Difference between revisions of "Promoting Access to Finance in Benin"

***** (***** | *****) Tag: 2017 source edit |

***** (***** | *****) |

||

| Line 7: | Line 7: | ||

* Subsidising loans to de-risk the market of solar productive use appliances and improve loan terms and conditions. The subsidies are up to 33% of the loan amount, according to different loan conditions, and are paid to MFIs. | * Subsidising loans to de-risk the market of solar productive use appliances and improve loan terms and conditions. The subsidies are up to 33% of the loan amount, according to different loan conditions, and are paid to MFIs. | ||

* In addition, awareness raising events are organized around the country to inform about solar technologies and productive use appliances, improve business development skills and to advise farmers and shopkeepers on the integration of solar appliances into their businesses, in particular solar fridges, and water pumps. | * In addition, awareness raising events are organized around the country to inform about solar technologies and productive use appliances, improve business development skills and to advise farmers and shopkeepers on the integration of solar appliances into their businesses, in particular solar fridges, and water pumps. | ||

| − | * Moreover a small fair is organized in the Zou department in collaboration with the city hall of Bohicon | + | * Moreover a small fair is organized in the Zou department in collaboration with the city hall of Bohicon. |

== Key findings == | == Key findings == | ||

| Line 14: | Line 14: | ||

The intervention has facilitated partnerships between four MFIs and four solar companies. Partnership agreements were signed, and operational procedures defined at the start of the collaboration, to provide the basis and framework for long-term cooperation. In this tri-partite relationship, solar companies sell Productive Use of Energy (PUE) appliances to the end-users that are financed by the MFI, and the end-users, instead of paying the solar company, pay the MFIs over their loan terms (see also figure 1).This arrangement brings multiple benefits to all actors. Solar companies gain access to a larger customer base (the four MFIs together had 159,000 borrowers in 2021) thanks to the MFIs’ wide network of service points and MFIs get the opportunity to serve customers whose activities are eventually more profitable than those using conventional, diesel appliances. | The intervention has facilitated partnerships between four MFIs and four solar companies. Partnership agreements were signed, and operational procedures defined at the start of the collaboration, to provide the basis and framework for long-term cooperation. In this tri-partite relationship, solar companies sell Productive Use of Energy (PUE) appliances to the end-users that are financed by the MFI, and the end-users, instead of paying the solar company, pay the MFIs over their loan terms (see also figure 1).This arrangement brings multiple benefits to all actors. Solar companies gain access to a larger customer base (the four MFIs together had 159,000 borrowers in 2021) thanks to the MFIs’ wide network of service points and MFIs get the opportunity to serve customers whose activities are eventually more profitable than those using conventional, diesel appliances. | ||

[[File:Rbf microfinance.png|left|frameless|644x644px]] | [[File:Rbf microfinance.png|left|frameless|644x644px]] | ||

| − | All four MFIs have developed solar loans with better terms than conventional loans. These preferential conditions can be such as (1) simplified guarantee requirements by accepting the solar appliance itself as a collateral and (2) extending the repayment period to 24 to 36 months. The improved conditions made it easier for end-users to access financing for solar appliances, which they use to generate additional income and pay back the loans. As of June 2023, 37 credits have been granted through the support of the RBF mechanism. The successful experience of some of the end-users, who (thanks to the credit) were able to finance a solar powered irrigation system or a solar fridge, continues to draw interest from other potential users (for more information see case study on RBF-Mechanism for the Sale of Productive Equipment in Benin). | + | All four MFIs have developed solar loans with better terms than conventional loans. These preferential conditions can be such as '''(1)''' simplified guarantee requirements by accepting the solar appliance itself as a collateral and '''(2)''' extending the repayment period to 24 to 36 months. The improved conditions made it easier for end-users to access financing for solar appliances, which they use to generate additional income and pay back the loans. As of June 2023, 37 credits have been granted through the support of the RBF mechanism. The successful experience of some of the end-users, who (thanks to the credit) were able to finance a solar powered irrigation system or a solar fridge, continues to draw interest from other potential users (for more information see case study on RBF-Mechanism for the Sale of Productive Equipment in Benin). |

=== Intermediate Impact === | === Intermediate Impact === | ||

Revision as of 11:37, 5 September 2023

Project Approach

Benin is one of the 20 least electrified countries in the world, with an access rate of 42%, leaving around seven million people without electricity. Progress has been slow, with an annual increase in electrification of less than 1% on average between 2010 and 2021. The issue is particularly challenging in rural areas, where the access rate to electricity was only 18% in 2018, compared to 67% in urban areas. Solar energy offers a suitable solution for off-grid electricity. However, despite the maturity of solar technologies in Benin and its proven business case, the cost structure of solar appliances presents a capital barrier that is difficult to overcome. Since farmers and rural SMEs often lack the capital to purchase solar systems, access to micro-loans may help them overcome this challenge. While local micro-finance institutions (MFIs) have experience working with smallholder farmers and Micro, Small and Medium Enterprises (MSMEs) in rural areas, they are not familiar with solar technologies, and hesitant in granting loans with appropriate terms and conditions for the investment in the productive use of such technologies.To address this challenge, the Green People´s Energy Programme (Grüne Bürgerenergie, GBE) in Benin launched a results-based financing (RBF) mechanism to encourage microfinance institutions (MFI) to grant microloans to potential solar end-users. The RBF scheme targets mainly the promotion of solar refrigerators and freezers and solar water pumps. The RBF scheme consists of project kick-off grants to MFIs to design appropriate financial products for productive appliances of solar energy and loan-tied incentives for each loan issued by the MFI. This approach goes hand-in-hand with GBE Benin’s RBF mechanism that aims to support the development of a commercial market for solar appliances by promoting reliable solar devices with functional guarantees and after-sales services based on cooperation between the MFIs and solar companies. Specifically, the project activities consist of:

- Facilitating partnerships between MFIs and solar companies. The GBE project team and its implementation partner, CIDR Pamiga, organize match-making events, facilitation conversations and support negotiations between MFIs and solar companies. After the signature of the memorandum of understanding (MoU), CIDR Pamiga supports the two parties to elaborate operational procedures and hold quarterly pilot committee meetings to review and address challenges.

- Providing technical assistance to MFIs to acquire knowledge and develop in-house expertise in solar energy technologies, and to develop appropriate financial products that meet the needs of end-users. MFIs assign energy focal points who are initially trained and then pass the gained knowledge to local agents of MFIs in rural areas.

- Subsidising loans to de-risk the market of solar productive use appliances and improve loan terms and conditions. The subsidies are up to 33% of the loan amount, according to different loan conditions, and are paid to MFIs.

- In addition, awareness raising events are organized around the country to inform about solar technologies and productive use appliances, improve business development skills and to advise farmers and shopkeepers on the integration of solar appliances into their businesses, in particular solar fridges, and water pumps.

- Moreover a small fair is organized in the Zou department in collaboration with the city hall of Bohicon.

Key findings

Project Achievements

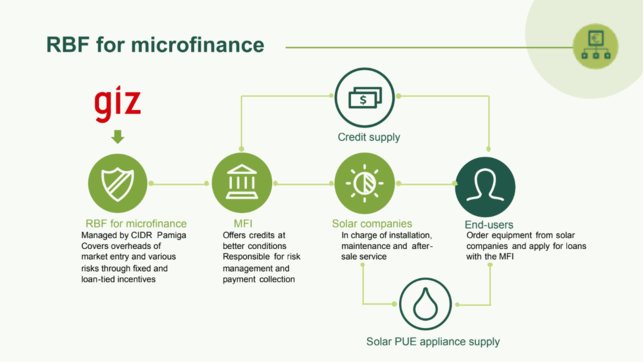

The intervention has facilitated partnerships between four MFIs and four solar companies. Partnership agreements were signed, and operational procedures defined at the start of the collaboration, to provide the basis and framework for long-term cooperation. In this tri-partite relationship, solar companies sell Productive Use of Energy (PUE) appliances to the end-users that are financed by the MFI, and the end-users, instead of paying the solar company, pay the MFIs over their loan terms (see also figure 1).This arrangement brings multiple benefits to all actors. Solar companies gain access to a larger customer base (the four MFIs together had 159,000 borrowers in 2021) thanks to the MFIs’ wide network of service points and MFIs get the opportunity to serve customers whose activities are eventually more profitable than those using conventional, diesel appliances.

All four MFIs have developed solar loans with better terms than conventional loans. These preferential conditions can be such as (1) simplified guarantee requirements by accepting the solar appliance itself as a collateral and (2) extending the repayment period to 24 to 36 months. The improved conditions made it easier for end-users to access financing for solar appliances, which they use to generate additional income and pay back the loans. As of June 2023, 37 credits have been granted through the support of the RBF mechanism. The successful experience of some of the end-users, who (thanks to the credit) were able to finance a solar powered irrigation system or a solar fridge, continues to draw interest from other potential users (for more information see case study on RBF-Mechanism for the Sale of Productive Equipment in Benin).

Intermediate Impact

One of the key impact areas of the intervention is building a competitive solar market in Benin that offers quality solar PUE appliances leveraging local financial resources. Thanks to GBE support, MFIs entered the market of finance for solar PUE appliances, gaining relevant knowledge, and developing in-house expertise on solar technologies. The financial incentives enabled the MFIs to offer loans with better terms and conditions, and thereby allowing end-users to overcome the initial capital barrier for buying solar PUE appliances. With access to finance, farmers and shop keepers are able to invest in PUE appliances that will eventually increase their income.In addition, the project established partnerships between MFIs and solar companies, which continue beyond the duration of the GBE-project. Some of these partnerships are extended to cover other applications of solar technologies such as solar kits for lighting and for charging cellphones / radios or operating televisions, as mentioned by one solar company.

Challenges in Project Implementation

The project implementation has faced several challenges, which the implementer was able to address appropriately. A challenge that occurred at the start of the project, consisted in a misalignment of the procedures and terms and conditions between the solar companies and the MFIs. For example, according to a representative of GBE Benin, MFIs do not finance start-up activities while solar companies are interested in selling and installing solar PUE appliances. The project team was able to address these challenges by facilitating and intensifying the dialogue between solar companies and MFIs. Moreover, there was a shortage of solar appliances supply at the beginning of the demonstration and marketing campaign, and it was difficult to organize solar water pumping demonstration events in urban centers where access to boreholes was difficult. Although boreholes are not necessary for demonstration of solar water pumps, farmers were asking for demonstration in “real working conditions”. Generally, MFIs’ lack of financial resources limits their possibi�lities for providing loans for PUE appliances. Nevertheless, they have started to see a strong business case for PUE appliances. By leveraging the concessional finance they receive from the GBE-project, MFIs can seek cheaper financing from international investors, especially targeting impact investors. Finally, there is the need for further support to MFIs to improve their procedures for assessing loan applications and to make these processes more efficient and customer friendly. For example, farmers usually do not have long-term plans for investments. Often, they decide to invest in solar water pumps only when they urgently need to irrigate their growing crop. MFIs could shorten the duration needed for processing loan requests. Another element is that interest rates are still high for the end-users (usually 24%).

Lessons Learned

The project has demonstrated that the RBF approach shows strong potential in supporting the MFIs in entering the market to provide financing for solar PUE appliances. The partnerships between solar companies and the MFIs open up further possibilities for the two sectors to create synergies, for MFIs to expand their loan portfolio and for solar companies to serve a larger rural population. One of the key success factors of the project is the MFIs’ previous experience of working in rural areas with farmers and in the agribusiness sector, and their knowledge of the social and economic context in rural areas. The MFI have large networks of agents and solid experience in providing services close to the rural population. However, as renewable energy investment is still an emerging practice for local financial institutions in Benin, technical assistance needs to go hand-in-hand alongside other financial risk mitigation measures. A lack of technical assistance would further delay MFIs’ uptake of RE financing activities. The project results have also identified future needs for supporting MFIs, particularly, the need for having credit facilities accessible to MFIs to strengthen their financial possibilities to provide loans to farmers and rural MSMEs for PUE appliances. Such credit facilities could be loans from multilateral development institutions or national institutions, subordinated with technical assistance and sectoral/operational requirement. Access to climate finance or green finance would also be very beneficial for the MFIs. Moreover, the project has strongly demonstrated that quality of solar appliances is of high importance for the reliability of the solar market. To consolidate the project results, MFIs and solar companies could consider the establishment of an institutionalised solar energy ecosystem, such as a solar energy cluster, that supports the exploitation of business opportunities, develops the market, and ensures its reliability and sustainability. The ecosystem should also include competent agencies and authorities, relevant universities, training institutions, development organisations and NGOs. However, the success of the approach is dependent on the MFIs’ ability to institutionalize the knowledge acquired. Some MFIs, for example, proposed to integrate solar credit trainings for field agents during their annual general assembly. Continuous capacity building and knowledge diffusion will ensure long-term sustainability of the approach.

Sustainability of the Intervention

The financial model is attractive and working for end-users, solar companies and MFIs. It is being used to cover other solar appliances not covered by the GBE programme and will continue beyond the GBE implementation period with the same terms such as the 36 months loans duration, interest rate, and the solar appliance as a collateral against the loan. According to a representative from an MFI, these terms are still beneficial for MFIs without subsidies. Moreover, technical capacity building has provided the MFIs with relevant knowledge and initiated the development of in-house expertise in solar energy. This knowledge is also shared with MFI staff in rural areas, ensuring the sustainability of the intervention results.The installed solar systems have proven their economic viability and the owners are very much interested in ensuring their continuous functionality, as they represent a significant source of income for them. The warranty provided by the solar companies also helps to ensure sustainable operation of the solar systems. The warranty generally covers at least the duration of the loan period, so that the MFIs do not bear the risk of the equipment malfunctioning.

Conclusion and outlook

A combination of technical and financial assistance, as provided by the project, presents a suitable approach to promote solar energy solutions for productive use in rural areas. The intervention has laid the foundation for a long-term partnership between MFIs and solar companies and has developed a solar credit model based on the market conditions and end-user needs. The solar credit model has demonstrated its relevance to end-users and its attractiveness in the solar market. The market-based approach was appropriate to adequately address the market barriers and failures of the solar energy market in Benin, as well as the specific needs of end-users. Working with MFIs is reasonable as they serve a large population in rural areas of Benin and have access to a large number of potential end-users of solar appliances. MFIs also have a large network of agents in rural areas. Tapping into local financial resource may be one pathway to scale up productive use in Benin. By facilitating access to green and climate finance to expand the renewable energy loan portfolio in Benin, the sector has the potential to serve a large portion of end-users of solar PUE appliances.