from 67% to over 90% of the population

- Energy: (a) reduce average cost per unit by over 25% by improving generation mix (15%) and reducing distribution losses (10%); (b) increase percentage of indigenous sources of power generation to over 50%; and (c) address demand management by increasing usage of energy efficient appliances/products to 80%.

The elimination of current energy demand-supply gap by 2018 and optimizing the energy mix of oil, gas, hydro, coal, nuclear, solar, wind and biomass are some of the key priorities of the policy.[41]

Alternative and Renewable Energy Policy, 2011 (Medium term policy)

As a medium term policy, the Renewable Energy Policy (2006) was updated to Alternative and Renewable Energy Policy, 2011. This policy is currently in force and builds upon the short term policy by:

- Resolving policy conflicts and addressing stakeholder concerns.

- Developing the concept that ARE projects actually cost the nation less and thus deserve and require better rate of return than fossil fuels.

- Developing the policy of non-electric RE and a policy for Biofuels.

- Expanding incentives for alternative energies such as: the Alternative Energy Development Fund, partial resource risk coverage, tariffs on the basis of a premium rate of return for developers, mandatory grid connection, mandatory purchase requirements, small business programmes for ARE (<10 MW), Asian Development Bank (ADB) loan guarantee facility, credit market facility and 100% carbon credits to Independent Power Producers.[42]

Link: http://www.iea.org/policiesandmeasures/pams/pakistan/name-38076-en.php

Policy for Development of Renewable Energy for Power Generation. Employing Small Hydro, Wind, and Solar Technologies, 2006 (short term policy)

This was the first policy implemented by Government of Pakistan that firmly supported renewables in the national energy mix. It also provided a policy framework for upscaling renewables. It was developed as a short-term policy with a view to develop a long term policy. It is tentatively valid until 2018.[25] The goal of this policy was to provide 10% of Pakistan’s energy supply mix by renewable technologies by 2015 focusing on the following technologies:[18]

- Small hydro of 50 MW or less capacity

- Solar photovoltaic (PV) and thermal energy for power generation and

- Wind power generation

Link: http://www.aedb.org/Documents/Policy/REpolicy.pdf

Other technologies such as those based on municipal waste and landfill methane recovery, anaerobic or pyrolytic biomass gasification, co-firing or cogeneration utilizing agricultural crop residues, bio-fuels, wave, tidal, geothermal energy, and fuel cells were not yet dealt with in this policy.[5] It did, however, mention the goal of universal access to electricity.

Features of this policy are:

- It invites investment from private sector for Independent power projects, or IPPs (for sale of power to the grid only), Captive cum grid spill over power projects. (i.e., for self-use and sale to utility), captive power projects (i.e., for self or dedicated use) and isolated grid power projects (i.e small, stand-alone). Except for IPPs, the other projects do not require any LOI, LOS or IA from the government

- Electricity purchase from qualifying renewable energy-based generation projects is mandatory

- Net metering and billing

- Delicences and deregulates small scale power production from renewable resources (up to 5 MW for hydro and 1 MW for net metered sales)

- Simplified and transparent principles of tariff determination

- Facilitates projects to obtain carbon credits for avoided greenhouse gas emission[43]

In order to fulfil the objectives of the policy (1. Energy Security 2. Economic Benefits 3. Social Equity 4. Environmental Protection), the GOPs strategy include to:

- Increase the deployment of renewable energy technologies (RETs) in Pakistan so that RE provides a higher targeted proportion of the national energy supply mix, i.e., a minimum of 9,700 MW by 2030 as per the Medium Term Development Framework (MTDF), andhelps ensure universal access to electricity in all regions of the country.

- Provide additional power supplies to help meet increasing national demand.

- Introduce investment-friendly incentives, and facilitate renewable energy markets to attract private sector interest in RE projects, help nurture the nascent industry, and gradually lower RE costs and prices through competition in an increasingly deregulated power sector.

- Devise measures to support the private sector in mobilizing financing and enabling public sector investment in promotional, demonstrative, and trend setting RE projects.

- Optimize impact of RE deployment in underdeveloped areas by integrating energy solutions with provision of other social infrastructure, e.g., educational and medical facilities, clean water supply and sanitation, roads and telecommunications, etc., so as to promote greater social welfare, productivity, trade, and economic wellbeing amongst deprived communities.

- Help in broad institutional, technical, and operational capacity

- Facilitate the establishment of a domestic RET manufacturing base in the country that can help lower costs, improve service, create employment, and enhance local technical skills.[5]

Yet, the goals of this policy despite of its innovative character then have not been achieved and the policy is not replaced by an updated version.

International Programmes and Projects

There are no major nationwide energy access efforts. Donors and the Government of Pakistan focus on large energy generation and distribution projects or on policy advisory.

Main supporters of the Pakistan energy sector are Germany, ADB, JICA, WB Group, USAID.

Germany: KfW (Hydropower), GIZ (Renewable energy and energy efficiency), Integrate German support to renewables in Pakistan in the “Pakistan-German Renewable Energy Forum” (PGREF), which will promote the dissemination of technologies in Pakistan such as wind, solar, hydro, biomass/biogas

ADB has launched in 2016 a programme on Access to Clean Energy in Pakistan: The programme aims at increasing access to energy to off-grid communities in selected districts of Khyber Pakhtunkhwa (KPK) and Punjab in Pakistan by exploiting the available clean energy resources. The Integrated Energy Development Programme is one of the central pillars of Pakistan Poverty Reduction Strategy (PRSP) – II, which underscores the importance of maximizing access to affordable and clean energy to all. Energy is one of the key focused areas of Pakistan’s Vision 2025 which aims at ensuring uninterrupted access to affordable and clean energy to all sections of the population by 2025. The objectives of the project therefore will directly contribute to PRSP-II and Vision 2025.

The proposed results-based lending (RBL) program is consistent with the ADB’s Country Partnership Strategy (2015–2019) for Pakistan with energy defined as one of the six sectors that ADB assistance will continue to focus on. Provision of energy to those remote and rural areas that are outside of the reach of the national grid is also aligned with the ADB’s Energy Policy 2009 where maximizing energy access to all, specifically for the rural poor is defined as one of the priority areas.

The main beneficiaries of the RBL will be the off-grid communities who live in far-flung rural areas, where the socio-economic indicators are relatively lower than the rest of the country. It will promote inclusion of isolated and comparatively disadvantaged segments of the rural population. Access to electricity will increase economic activity, create more job opportunities, reduce time poverty of both men and women, improve social services such as education and health, increase access to ICT, and will bring positive impact to the overall socio-economic well-being of the people. One of the key outputs of the proposed RBL is to support inclusive economic activity through increased power for productive uses and income generating activities. The program will directly benefit the off-grid communities who being isolated are relatively more vulnerable to economic shocks. Communities to be targeted by the program are the rural and inaccessible communities in KPK and Punjab where almost 70% of the rural population in KPK and more than 65% in Punjab lives below USD 1.25 per day. Access to clean and affordable energy offers substantial health and education gains, improved living standards, reduced time poverty, increased household income and significant employment creation. The program will install renewable energy power plants including the construction of 1,000 micro-hydropower plants (MHPs) in off-grid areas of KPP. It will also provide and install rooftop solar plants for 23,000 schools and over 2,500 primary healthcare facilities and a university.[44]

World Bank Group: is implementing the Pakistan Community-Based Renewable Energy Development in Northern Areas and Chithral. The objective of the project is to reduce global emissions of carbon dioxide and increase access to modern energy from renewable energy sources. The project will provide additional support for the achievement of the following objectives, namely: (a) develop hydropower potential in an environmentally and socially sustainable manner so as to help meet local electricity demand, (b) improve access of rural areas to modern electricity services, and (c) improve standards of living for the poor through provision of community level infrastructure.

In addition, ESMAP has carried out a renewable energy resource mapping to improve the country’s knowledge and awareness of biomass, solar, wind energy resources.[45]

IFC is focusing on mobilizing investments in energy. IFC has been contributing to the generation of over 3,500 MW through generation and distribution projects—which has helped approximately 12 million people—and promoting renewable and clean energy. In addition, IFC is promoting sales of solar lighting products through the Lighting global programme.

USAID has supported infrastructure and operational improvements, and promoted policy reforms to help the energy sector function more efficiently and sustainably. Since 2011, USAID has added “more than 2,400 megawatts of electricity to the national grid”. This total includes 1,013 megawatts from new or rehabilitated dams and thermal power plants, and 1,447 megawatts from improvements in the transmission and distribution system. Customers are receiving more accurate energy bills as a result of USAID’s efforts to install or repair over 250,000 meters. (https://www.usaid.gov/pakistan/energy)

JICA has no projects regarding energy access, but six projects in Pakistan regarding electric power (mostly loan aid) and one project regarding the planning of disaster risk management. JICA has also been providing technical cooperation in promoting energy efficiency on the demand side in the form of energy saving, and supporting policymaking. JICA is placing priority on the assistance for solving energy shortages.[46]

International Initiatives

SE4ALL

The Government of Pakistan joined the UN’s global initiative - Sustainable Energy for All'(SE4ALL)' in 2013. SE4ALL which has been initiated by UNSG Ban Ki-moon in 2012 with a Global Facilitation Team placed in Vienna, Austria, exists to meet the dual challenge of reducing the carbon intensity of energy while making it available to everyone on the planet.

SE4All has three objectives which are in accordance with SDG7:

- ensure universal access to modern energy services;

- double the global rate of improvement in energy efficiency; and

- double the share of renewable energy in the global energy mix.

Having played a core role in putting universal access to modern energy services at the heart of the SDGs and the Paris Agreement, SE4ALL is currently stepping up to help partners to take rapid, tangible action on the promises made by the world community.

In order to achieve the three key objective of SE4ALL (universal access to energy; doubling the rates of energy efficiency and conservation; and doubling the share of renewable energy in the overall energy mix), the following key challenges needs to be addressed in Pakistan: improving the regulatory governance structure, focussing on water-based power generation and conservation, promotion of off -grid solutions, capacity building and knowledge sharing, strengthening micro financing in remote areas, building and appliance standardization, investing in Research and Development (R&D) for renewable technologies, improving the process for approval of PSDP projects, advocacy for energy conservation & efficiency, and public sector energy conservation audits.[5]

Energy for All Initiative

The Asian Development Bank (ADB) launched the Energy for All Initiative in 2008 to address energy poverty in Asia. In 2009 the regional ‘Energy for All Partnership’ was launched with the objective of providing energy access to 100 million people in Asia by 2015.[19]

Further Information

- Country portal on energypedia

- IEA site on Pakistan: https://www.iea.org/countries/non-membercountries/pakistan/Includes statistics on energy sources as well as information on policies.

- IRENA Pakistan page: http://resourceirena.irena.org/gateway/countrySearch/?countryCode=PAK

- World Bank Energy Project in Pakistan: http://projects.worldbank.org/P101640/pakistan-community-based-renewable-energy-development-northern-areas-chithral?lang=en

- Pakistan Council of Renewable Energy Technologies: http://www.pcret.gov.pk

Publications, presentations

- Awan, Amjad Ali. ‘Renewable Energy In Pakistan (Potential and Prospects)’. presented at the Intersolar, 6 October 2015. https://www.export-erneuerbare.de/EEE/Redaktion/DE/Downloads/Publikationen/Praesentationen/2015-06-10-intersolar-04-energy-ministry-pakistan.pdf?__blob=publicationFile&v=2.

- Tait, Bryanne. ‘A Solar Developer’s Guide to Pakistan’. International Finance Corporation, World Bank Group, January 2016. http://www.ifc.org/wps/wcm/connect/b46619004b5e398cb8b5fd08bc54e20b/IFC+-+Solar+Developer's+Guide+-+Web.pdf?MOD=AJPERES.

Publications, articles

- Pakistani Energy Update Magazine: http://www.energyupdate.com.pk/index.html

- Feasibility of Renewable Energy in Pakistan: http://www.tbl.com.pk/the-feasibility-of-renewable-energy-in-pakistan/

- Article Evaluating the Renewable Energy Alternative of Pakistan: http://www.altenergymag.com/article/2016/02/renewable-energy-readiness-of-pakistan/22821/

- Renewable Energy World “Pakistan’s Winds Blow Slow: http://www.renewableenergyworld.com/articles/2015/01/pakistans-winds-blow-slow.html

References

This article is mainly based on a paper written for the GIZ Pakistan (Energy access situation in Pakistan. Energy sector overview of micro hydropower, solar and cooking technologies, January 2016)

- ↑ Central Intelligence Agency, ‘The World Factbook — Pakistan’, 2016, https://www.cia.gov/library/publications/the-world-factbook/geos/pk.html.

- ↑ Alexander Simoes, ‘OEC: The Observatory of Economic Complexity’, 2016, http://atlas.media.mit.edu/en/.

- ↑ The World Bank, ‘Pakistan Overview’, 2016, http://www.worldbank.org/en/country/pakistan/overview.

- ↑ 4.0 4.1 Ministry of Finance, Government of Pakistan, ‘Pakistan Economic Survey 2015-16. Chapter 14-Energy’, 2016, http://www.finance.gov.pk/survey/chapters_16/14_Energy.pdf.

- ↑ 5.00 5.01 5.02 5.03 5.04 5.05 5.06 5.07 5.08 5.09 5.10 5.11 5.12 5.13 5.14 5.15 5.16 5.17 Sustainable energy for all and Ministry of Finance - Implementation and Economic Reforms Unit (IERU), ‘Pakistan: Rapid Assessment and Gap Analysis’, 2014, 15, http://www.se4all.org/sites/default/files/Pakistan_RAGA_EN_Released.pdf.

- ↑ http://www.trust.org/item/20140717081934-6sjf2

- ↑ http://www.aedb.org/Policy/REpolicy.pdf

- ↑ ADB blog: https://blogs.adb.org/blog/grid-solar-can-be-game-changer-electricity-access-central-asia

- ↑ Climatescope 2015, ‘Pakistan’, Climatescope 2015, accessed 13 December 2016, http://global-climatescope.org/en/country/pakistan/.

- ↑ Bryanne Tait, ‘A Solar Developer’s Guide to Pakistan’ (Inernational Finance Corporation, World Bank Group, January 2016), 15, http://www.ifc.org/wps/wcm/connect/b46619004b5e398cb8b5fd08bc54e20b/IFC+-+Solar+Developer%27s+Guide+-+Web.pdf?MOD=AJPERES.

- ↑ http://www.aedb.org/Policy/REpolicy.pdf

- ↑ Mazhar H. Baloch, Ghulam S. Kaloi, and Zubair A. Memon, ‘Current Scenario of the Wind Energy in Pakistan Challenges and Future Perspectives: A Case Study’, Energy Reports 2, no. Supplement C (1 November 2016): 201–10, doi:10.1016/j.egyr.2016.08.002.

- ↑ IBP Inc, Pakistan Energy Policy, Laws and Regulations Handbook Volume 1 Strategic Information and Basic Laws (2015).

- ↑ 14.0 14.1 14.2 14.3 Luz Aguilar, ‘Value Chain Analysis of the PV Market in Pakistan. Project “Pakistan Solar Quality Potential“’ (Bundesverband Solarwirtschaft e.V. (BSW-Solar) Pakistan Business-Roundtable Berlin. 22nd November 2016, 22 November 2016), https://www.solarwirtschaft.de/fileadmin/user_upload/BSW_VCA_Presentation.pdf.

- ↑ ‘Pakistan at a Glance | FAO | Food and Agriculture Organization of the United Nations’, accessed 13 December 2016, http://www.fao.org/pakistan/fao-in-pakistan/pakistan-at-a-glance/en/.

- ↑ 16.0 16.1 Jan Inayatullah, ‘What Makes People Adopt Improved Cook Stoves? Empirical Evidence from Rural Northwest Pakistan. The Governance of Clean Development Working Paper 012. The Governance of Clean Development Working Paper Series.’ (School of International Development, University of East Anglia UK, 2011), https://www.uea.ac.uk/documents/439774/5807661/GCD+Working+Paper+012+-+Inayat+2011.pdf/46d4a093-fbac-44a4-8157-d687b0a5ede5.

- ↑ World Bank, ‘Forest Area (% of Land Area) | Data’, 2015, http://data.worldbank.org/indicator/AG.LND.FRST.ZS?end=2015&locations=PK&start=1990&view=chart.

- ↑ 18.0 18.1 Renewable Energy and Energy Efficiency Partnership, ‘Pakistan (2012)’, Reegle - Clean Energy Information Gateway, accessed 14 December 2016, http://www.reegle.info.

- ↑ 19.00 19.01 19.02 19.03 19.04 19.05 19.06 19.07 19.08 19.09 19.10 19.11 19.12 19.13 19.14 19.15 Jiwan Ach and Alfredo Baño Leal, ‘Energy Access Assessment Punjab (Pakistan). Final Report’ (ADB Energy for All Programm, 2014), 17, https://www.energynet.co.uk/webfm_send/1183.

- ↑ Winrock International, ‘Policy and Governance Framework for Off-Grid Rural Electrification with Renewable Energy Sources (TF090884)’ (The World Bank, 2008), 5, https://openknowledge.worldbank.org/bitstream/handle/10986/7954/683390ESW0WHIT0lectrification0Final.pdf;sequence=1.

- ↑ I. A. Mirza and M. S. Khalil, ‘Renewable Energy in Pakistan: Opportunities and Challenges’, Science Vision 16–17 (2011): 13–20.

- ↑ 22.0 22.1 22.2 International Energy Agency, ‘WEO - Energy Access Database’, 2016, http://www.worldenergyoutlook.org/resources/energydevelopment/energyaccessdatabase/. Cite error: Invalid

<ref>tag; name "International Energy Agency, ‘WEO - Energy Access Database’, 2016, http://www.worldenergyoutlook.org/resources/energydevelopment/energyaccessdatabase/." defined multiple times with different content Cite error: Invalid<ref>tag; name "International Energy Agency, ‘WEO - Energy Access Database’, 2016, http://www.worldenergyoutlook.org/resources/energydevelopment/energyaccessdatabase/." defined multiple times with different content - ↑ Umul Awan, ‘Pontential for Financing Off-Grid Solar Devices through Pakistan’s Microfinance Industry’ (Lighting Asia, February 2016), https://drive.google.com/file/d/0BxoafGd1mpz5N04xU01wNHEzVXc/view?usp=drive_web&usp=embed_facebook.

- ↑ Sohail Hasnie, ‘Off-Grid Solar Can Be Game-Changer for Electricity Access in Central Asia’, Text, (9 2016), https://blogs.adb.org/blog/grid-solar-can-be-game-changer-electricity-access-central-asia.

- ↑ 25.0 25.1 Liam Grealish, ‘Pakistan Off-Grid Lighting Consumer Perceptions. Study Overview’ (International Finance Corporation, World Bank Group, 2015), 15, http://www.ifc.org/wps/wcm/connect/d72aa0004886746d8388f7299ede9589/Pakistan+Solar+Consumer+Study+Overview_26thMay2015_LQ.pdf?MOD=AJPERES.

- ↑ 26.0 26.1 Michael Kugelman and Woodrow Wilson International Center for Scholars, Pakistan’s Interminable Energy Crisis: Is There Any Way Out?, 2015, 97, http://www.wilsoncenter.org/sites/default/files/ASIA_150521_Pakistan%27s%20Interminable%20Energy%20Crisis%20rpt_0629.pdf.

- ↑ 27.0 27.1 Hafiz A Pasha, ‘ECONOMY OF TOMORROW: Case Study of Pakistan’ (Friedrich Ebert Stiftung, April 2014), 79, http://library.fes.de/pdf-files/bueros/pakistan/10786.pdf.

- ↑ Imran Shah, ‘Power Outages of up to 10 Hours Imposed Again’, 20 October 2015, http://www.pakistantoday.com.pk/blog/2015/10/20/power-outages-of-up-to-10-hours-imposed-again/.

- ↑ http://www.aedb.org/Policy/REpolicy.pdf

- ↑ 30.0 30.1 ‘Pakistan Poverty Alleviation Fund (PPAF)’, accessed 19 December 2016, http://www.ppaf.org.pk/Default.aspx.

- ↑ PMIC, ‘Pakistan Microfinance Investment Company Limited (PMIC) | Who We Are’, 2017, http://pmic.pk/who-we-are/.

- ↑ The Council has developed 6-models of efficient smokeless cook stoves for cooking and space heating; until 2012, they have installed/disseminated more than 60,000 energy conserving, improved stoves devices all over the country and has provided training in construction and use of such stoves to the workers of various NGOs and local population. PAKISTAN RENEWABLE ENERGY SOCIETY, ‘PCRET Gives Solar Power to 500 Houses’, June 2012, http://www.pres.org.pk/?s=improved+stove.

- ↑ ‘REAP-Profile’, 2017, http://reap.org.pk/wp-content/uploads/2017/07/REAP-Profile-ilovepdf-compressed.pdf.

- ↑ Aga Khan Rural Support Programme, ‘AKRSP | Pakistan’, 2016, http://akrsp.org.pk/index.php/economic-pillar/renewable-energy/.

- ↑ GNESD Secretariat, ‘Bringing Hydro Power to the Rural Areas of Pakistan’, 2015, http://energy-access.gnesd.org/cases/48-sarhad-rural-support-programme.html#key_features.

- ↑ Nida Pakistan, ‘National Integrated Development Association’, 2016, http://www.nidapakistan.org/; ‘Global Alliance for Clean Cookstoves’, Global Alliance for Clean Cook Stoves, accessed 16 December 2016, http://cleancookstoves.org/country-profiles/85-pakistan.html.

- ↑ Jaan Pakistan, ‘Our Story’, Jaan Pakistan, 2016, http://www.jaanpak.com/?page_id=4079; ‘Global Alliance for Clean Cookstoves’; Harness Energy Pakistan, ‘Harness Energy Pakistan’, 2016, http://www.harnessenergy.pk/about.html.

- ↑ Aga Khan Development Network, ‘AKPBS Nominated for 2012 Zayed Energy Prize | Aga Khan Development Network’, 1 December 2012, http://www.akdn.org/news/akpbs-nominated-2012-zayed-energy-prize.

- ↑ Aga Khan Development Network, ‘Clean Energy Pioneer AKPBS Receives Prestigious Environmental Prize for BACIP Programme in Pakistan | Aga Khan Development Network’, 17 June 2011, http://www.akdn.org/press-release/clean-energy-pioneer-akpbs-receives-prestigious-environmental-prize-bacip-programme.

- ↑ Aga Khan Development Network, ‘AKDN Winter Newsletter: Pakistan Edition’, 2015, http://www.akdn.org/file/89391/download?token=D_f2_aqy.

- ↑ 41.0 41.1 41.2 41.3 41.4 Government of Pakistan, ‘Pakistan’s Intended Nationally Determined Contribution (PAK-INDC)’, accessed 15 December 2016, http://www4.unfccc.int/Submissions/INDC/Published%20Documents/Pakistan/1/Pak-INDC.pdf.

- ↑ International Energy Agency, ‘IEA - Pakistan: Alternative and Renewable Energy Policy, 2011 (Medium Term Policy)’, 2016, http://www.iea.org/policiesandmeasures/pams/pakistan/name-38076-en.php.

- ↑ Government of Pakistan, ‘Policy for Development of Renewable Energy for Power Generation. Employing Small Hydro, Wind, and Solar Technologies’, 2006, http://aedb.org/Documents/Policy/REpolicy.pdf.

- ↑ Asian Development Bank, ‘ADB to Help Improve Clean Energy Access, Efficiency in Pakistan’, Text, Asian Development Bank, (25 November 2016), https://www.adb.org/news/adb-help-improve-clean-energy-access-efficiency-pakistan.

- ↑ Full Advantage Co. Ltd., ‘Final Report on Biomass Atlas’ (The World Bank, 2016), http://documents.worldbank.org/curated/en/104071469432331115/pdf/107200-ESM-P146140-PUBLIC-PakistanBiomassMappingFinalReportWBESMAPJuly.pdf.

- ↑ Japan International Cooperation Agency, ‘JICA 2016 Annual Report’, 2016, https://www.jica.go.jp/english/publications/reports/annual/2016/c8h0vm0000aj21oz-att/2016_all.pdf.