Fuel Prices India

Part of: GIZ International Fuel Price database

Also see: India Energy Situation

Fuel Pricing Policies

| Local Currency: | INR |

| Exchange Rate: | 45.479

|

| Last Update: | 2011/05/01 |

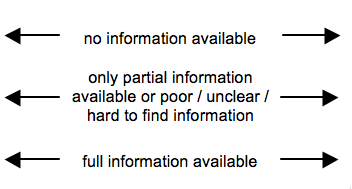

The Ministry of Petroleum and Natural Gas supervises both the upstream and downstream fuel sectors in India (http://petroleum.nic.in/). While there is plenty of legal information on the ministries website, clear and easy-to-understand information regarding fuel price breakdowns and further pricing policies is missing. Annual reports offer detailed top-level-statistics and also fuel price timelines.

The downstream market is open to private companies. The fuel price is regulated via maximum prices, which are set by the government / the ministry several times a year (depending on the degree of volatility of international crude oil prices). Prices are changed on an ad-hoc basis and in times of high crude oil prices OMCs are forced to sell at prices levels that do not cover the overall costs. This leads to temporary huge losses for oil companies that need to be outbalanced by the government. Thus, in fact fuels (especially diesel) are subsidized in India (→App. A1). Taxes on diesel are much lower than on gasoline.

Indian states impose different taxes on fuels. Also, every state imposes VAT independently.

The findings of latest reform effort are compiled in the report “Report of The Expert Group on A Viable and Sustainable System of Pricing of Petroleum Products”: http://petroleum.nic.in/reportprice.pdf , which contains a wealth of information.

Fuel Prices and Trends

| Gasoline 95 Octane | Diesel | |

|---|---|---|

| in USD* |

|

|

| in Local Currency |

|

|

* benchmark lines: green=US price; grey=price in Spain; red=price of Crude Oil

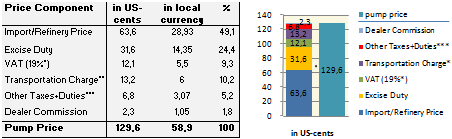

Fuel Price Composition

Price composition for one litre of Gasoline 95 Octane.

For an assumed price of 58.90 INR.

(*VAT differ among states and over time; 19% is an usual value; up to 28% for gasoline in some states.)

(**Transportation charge differs depending on actual transportation costs. 6 INR is an average value.)

(***includes: Education Tax (0.43INR), Crude Oil Custom Duty (1.1INR) and Petrol Custom Duty (1.54INR).)

Source: http://www.kokkada.com/calculations-of-petrol-prices-in-india/ (→App. A3). Taxation on Diesel is considerably lower, resulting to overall lower pump prices.

At a Glance

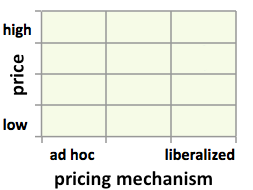

| Regulation-Price-Matrix |

| ||||

|

|

|

| ||

Clear information on fuel price breakdown and pricing formula missing.

Sources to the Public

| Type of Information | Web-Link / Source |

|---|---|

| Other Information | http://www.iisd.org/pdf/2010/lessons_india_kerosene_subsidy.pdf |

| Other Information | http://petroleum.nic.in/ (GSI: Lessons Learned from Attempts to Reform India's Kerosene Subsidy) |

| Pump prices and margins | http://www.iocl.com (Indian Oil; retailer) |

| Pump prices and margins | http://petroleum.nic.in/petstat.pdf (Ministry report) |

Contact

Please find more information on GIZ International Fuel Price Database and http://www.giz.de/fuelprices