Wind Energy Country Analyses Pakistan

Wind energy potential

National Renewable Energy Laboratories (NREL) USA under the USAID assistance program in 2007 has carried out a wind resource study of Pakistan and developed a map showing the wind speed potential available at 50m altitude[1]. The NREL wind resource map of Pakistan has given a great boost to the wind power development activities in the wind corridor regions. These regions are: The Karachi – Hyderabad region especially on hilltops, ridges in the northern Indus valley, wind corridor areas in western Pakistan, high mountainous regions and hills and ridges in south-western Pakistan. Now this potential area has become the focal point for the development of wind energy in the near future. As per the collected data, the coastal belt of Pakistan has a wind corridor that is 60 km wide and 180 km long. This corridor has an exploitable wind power potential of up to 50 000 MW of electricity generation.

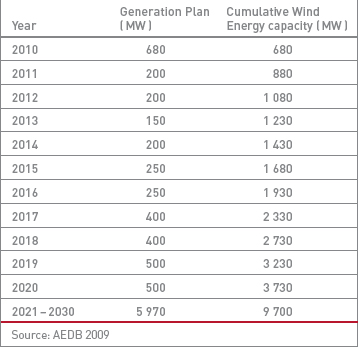

With regard to production targets for renewable energy the short term plan aims to develop 680 MW of wind generation capacity by 2010, 3 730 MW by 2020 and 9 700 MW by 2030[2]. The development for the increase in generation can be seen in table 1.

Framework Conditions for Wind Energy

The Policy for Development of Renewable Energy for Power Generation, December 2006, provides the following incentives for wind energy project developers:

- The provision of land at an attractive cost for wind energy projects ($ 8 per acre per year),

- Pre-feasibility studies have been done by Alternative Energy Development Board of the Ministry of Water and Power of Pakistan (AEDB)

- Wind data has been measured and analyzed and the wind data has been validated by Risoe National Laboratory of Denmark,

- The wind risk for the first few projects is taken over by the Government. The term wind risk refers to the following provision: If the wind speed at the wind farm is below the set benchmark for the site and generation is reduced accordingly the IPP will nevertheless be paid according to the benchmark capacity.[3] and,

- A 15 % Return on Equity (ROE) guaranteed as per guidelines of the National Electric Power Regulatory Authority (NEPRA).

Licensing and Permitting Procedure

Table 2 shows the sequence of activities required for setting up a wind powered Independent Power Producers for sale of all power generated to the grid. AEDB has issued Letters of Interest (LoI) to 93 national and international investors, 7 of which completed feasibility studies.

The eight following investors have so far applied for grant of Generation License to NEPRA: New Park Energy Ltd, Tenaga Generasi Ltd., Green Power ( Pvt ) Ltd, Win Power Ltd., Zephyr Power Ltd, Milergo Pakistan Ltd, Beacon Energy Ltd and Zorlu Enerji

Pakistan Ltd.

Current Use of Wind Energy and Project Pipeline

The Zorlu Enerji 50 MW Project is the first ever wind power plant of Pakistan and was inaugurated in April 2009 at Jhimpir, Sindh. This project is being developed by Zorlu Enerji of Turkey and will be completed in two phases. In the first phase 6 MW were commissioned, while the complete 50 MW shall be commissioned by December 2009[4]. Zorlu Enerji Groups plans to enhance the capacity of the wind farm to 300 MW upon successful completion of the 50 MW phase. NEPRA has awarded the project a tariff of 12.1057 US cents per kWh (8.3 €c), which is less than electricity generated from conventional thermal sources. This tariff is nevertheless assumed to be deemed sufficient to fulfil the guaranteed ROE for the wind farm of 15 % as per NEPRA guidelines[5]. Besides large scale plants the AEDB installed a 40 kW Micro Wind Turbine Demonstration Unit at Kallar Kahar, district Chakwal. The project, which is the first effort in the wind energy sector in the province of Punjab, aims at the setting up of 160 turbines of 600 kW.[6]

Business Climate

Pakistan’s emerging wind industry is facing manifold challenges. The first challenge is the lack of historical proven and bankable wind data which is available in western countries and improves lenders confidence. Furthermore fluctuations in wind turbine prices make the long-term planning of projects more complicated. International contractors have currently shown little interest in Pakistan due to a perceived high risk environment.

As the pilot projects are located on tidal flats (i.e. areas endangered by frequent flooding), construction costs are high and land ownership is fragmented. Infrastructure which is needed for the erection of a wind park is often insufficient and therefore existing bridges and roads have to be updated. Another hindrance is the lack of heavy lift cranes. The regulatory process is fragmented (see table 2) and a bureaucratic resistance is being perceived by investors.

The unregulated nature of wind power leads to a negative bias of the regulatory body which is more used to deal with thermal power plants. Furthermore technical requirements are based on thermal power plants. On the one hand the Government of Pakistan is offering a wind speed risk guarantee as an incentive to promote wind project development. Yet the drafting of a legal document (plant power curve & bench mark energy table) with consideration of the technical issues, incorporating such a guarantee poses a major challenge.[7]

References

- ↑ NREL/USAID/3TIER Wind energy map (50m height wind speeds)for pakistan, retrieved 21.7.2011 [[1]]

- ↑ AEDB 2009 – Alternative Energy Development Board, Retrieved 20.7.2011 [[2]]

- ↑ GOP 2009 – Government of Pakistan Press Information Department, Retrieved on 18th August 2009 [[3]]

- ↑ AEDB 2009 – Alternative Energy Development Board, Retrieved 20.7.2011 [[4]]

- ↑ AEDB 2009 – Alternative Energy Development Board, Retrieved 20.7.2011 [[5]]

- ↑ AEDB 2009 – Alternative Energy Development Board, Retrieved 20.7.2011 [[6]]

- ↑ Mayura Botejue 2007 – Wind Power Sector: Issues & challenges in Pakistan, Retrieved on 14th September 2009 [[7]]

Wind Energy Map (country-specific wind energy facts)

Portal:Wind