Difference between revisions of "Rwanda Energy Situation"

***** (***** | *****) |

***** (***** | *****) |

||

| (62 intermediate revisions by 14 users not shown) | |||

| Line 1: | Line 1: | ||

| − | |||

| − | {| | + | {{CES Country|CES Country Name=Rwanda |

| − | | | + | |CES Country Capital=Kigali |

| − | | | + | |CES Country Region Africa = Sub-Saharan Africa |

| − | + | |CES Country Coordinates=1.9403° S, 29.8739° E | |

| − | | | + | }} |

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | <br/> | |

| − | <br/> | ||

| − | + | = Introduction = | |

| − | |||

| − | |||

| − | + | Rwanda‘s energy balance shows that about 85% of its overall primary energy consumption is based on biomass (99% of all households use biomass for cooking),11% from petroleum products (transport, electricity generation and industrial use) and 4% from hydro sources for electricity. In April 2011 about 14% of the total population had access to electricity from the grid and the government has started a roll-out programme to rapidly increase this to 16% (350 000 connections) by 2012 and 60% by 2020. | |

| − | |||

| − | + | Until 2004, Rwanda depended on a single energy source – hydropower – whose limited capacity relied on a dilapidated network with technical and commercial losses of around 30%, much of which is attributed to the lack of investment in the sector for the last 25 years. In recent years (2004-2006), Rwanda has suffered from acute electricity supply shortage and severe load shedding. Its installed generation capacity (mostly hydropower), has been severely constrained by regional drought leading to a rapid draw down of the reservoirs. Drought has also affected Kenya, Tanzania and Uganda, leaving Rwanda with no possibility of sourcing electricity from its neighbours. | |

| − | + | ||

| − | Government | + | In late 2004, the Government was forced to make a difficult choice: better expensive energy than none. Diesel generators were rented from private companies at a high cost and this in addition to high fuel costs increased tariffs by over 100% to about US$ 0.22/kWh. Average retail tariffs in the rest of the region are around US$ 0.10-0.12/kWh<ref name="Energy resource">GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: II - Energy Resource. </ref>; in 2017, average tariffs (life line tariffs) are around 0.12 for industries and 0.17 $c/kWh for consumers.<ref name="https://cleanenergysolutions.org/training/energy-access-2020-rwanda">https://cleanenergysolutions.org/training/energy-access-2020-rwanda</ref> In order to realize its ambition of becoming a middle-income country, Rwanda will require strong, sustained economic growth with an average of 8-9% annual GDP growth (information as of 2007). To succeed in this move, the Government of Rwanda together with the private sector will endeavour to scale up the energy production and distribution so as to make the energy sector competitive in the sub-region. The Government of Rwanda is exploring mechanisms to improve modern energy services in rural areas, by implementing the Second Generation Poverty Reduction Strategy Program (EDPRS). The program focuses on promising options for rural energy supply, such as solar energy, wind energy and extension of the grid to rural areas<ref name="Energy resource">GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: II - Energy Resource. </ref>. |

| − | + | The country has currently about 97 MW installed generating capacity (57 MW hydro and 40 MW diesel out of which, however, only 87 MW are available). A number of new sources are supposed to come on line within the coming years adding a capacity of 232 MW by 2013. | |

| − | |||

| − | + | GoR has the ambitious target to increase production capacity to 1 GW until 2017 (Hydro capacity to be increased to 333MW, 310MW geothermal capacity to be developed, methane powered capacity of 300 MW). In 2017, though the steady increase of electricity generation continues (current 208 MW)<ref name="https://cleanenergysolutions.org/training/energy-access-2020-rwanda">https://cleanenergysolutions.org/training/energy-access-2020-rwanda</ref>, this capacity is not yet met. Electricity generation: 49% hydro, 26% thermal, 14% methane, 7% peat and 4% solar PV. In 2017, though thee steady increase of electricity generation continues (current 208 MW), this capacity is not yet met.<ref name="https://cleanenergysolutions.org/training/energy-access-2020-rwanda">https://cleanenergysolutions.org/training/energy-access-2020-rwanda</ref> | |

| − | |||

| − | |||

| − | + | The economic sectors with the highest potential for growth (agricultural processing, mining, tourism, IT) depend heavily on energy supply. The costs of electricity are very high at about US$0.21 per kWh. At the same time, due to the lack of electricity in rural areas, this reduces the efficiency of the social services (health, education and administration). The Government has a programme to provide all health centres and administrative centres and 50% of the schools with solar power if they are too far from the grid by 2012 and extend provision further to 100% of all schools by 2017. A number of special programmes are already under implementation. (update 2017: schools 64% and health clinics 100%<ref name="https://cleanenergysolutions.org/training/energy-access-2020-rwanda">https://cleanenergysolutions.org/training/energy-access-2020-rwanda</ref>). | |

| − | |||

| − | + | Currently (in 2018), the GoR has a target of 100% electrification by 2024. According to the Rwanda Energy Group, 48% of Rwandan households will use off-grids solutions to meet their needs while 52% will be connected to the grid, to achieve this target. <ref name="https://www.newtimes.co.rw/news/featured-grid-electrification-helping-achieve-rwandas-energy-targets">https://www.newtimes.co.rw/news/featured-grid-electrification-helping-achieve-rwandas-energy-targets</ref><br/><!--EndFragment--> | |

| − | |||

| − | |||

| − | | | + | [[Rwanda Energy Situation#toc|►Go To Top]] |

| − | |||

| − | + | <br/> | |

| − | |||

| − | |||

| − | + | = Renewable Energy Resources<br/> = | |

| − | |||

| − | + | Generally, Rwanda is well endowed with renewable energy resources, but most potential still remains untapped. Micro hydro-power in particular constitutes a significant potential for rural power supply with many areas having ample rainfall and most streams and rivers unexploited. Solar irradiation is high - between 4-6 kWh/m<sup>2</sup>/day - but diffusion is hampered by high initial cost and limitations on high load usage. Biogas is promising for thermal energy needs for farms and small institutions, especially considering the large number of households that own cows and other livestock. | |

| − | |||

| − | |||

| − | | | + | [[Rwanda Energy Situation#toc|►Go To Top]] |

| − | |||

| − | + | <br/> | |

| − | |||

| − | |||

| − | + | == Hydro Sector<br/> == | |

| − | |||

| − | + | The country currently has about 57 MW installed hydropower generating capacity. Hydroelectric power is mainly from the northern and southern parts of the country (Ruhengeri , Gisenyi and Cyangugu) namely from the following power plants: Ntaruka, Mukungwa , Gisenyi, Gihira as well as Rusizi 1 and Rusizi 2<ref name="Energy resource">GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: II - Energy Resource. </ref>. A number of new sources are supposed to come on line within the coming years adding a capacity of 232 MW by 2013. This includes the hydropower site Nyaborongo with 27,5 MW in Muhanga and Ngororero Districts planned to come on line by February 2013 but currently experiencing delays, and numerous mini/micro hydro plants adding up to 35 MW. The new hydropower plant Rukarara located in Nyamagabe district, Southern Province, with 9.5 MW and costs of US$ 23.5<span style="font-family: monospace"></span>million was commissioned in January 2011. Construction for this plant had already started in 2007. An additional three BTC supported hydropower plants adding a capacity of about 2.2. MW were recently completed and are currently under commissioning. | |

| − | |||

| − | |||

| − | + | Feasibility studies are under implementation for large dams with a total capacity of 400 MW or more, among those are studies for the hydro power plant Rusizi III, that could produce 145 MW and would be shared among Rwanda, the Democratic Republic of Congo and Burundi (resulting in a production of 48.3 MW for each of the three countries). It is expected to be completed by 2016. Rusizi IV is currently at the pre-feasibility study stage and has an estimated production capacity of 96 MW. Another feasibility study has been elaborated for the Rusumo plant expected to produce 90 MW and to be shared among Burundi, Tanzania and Rwanda (30 MW to be produced for each country). It is planned to be completed by 2015. The first power production using methane gas from Lake Kivu started at the end of 2008 and private companies have been contracted to supply 250-300 MW by 2017. The currently utilized hydro capacity is 57 MW. However, the strong dependence on hydro power represents a risk which became evident in the 2004 energy crisis when a combination of drought and over-utilization led to a rapid draw down of the dam water levels leading to acute supply shortages. Although diversification of energy sources is a high priority, the Government of Rwanda continues to develop mainly hydro power as the least cost generation resource | |

| − | |||

| − | + | To address the low rural electricity access level and the relatively high cost of existing generation alternatives, the government has embarked upon a sizable micro hydro development programme to provide power to rural villages and towns. The projects are implemented in cooperation with a large number of Donor partners and often focused primarily on the construction phase. There are in total 23 Government initiated projects that aim to deliver an additional amount of 14.13MW. | |

| − | |||

| − | |||

| − | + | <br/> | |

| − | |||

| − | + | '''''Further advancements are also being made in the pico hydro power sector. Currently, there exist at least 21 hydro power plants below 50 kW. Their distribution per installed generation capacity is as follows:''''' | |

| − | |||

| − | |||

| − | + | '''''0 - 5 kW : 13''''' | |

| − | |||

| − | + | '''''5 - 25 kW: 4''''' | |

| − | |||

| − | |||

| − | + | '''''25- 50 kW: 4''''' | |

| − | |||

| − | + | <br/> | |

| − | + | The PSP Hydro project will provide technical and business expertise to support the creation and development of economically sustainable small and micro energy providers. This will contribute to improve the power supply in Rwanda. . A MININFRA survey in 2007 prepared a micro hydro atlas which identified 333 sites for small and micro hydro power which can be used for mini-grids or connected to the national grid, depending on the location. There have already been a number of projects implemented through the Ministry with assistance of UNIDO, BTC and the EU. These are constructed under direct supervision of the ministry and once operational, will be managed through private companies. To facilitate the privatization process PSP Hydro has financed a study to identify best practices in the privatization of micro hydro power plants and is in the process of carrying out technical and financial audits for the first five sites to be privatized on a pilot basis. | |

| − | |||

| − | |||

| − | | | + | [[Rwanda Energy Situation#toc|►Go To Top]] |

| − | |||

| − | |||

| − | + | <br/> | |

| − | + | == Biomass Sector<br/> == | |

| − | + | There has been a rapid increase in household biomass energy consumption which has been occurring recently in Rwanda particularly in urban and semi-urban households due to the energy crisis in the country. This involved critical shortage or total lack in some cases of other energy alternatives. | |

| − | The | + | <u>The results of a survey covering all the districts under the 4 provinces and City of Kigali in 2005 suggest that the energy supply is not sustainable due to the following reasons:</u> |

| − | + | *Urbanization rates have increased substantially, and households are increasingly demanding more modern lifestyles thereby accelerating the demand for wood products; | |

| + | *Prices of wood fuel have increased substantially in real terms; | ||

| + | *Wood fuel transport distances appear to be increasing and production methods are worsening; | ||

| + | *Households complain about the availability of wood fuels, some wood products are now regulated (i.e. prohibited), and the (peri) urban use of sawdust, coffee husks and other residues is increasing. | ||

| + | *During the time that the survey was being carried out (2005), there was a complete embargo in all provinces on the cutting of trees for firewood or charcoal. Despite the Government's ban charcoal was being smuggled in huge quantities to different provinces and districts<ref name="Energy resource">GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: II - Energy Resource. </ref>. | ||

| − | = | + | Biomass (firewood, charcoal and residues) remains practically the only source for cooking for many years to come as electricity will remain too expensive in the medium future. LPG consumption is extremely low (consumption per capita is 1/50 only of Kenya, the market leader in the region) while kerosene is practically only used for lighting. For the urban areas wood and charcoal will remain the most import sources of fuel for cooking while in rural areas households mainly rely on agricultural residues (with its negative impacts on soil fertility) and collected wood. According to the '''Kigali Institute of Science and Technology (KIST),''' Rwanda is, however, running a fuel wood deficit of approximately 4.5 million cubic meters per year<ref name="Best practice">GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: VII - Best Practice Case Studies. </ref>. |

| − | + | The percentage of the population dependend on soley biomass consumption was reduced from 99% in 2000 to 85% in 2014 (with the target of 55% in 2018).<ref name="https://cleanenergysolutions.org/training/energy-access-2020-rwanda">https://cleanenergysolutions.org/training/energy-access-2020-rwanda</ref> However, according [http://documents.worldbank.org/curated/en/406341533065364544/pdf/129101-ESM-P156666-PUBLIC-MTF-Energy-Access-Country-Diagnostic-Report-Rwanda-6-2018.pdf to this study] in 2018, 99.6% of households cooked with biomass and only 53% use a three-stone fire. <ref name="Bonsuk Koo, B., Rysankova, D., Portale, E., Angelou, N., Keller, S. and Padam, G. (2018) Rwanda: Beyond Connections – Energy Access Diagnostic Report Based on the Multi-Tier Framework, World Bank Group, ESMAP, SEforALL, SREP, Washington, DC, https://energydata.info/dataset/e0233428-1a11-43bc-8fce-c2348d453ed5/resource/547d1558-0109-4b9c-a487- a3a4a5effd2f/download/mtf-energy-access-country-diagnostic-report_rwanda_430.pdf.">Bonsuk Koo, B., Rysankova, D., Portale, E., Angelou, N., Keller, S. and Padam, G. (2018) Rwanda: Beyond Connections – Energy Access Diagnostic Report Based on the Multi-Tier Framework, World Bank Group, ESMAP, SEforALL, SREP, Washington, DC, https://energydata.info/dataset/e0233428-1a11-43bc-8fce-c2348d453ed5/resource/547d1558-0109-4b9c-a487-a3a4a5effd2f/download/mtf-energy-access-country-diagnostic-report_rwanda_430.pdf.</ref> | |

| − | + | [[Rwanda Energy Situation#toc|►Go To Top]] | |

| − | + | <br/> | |

| − | + | === Biomass Potential and Distribution in Rwanda<br/> === | |

| − | + | It has been observed that if an average household used 1.8 tonnes of firewood in a year to satisfy its cooking needs with a traditional stove, the same household would use 3.5 tonnes of wood if it were to switch to charcoal with an improved stove. The use of charcoal in urban areas, in combination with high urban growth rates, therefore is a worrisome phenomenon that accelerates pressure on wood resources. Peat is also a resource the government intends to promote use of. It is estimated that there exists in Rwanda estimated reserves of 155 million tons of dry peat spread over an area of about 50,000 hectares. About 77% of peat reserves are near Akanyaru and Nyabarongo rivers and the Rwabusoro plains Potential for Peat-to-Power Generation. Peat in the Rwabusoro marshland and around the Akanyaru river can fuel 450MW of electricity generation for 25 years. Currently a cement plant and some prisons utilise peat for cooking. | |

| − | + | The average costs of biomass fuel escalated overtime with records indicating that 1995 prices of a bag of charcoal (35kg) and one steer (350kg) of firewood to be 400 Rwandan Francs (Frw) and 700 Frw respectively while 2005 prices stood at 5000 Frw for one bag of charcoal and 4200 Frw for one steer of firewood. The percentage increase of the prices from 1995 to 2005 was 1250% for charcoal and 600% for firewood. | |

| − | + | The rate of urbanization has increased from 6% in the mid & late nineties to some 21% in 2004 (census). As a result, the urban population has more than tripled over just a few years. There are reasons to worry about the consequences of this on the wood source base and the sustainability of wood fuel supplies. The urban population has a strong preference for charcoal as a cooking fuel and the use of charcoal will undoubtedly increase in line with the increasing urban population. There also is a trend for urban households to construct durable houses, for which mainly fired clay bricks are used. These bricks are produced by artisans in the surroundings of the city who use a lot of wood for this process. There are no recent statistics on the total volume used; the 2000 survey found that brick making was the single largest commercial user of wood fuel in the country<ref name="Energy resource">GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: II - Energy Resource. </ref>. | |

| − | + | The Government‘s Vision 2020 asks for a reduction of biomass consumption by 50% by 2020, but is it not clear what the alternative sources of energy will be. Government programmes have focused on the increase of wood production (already 80% of the country‘s firewood and charcoal come from eucalyptus) through plantations and agro forestry programmes. The Government enforces very strict tree cutting laws and permits are required for cutting of all trees, even eucalyptus from private lands. This has partly resulted in inefficiencies in the wood and charcoal production and legislation should be adapted to address this issue. Also the use of wood for brick burning is virtually impossible in the country. All these measures have resulted in the remarkable achievement of reducing deforestation and keeping the remaining natural forests in Rwanda very well protected. These forests are even recovering from the war damage in the 1990s while planted and renewable Eucalyptus trees provide 80% or more of the required fire wood and charcoal. Furthermore, strong efforts are made to increase efficiency in charcoal production and the use of improved stoves. Already 60% of all households have improved stoves (different models depending on the fuel used - either the Kenyan Ceramic Jiko for charcoal in towns or mud stoves in the rural areas) and the Government wants to increase this percentage to 100% by 2012 while at the same time improving the efficiencies of the improved stoves. There are a number of special programmes to increase efficiency in charcoal production and to improve and disseminate better cook stoves. | |

| − | + | For information on the challenges and issues affecting the exploitation of biomass resources, click [[Challenges and Issues Affecting the Exploitation of Renewable Energies in Rwanda#Biomass|here]]. | |

| − | + | [[Rwanda Energy Situation#toc|►Go To Top]] | |

| − | + | <br/> | |

| − | + | === <span class="mw-headline" id="Biomass_stoves:_best_practice_case_study"><span class="mw-headline" id="Biomass_stoves:_best_practice_case_study.5B14.5D"><span class="mw-headline" id="Biomass_stoves:_best_practice_case_study.5B2.5D">Improved Charcoal Stoves: Best Practice Case Study</span></span></span><br/> === | |

| − | + | The project <span class="mw-headline" id="Improved_charcoal_stoves_in_urban_and_peri-urban_Kigali.2C_Rwanda">[[Rwanda: Best Practice Case Studies#Improved Charcoal Stoves in Urban and Peri-urban Kigali.2C Rwanda|Improved charcoal stoves in urban and peri-urban Kigali]]</span> builds on previous advances, and uses the power of the Rwandan private commercial sector to increase the production and purchase of fuel-efficient charcoal stoves in a sustainable manner.<br/>While <span style="font-family: monospace"></span>the plan focuses on Kigali as the largest market with the best potential for significantly reducing charcoal usage in a sustainable, commercial way, it is envisioned that some of the secondary towns likely <span style="font-family: monospace"></span>will be served by the market linkages created by the project. However, additional resources would need to be allocated to an additional program specifically targeting secondary towns to achieve similar impacts (i.e. the 80% market penetration sought in Kigali) elsewhere.<br/>Surveys <span style="font-family: monospace"></span>of both cook stove vendors and randomly-selected households in various parts of Kigali undertaken during the project study indicate that the canamaké stove is the most popular existing improved stove, with approximately 40% market penetration (percentage of households with one or more canamaké stove). The stove tests revealed that the higher quality one-pot canamaké, representative of the model to be disseminated, achieved average fuel savings of approximately 33% over traditional all-metal and all-ceramic stoves. In other words, the canamaké stove used one-third less fuel on average than the household’s existing stove. At this rate, the payback period for the stove would be <span style="font-family: monospace"></span>one to two weeks, depending on the canamaké’s purchase price (between US$2-3) and the user’s actual savings, which will vary somewhat according to stove use and the household’s current stove.<br/>Though distribution of the stoves is well developed, some improvements could be<span style="font-family: monospace"></span>made in Kigali neighborhoods with low penetration of the high quality stove. In this way, underserved neighborhoods would become better served by the commercial distribution network, and the rate of adoption in those areas and in general would be improved<ref name="Best practice">GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: VII - Best Practice Case Studies. </ref>. | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | For more information on the impacts and benefits of the project, click [[Rwanda: Best Practice Case Studies#Impacts and Benefits|here]]. | |

| − | + | [[Rwanda Energy Situation#toc|►Go To Top]] | |

| − | + | <br/> | |

| − | + | === Bioenergy and Food Security Assessment and Capacity Building for Rwanda Project === | |

| − | The | + | The Food and Agriculture Organization of the United Nations and the Rwandan Ministry of Environment have signed an agreement in March 2019, to implement the bioenergy project called, Bioenergy and Food Security Assessment and Capacity Building for Rwanda. This project will identify bioenergy options that are environmentally suitable in the Rwandan context. It will also help Rwanda to meet the targets set within its Nationally Determined Contributions (NDCs). The project will provide capacity building training to key stakeholders on how to bioenergy tools. The stakeholders include those who are working in the bioenergy sector and also those who are involved in the development of the Biomass Energy Strategy. <ref>http://rwandainspirer.com/2019/03/14/fao-ministry-of-environment-signed-mou-to-promote-food-and-energy-security/</ref> |

| − | + | <br/> | |

| − | + | == Biogas<br/> == | |

| − | + | Biogas has been introduced in the country many years ago and Rwanda has gained international recognition for its programme in prisons and large institutions. The Government in 2008 announced a policy to introduce biogas digesters in all boarding schools (estimated at around 600 schools), large health centres and institutions with canteens to reduce the consumption of firewood. This process started in 2010 but until today the focus has been mainly on installations for schools. In total, about 50 large biogas digesters have been constructed in institutions in Rwanda and the biogas systems that have been installed in the prisons over the last decade have reduced firewood consumption by up to 40% and improved hygienic conditions. | |

| − | + | Activities in the domestic biogas sector started much later. It is estimated that over 120,000 households have dairy cows that are kept under zero grazing conditions to reduce soil erosion and also due to lack of grazing areas. These numbers are increasing due to the governments programmes to increase the number of families with dairy cows. The National Domestic Biogas Programme started in 2007 with the construction of 101 pilot digesters funded by the Ministry and with technical assistance from SNV. GIZ/EnDev inputs were available from January 2008 until December 2011. During that period the focus had been on capacity development, training of technicians and entrepreneurs, awareness campaigns and promotion. As a result, by december 2011 a total of 1700 biogas digesters had been constructed, over 200 masons had been trained and approximately 40 companies were actively involved in the programme. | |

| − | + | [[Rwanda Energy Situation#toc|►Go To Top]] | |

| − | + | <br/> | |

| − | + | === <span class="mw-headline" id="Biomass_stoves:_best_practice_case_study"><span class="mw-headline" id="Biomass_stoves:_best_practice_case_study.5B14.5D"><span class="mw-headline" id="Biomass_stoves:_best_practice_case_study.5B2.5D">Biogas: Best Practice Case Study</span></span></span><br/> === | |

| − | + | Between 2001 and 2002, the Kigali Institute of Science, Technology and Management (KIST) successfully set up a [[Rwanda: Best Practice Case Studies#Institutional Biogas in Rwandan Prisons|pilot biogas project at CyanguguCentral Prison]] to address the problems of sanitation, alternative fuel for cooking purposes, and the possibility of recovering manure for production of food crops and woodlots. The Project was financed by the Ministry of Internal Security, and Penal Reform International, with contribution from KIST in the form of continuous research and development. | |

| − | + | Through treating toilet wastes from the entire prison, 275 m³ of biogas is generated daily for cooking purposes. As a result, biogas has reduced firewood demand in the prison by 50%; the bio-effluent is now safely applied on the farm, and the bucket system of evacuating toilet pits has stopped, as the wastes flow by gravity: from toilets to bio-digester, and from bio-digester to the farm. To ensure the replication of this success, UNDP is supporting a KIST-implemented biogas project for Kigoma Prison, with funding from the Netherlands Embassy. In addition, the Ministry of Internal Security, in partnership with the Red Cross, has plans to provide three prisons per year with biogas systems<ref name="Best practice">GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: VII - Best Practice Case Studies. </ref>. | |

| − | + | [[Rwanda Energy Situation#toc|►Go To Top]] | |

| − | + | <br/> | |

== PV Sector<br/> == | == PV Sector<br/> == | ||

| − | Rwanda’s PV market is still nascent and primarily dominated by the institutional market driven by the needs of rural health and education service providers. Much of the installations have been fully grant financed by donors with limited government coordination at the national level. This has resulted in a broad range of different technologies and standards being applied by different projects and limited involvement of local companies in procurement and installation. Lack of funds and knowledge about proper maintenance have led to an array of technical problems including malfunctioning batteries, faulty wiring, broken DC-appliances. A study commissioned by one of the largest donors in the institutional health PV market, PEPFAR, makes four recommendations to improve the performance of institutional PV systems: | + | Rwanda’s PV market is still nascent and primarily dominated by the institutional market driven by the needs of rural health and education service providers. Much of the installations have been fully grant financed by donors with limited government coordination at the national level. This has resulted in a broad range of different technologies and standards being applied by different projects and limited involvement of local companies in procurement and installation. Lack of funds and knowledge about proper maintenance have led to an array of technical problems including malfunctioning batteries, faulty wiring, broken DC-appliances. |

| + | |||

| + | <u>A study commissioned by one of the largest donors in the institutional health PV market, PEPFAR, makes four recommendations to improve the performance of institutional PV systems:</u> | ||

#to specify energy systems suitable for Rwandan health facilities, | #to specify energy systems suitable for Rwandan health facilities, | ||

#to assist partners to develop a clear design, installation and after-service process, | #to assist partners to develop a clear design, installation and after-service process, | ||

| − | #to help develop the quality chain through provision of capacity building activities and enforcement of standards and practices, | + | #to help develop the quality chain through provision of capacity building activities and enforcement of standards and practices, |

#to coordinate regular meetings between key stakeholders. | #to coordinate regular meetings between key stakeholders. | ||

| − | Apart from institutional PV applications, solar water heating is increasingly gaining importance to replace biomass and electricity as the primary water heating sources. Therefore, it is planned to make solar water heating mandatory for all new constructions in the country. In order to support and promote this process a subsidy scheme was recently designed by the Government. | + | <br/>Apart from institutional PV applications, solar water heating is increasingly gaining importance to replace biomass and electricity as the primary water heating sources. Therefore, it is planned to make solar water heating mandatory for all new constructions in the country. In order to support and promote this process a subsidy scheme was recently designed by the Government. |

| + | |||

| + | In addition, the first larger-scale solar project, Kigali Solaire project, has been established on the outskirts of Kigali, producing 250 kW of electricity to be fed into the grid. This is the largest one established in all of sub-Saharan Africa until now. However, projects of this extent and scope will remain limited and the focus will remain on smaller solar PV installations to provide institutions with solar energy as well as on the development of a market for solar home systems and small solar lighting applications. This is partly due to the general lack of financing for large scale projects which could be overcome in the case of Kigali Solaire due to the project being funded and implemented by Stadtwerke Mainz. | ||

| + | |||

| + | A new dimension of investment into PV is in reach: Scatec Solar has partnered with the Norwegian Investment Fund for Developing Countries (Norfund) and Dutch developer Gigawatt Global Coöperatief to close a $23.7-million deal on an 8.5-MW solar PV park in Rwanda. Once completed, the park will be East Africa’s first utility-scale solar plant, increasing Rwanda’s power generation capacity around 8%. The plant will be located 60 km from Rwanda’s capital, Kigali. Annual electricity generation is estimated at 16 million kWh fed into the national grid under a 25-year power purchase agreement with the Rwanda Energy, Water and Sanitation Authority (EWSA). Commercial operation is expected in summer 2014. | ||

| + | |||

| + | In 2017, over 185,000 solar home systems and nearly 300,000 solar lanterns were distributed in Rwanda.This activity is in track with Rwanda's target to achieve 48% off-grid electrification rate by 2024.<ref name="https://www.newtimes.co.rw/business/rwanda-ranks-favourably-clean-energy-study">https://www.newtimes.co.rw/business/rwanda-ranks-favourably-clean-energy-study</ref><br/><br/> | ||

| + | |||

| + | [[Rwanda Energy Situation#toc|►Go To Top]] | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | = Wind = | ||

| + | |||

| + | Wind Potential in Rwanda has not been fully exploited for Power Generation although potential wind power that Rwanda has in some areas may provide with possible solutions such as water pumping, windmill and electricity generation. A study of wind speed distribution has been made. (In this study, the results have been found for the average wind speeds and directions for 3 stations (Kigali, Gisenyi and Butare) from 1985 to 1993. | ||

| + | |||

| + | <u>These results can be summarized as follows :</u> | ||

| + | |||

| + | *Direction of wind varies from 11 to 16° | ||

| + | *Wind speed varies from 2 to 5.5 m/s | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | The National Meteorological Service is responsible of the Rwandan synoptic stations, and supplies data summaries. The National Meteorological Service is accountable for more than 5 synoptic sites (Kigali-Kanombe Airport, Cyangugu-Kamembe Airport, Butare, Gisenyi, Gikongoro, Nyagatare.) with hourly wind records. This data collection started in 1985. | ||

| + | |||

| + | Among the data used for this analysis were hourly wind records over a 4 year period between 1985-1993 from 3 weather station (Kigali, Butare and Gisenyi). | ||

| + | |||

| + | All of these stations are located in the local airports with windmill type anemometers installed at 10m above ground level. Using the Weibull function to analyse the wind speed (wind speed frequency distribution is an important parameter for predicting the energy out put of a wind energy conversion), the annual mean wind speed exceeds 2 m/s for these 3 stations. This wind can be used for water pumping or windmills. | ||

| + | |||

| + | The analysis of the wind energy possible solution for energy supply in rural areas of Rwanda, was undertaken to estimate the wind power potential. In total data from 4 stations (Kamembe, Butare, Nyagatare and Gisenyi) have been analysed by the National Meteorological Division in 1989. Once again, the data from 3 synoptic sites (Kigali, Butare and Gisenyi) are analysed by the Weibull function. The considered data has been used to evaluate the annual frequency of wind speed and the direction of wind, yearly variation of the monthly average, annual and daily variation, vertical profile of wind energy potential. Nevertheless more detailed data is still required. In 2010 a wind system was put in place to serve the Rwanda office of information ORINFOR on Mount Jali overlooking Kigali. This is the same site for the 250KW solar system feeding to the grid. There is need for more thorough assessment of the wind potential in the country | ||

| + | |||

| + | [[Rwanda Energy Situation#toc|►Go To Top]] | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | = Geothermal = | ||

| + | |||

| + | According to a study by Geothermal Energy Association, geothermal potential in Rwanda ranges from 170- 340 MW. | ||

| + | |||

| + | In Rwanda geothermal is a main energy policy priority and forms a significant part of the 7-year electricity development strategy including a very ambitious action plan targeting 150 MW of generation capacity by 2017 (which represents up to 50% of total generation). A Geothermal Act and a geothermal exploration and development paper have been drafted although a proposal for a feed-in-tariff for geothermal still needs to be developed. Three sites (Gisenyi, Kibuye and Cyangugu) were identified by BRGM already in the 1980’s with resource temperatures in excess of 150°C which could be suitable for geothermal power generation. In early 2012 test drilling commenced to explore possibilities to harness energy in Gisenyi, Karisimbi, Kinigi located in western region as well as Bugarama in southern region. The Government has self-financed and contracted the first exploratory drilling in 2013.<br/> | ||

| + | |||

| + | [[Rwanda Energy Situation#toc|►Go To Top]] | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | = Fossil Fuels<br/> = | ||

| + | |||

| + | Rwanda's main fossil fuel resources is methane gas. It is estimated that there are 50 billion cubic meters of exploitable methane, which is the equivalent of 40 million tons of petrol (TOE) lying at the bottom of the Lake Kivu under 250 meters of water. Of the 55 billion cubic metres (cum) Standard Temperature and Pressure, STP) of methane gas reserves, 39 billion cum (STP) are potentially extractable. This represents a market value of USD 16 billion, equivalent to 31 million Ton Oil Equivalent (TOE). The technical and economic feasibility of methane gas exploitation has been clearly demonstrated since 1963 by the small methane extraction pilot unit at Cape Rubona with a capacity of 5000 cum of methane per day at 80 % purity.The resource is estimated to be sufficient to generate 700MW of electricity for 55 years with Rwanda's share being 350MW. The other half belongs to the DRC. Several investors are currently on site harnessing the energy including the Rwanda Government, Kivuwatt and Rwanda Energy Company among others. | ||

| + | |||

| + | The main challenge is finances and a regulatory framework. Further the government is putting in place necessary laws such as the gas law and regulation whilst seeking investors. For more information on the energy sector and investment opportunities click [http://rdb.rw/investinrwandaenergy/energy/Energy_Brochure_2012_final.pdf here]. | ||

| + | |||

| + | [[Rwanda Energy Situation#toc|►Go To Top]] | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | = Key Problems of the Energy Sector<br/> = | ||

| + | |||

| + | <u>The following problems are noted for the energy sector:</u> | ||

| + | |||

| + | *Access to electricity remains low and in particular so in the rural areas. Even if roll out plans are implemented as scheduled 40% of the population will still remain without electricity by 2020. However, the electricity rate increased from 6% in 2008 to 35.3% in May 2017.<ref name="https://cleanenergysolutions.org/training/energy-access-2020-rwanda">https://cleanenergysolutions.org/training/energy-access-2020-rwanda</ref> Additional efforts are required to provide electricity to those who will not be close to the national grid, | ||

| + | *Costs of new connections are at least $100/household, including subsidies from the public utility EWSA without which costs would amount to a staggering $ 1200/ connection, and are beyond the reach of most households in Rwanda. The roll out programme is supported by the development partners through a sector wide approach. The funds available exceed $280m for a period of 4 years | ||

| + | *Generally, there is a lack of entrepreneurial capacity in the country and this hampers small commercial electricity projects, | ||

| + | *The increasing population and rising incomes per capita will result in a higher demand for cooking energy, | ||

| + | *The Government wants a reduction of the consumption of biomass (firewood/ charcoal) but there are only few alternatives such as LPG and kerosene. However, these are more expensive while electricity is no real option due to the high costs and the low connection rate. | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | Additionally, Power Africa summarizes these 3 particular issues as the biggest, which face Rwanda's energy sector<ref name="Power Africa. (2018). Rwanda Factsheet. Retrieved from: https://www.usaid.gov/sites/default/files/documents/1860/Rwanda_-_November_2018_Country_Fact_Sheet.pdf">Power Africa. (2018). Rwanda Factsheet. Retrieved from: https://www.usaid.gov/sites/default/files/documents/1860/Rwanda_-_November_2018_Country_Fact_Sheet.pdf</ref>: | ||

| + | |||

| + | *Misalignment of power supply and demand <br/> | ||

| + | *Limited financing for off-grid companies <br/> | ||

| + | *Limited affordability of electricity solutions for rural households and businesses <br/> | ||

| + | |||

| + | [[Rwanda Energy Situation#toc|►Go To Top]] | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | = Policy Framework, Laws and Regulations<br/> = | ||

| + | |||

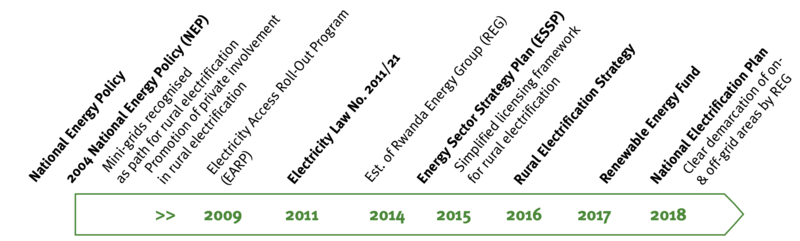

| + | The national energy policy was adopted in 2004 and aims at ensuring a better use of the energy resources, while promoting socio-economic development and protecting the environment. The National Policy goal is to meet the energy challenges and needs required for the economic and social development of Rwanda in an environmentally sound and sustainable manner. | ||

| + | |||

| + | The Government recognises that the market will not meet all needs The reliance on market forces in order to achieve the national development objectives of economic growth and poverty reduction is not intended to hinder the role of the Government to intervene when and where market forces fail to deliver desired results. | ||

| + | |||

| + | <u>The following policy actions stipulated in the Energy Policy indicate government support to reach the MDGs:</u> | ||

| + | |||

| + | *Encourage wider application of alternative sources of energy for cooking, heating, cooling, lighting and other application | ||

| + | *Encourage efficient use of alternative energy sources | ||

| + | *Facilitate agro-processing centers with appropriate energy alternatives, with emphasis on electrification in order to promote small-scale industry, employment creation and economic growth | ||

| + | *Priority shall be placed on developing domestic power generation capacity based on indigenous resources in order to meet increase in demand. Methane Gas exploitation on Lake Kivu takes priority followed by development of off grid mini hydro | ||

| + | *Introduce appropriate rural energy development financial, legal and administrative institutions | ||

| + | *Promote efficient biomass conversion and end-use technologies in order to save resources: reduce rate of deforestation and land degradation and mitigate the causes of climate change | ||

| + | *Promote entrepreneurship and private initiative in the production and marketing of products and services for rural and renewable energy | ||

| + | *Ensure continued electrification of rural economic centers and make electricity accessible and affordable to low income customers | ||

| + | *Facilitate increased availability of energy services including grid and off-grid electrification to rural areas | ||

| + | *Promote development of alternative energy sources including renewable energies and wood fuel end-use efficient technologies to protect woodlands | ||

| + | *Promote gender equality in the search for energy especially in rural areas<ref name="Energy policy">GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: IV - Energy Policy. </ref> | ||

| + | |||

| + | [[File:Rwanda energy policy.png|800px|border]] | ||

| + | |||

| + | [[Rwanda Energy Situation#toc|►Go To Top]] | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | |||

| + | |||

| + | == Energy Sector Strategic Plan (ESSP)<br/> == | ||

| + | |||

| + | ESSP2018/19-2023/24 aims for universal access to primary energy by 2024 and 48% of the demand will be met with off-grid energy.It includes plans for the three sub-sectors: electricity, petroleum and biomass <ref>Sustainable Mini-grid Systems in Refugee Camps: A Case Study of Rwanda: https://energypedia.info/wiki/Publication_-_Sustainable_Mini-grid_Systems_in_Refugee_Camps:_A_Case_Study_of_Rwanda</ref>. | ||

| + | |||

| + | |||

| + | == Rural electrification Strategy, 2016 == | ||

| + | |||

| + | [http://www.seforall.org/ Sustainable Energy for All] (SE4All) considers Rwanda a “large gap” country—while it has significant energy potential and the country provides 62% of electricity to urban communities, the rural parts of the country benefit from only 8% of energy access. | ||

| + | |||

| + | Rwanda’s government has targeted 70% of households to have access by 2017–2018, to be met through a combination of on-grid and off-grid supply, and 100% access to electricity by 2020. The Ministry of Infrastructure ([http://www.mininfra.gov.rw/index.php?id=188 MININFRA]), which leads the country’s national energy policy, has developed a [http://www.mininfra.gov.rw/fileadmin/user_upload/aircraft/Rural_Electrification_Strategy.pdf Rural Electrification Strategy] to this effect, which targets 22% of households gaining access to a Tier 1 energy service (as defined in the SEforAll [http://www.se4all.org/resources_tracking-progress Multi-Tier Framework] and 48% of households gaining access to on-grid or at least Tier 2 energy service by 2017–2018.<ref name="https://cleanenergysolutions.org/training/energy-access-2020-rwanda">https://cleanenergysolutions.org/training/energy-access-2020-rwanda</ref> | ||

| + | |||

| + | "Mini-grids will be developed by the private sector with Government playing a key role in identifying sites and establishing a gramefork through which these can become financially viable instruments"<ref name="Rural Electrification Strategy">Rural Electrification Strategy</ref>. SOGER (Scaling up off-grid energy in Rwanda) supports the private sector to overcome the existing challenges (technical capacities, management skills, financing gaps) enable it to be better prepared in terms of technologies and business models; and therefore contributes to the long-term vision of Rwanda.<ref name="https://cleanenergysolutions.org/training/energy-access-2020-rwanda">https://cleanenergysolutions.org/training/energy-access-2020-rwanda</ref> | ||

| + | |||

| + | *[https://cleanenergysolutions.org/training/energy-access-2020-rwanda Towards Universal Energy Access by 2020 in Rwanda: The role of government, multilateral and private sector stakeholder engagement to achieve scale (Webinar)] | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | |||

| + | == Policy Highlights, Cross-cutting Issues and Opportunities<br/> == | ||

| + | |||

| + | Medium term policy priority actions are to<ref name="Energy policy">GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: IV - Energy Policy. </ref>: | ||

| + | |||

| + | *Meet the crisis of blackouts caused by delayed investment and drought | ||

| + | *Provide economic power by developing the use of Lake Kivu methane, and by bringing on line more hydro power. | ||

| + | *Enhance overall electrical infrastructure to meet demand growth and supply quality needs – generation, transmission and major distribution construction and rehabilitation. | ||

| + | *Deliver a programme of rural electrification on the basis of enhanced distribution networks, micro hydro, and solar power. | ||

| + | *Implement a wood and charcoal efficiency and substitution strategy to counter the deforestation crisis. | ||

| + | *Continue steady progress to a viable electricity and gas sector, consistent with meeting social needs. | ||

| + | *Commence utilization of Kivu gas for uses other than power generation. | ||

| + | *Determine options for response to oil prices and petroleum products costs, and their impact on the economy. Reduce reliance on petroleum products. | ||

| + | |||

| + | [[Rwanda Energy Situation#toc|►Go To Top]] | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | === Cross Cutting-issues<br/> === | ||

| + | |||

| + | The sub-sectors within the energy sector are dependent on a number of issues that apart from being of a crosscutting nature within the sector also are determined by the development of the economy at large and other sectors. The following have policy implications: | ||

| + | |||

| + | '''Energy Efficiency and Conservation:''' | ||

| + | |||

| + | *Improvement in energy efficiency brings additional benefits and significant savings on energy use and cost and must be pursued consistently over a long-term across all sectors. There is a need to create awareness on energy efficiency and conservation in order to induce a behavioral change. It is also important to encourage, cleaner production and recycling, integration of energy efficiency in architecture and building designs and the establishment of standard and legal framework. | ||

| + | |||

| + | '''Energy Trade and Co-operation:''' | ||

| + | |||

| + | The new East African Community (EAC) Treaty envisions an improved and expanded trading environment by promotion of investment codes, proper regulation of the private sector and development of an East Africa Power Master plan. Although it is a challenge to maximize the potential gains from the regional and international energy trade and co-operation, Rwanda needs to attain a stronger and closer interaction in the energy planning processes with other countries in the region. There is a need to encourage joint development of common (shared with other countries) energy resources as a way of enhancing co-operation, collective reliance and security of energy supplies. | ||

| + | |||

| + | '''Energy Information System:''' | ||

| + | |||

| + | *Energy information collection, storage, analysis and exchange is vital for planning, policy formulation and in decision making for implementation of programmes and policies. There is a lack of an energy information system, resulting in poor information exchange amongst energy stakeholders. Further, inadequate capacity to manage and analyze energy information is also hampering development. There is therefore need for establishing a proper energy information system that will mobilize human resources and undertake sensitization and information dissemination to stakeholders in the sector for effective implementation of the energy policy. | ||

| + | |||

| + | '''Environment, Health and Safety:''' | ||

| + | |||

| + | *Environmental implications of energy consumption need to be considered in all sectors. All stages of energy resources exploitation, production, conversion, transportation, storage and end-use can have negative impact on the environment. Health, safety and environmental consequences of energy production and utilisation are a major concern e.g. uncontrolled use of wood-fuel puts pressure on forests and leads to erosion, desertification, and contributes to carbon-dioxide emission. There is a need to ensure that energy development projects and programmes are subjected to Environmental Impact Assessments (EIAs) and to strengthen co-operation in national, regional and international energy programmes aimed at mitigating environmental impacts of energy. | ||

| + | |||

| + | '''Investment:''' | ||

| + | |||

| + | *With reforms taking place in the energy sector such as the liberalisation of power generation, petroleum product trade, and emphasis on enhancing rural energy supplies, private investment is bound to increase substantially.There is, therefore, a need to make domestic and international investors aware of the potential within the energy sector. Public and private sector partnerships should be encouraged to invest in provision of energy services. Furthermore, there is a need to facilitate and encourage investment in the development of alternative sources of energy, putting emphasis on the utilization of local resources. An investment plan is currently available for potential investor. To have a look, click [http://rdb.rw/investinrwandaenergy/energy/Energy_Brochure_2012_final.pdf here.] | ||

| + | |||

| + | '''Gender Issues:''' | ||

| + | |||

| + | *On the demand side, especially in rural areas, there is a need to relieve women and children from the burden of searching for energy, especially wood-fuel. All stakeholders within the energy sector need to participate and take deliberate sensitization actions to encourage women participation in energy related education, training, programmes and projects, planning, decision-making and, not least, energy policy implementation. | ||

| + | |||

| + | '''Capacity Building:''' | ||

| + | |||

| + | *'''''Education''''': The majority of Rwandans are poorly informed about energy and related end - use practices and options. There is a need for adequate physical demonstrations on renewable energy and energy efficiency to pupils and students. It is, therefore, necessary to include energy education, in particular, renewable energy and rational use of energy, in curricula for schools, vocational training centers, colleges and other learning institutions. There is also a need for mass educational and promotional efforts on energy issues targeted to the public. | ||

| + | *'''''Human Resources Development''''': The development of the energy sector is dependent on the appropriate utilization and development of human resources. There is a lack of trained and skilled energy experts in the sector. In addition, there are inadequate incentives to attract and retain qualified energy experts in the sector. In addition, cultural and traditional influences inhibit gender-balanced training. There is, therefore, a need to encourage and facilitate training in disciplines necessary for the development of the energy sector in various institutions and organizations. Local communities, counterparts and partners in executing activities in the sector should be given priority in order to enhance dissemination of knowledge and skills and incentives should be established to enhance effective utilization of domestically and internationally available skills in the energy sector. | ||

| + | *'''''Research and Development''''': Identifying and targeting R&D policies and priorities must be supportive of national socio-economic development goals. R&D issues relating to biomass, rural energy, energy end-use, affordability, and pricing mechanisms need greater attention.The challenge is to overcome the inadequate financial resources and lack of skilled manpower for R&D. There is also a lack of understanding and appreciation of critical energy R&D issues both within the sector and for the general public as well as lack of institutional coordination in respect of various ongoing research activities in the sector. Co-operation between public and private sectors in R&D of energy issues such as demand and supply management, pricing, conservation and rural energy, need to be encouraged and coordinated. There is also a need to support regional and international co-operation in R&D on technological and non-technological advancement in the energy sector<ref name="Energy policy">GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: IV - Energy Policy. </ref>. | ||

| − | + | [[Rwanda Energy Situation#toc|►Go To Top]] | |

| − | + | <br/> | |

| − | + | == Economic Development and Poverty Reduction Strategy (EDPRS)<br/> == | |

| − | + | The energy sector in Rwanda is governed by the Government’s Vision 2020 and the Economic Development and Poverty Reduction Strategy (EDPRS) into which future energy development plans have been mainstreamed. These documents have been complemented by a national Energy Policy and a 7-year Electricity Development Strategy and set out ambitious electricity access targets which are supposed to be reached through the implementation of the five year Electricity Access Roll-Out Programme (EARP) (2009-2013). The international donor community has pledged 228 M$ to support the EARP. | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | Vision 2020 (published in 2000) is Rwanda‘s long-term development blueprint seeking to transform the country into a middle income position. The policy statement includes a pillar on infrastructural development, including energy with high priority to access to electricity for the population but also a reduction of the use of wood energy from 94% in 2000 to 50% in 2020. | |

| − | The | + | <u>The EDPRS refers to Vision 2020 and for the energy sector has four main elements:</u> |

| − | + | #Increased access to electricity for enterprises, households, health centres, schools and local government administrative offices, | |

| + | #Reduced costs of supply of electricity and the cost of imported petroleum products, | ||

| + | #Diversified sources of energy supply and enhanced energy security, and | ||

| + | #Strengthened governance framework and institutional capacity. | ||

| − | + | <br/> | |

| − | |||

| − | |||

| − | |||

The EDPRS requires the increase of electricity generation from a variety of sources such as hydro and methane gas. It specifically asks for at least 50 MW of additional hydro power to be installed before 2012. The EDPRS has specific targets for the number of electricity connections to be reached by 2012 (initial target 200,000 but this has been increased to 350,000), 100% of all health and social centres to be connected to the grid or equipped with PV systems and 50% of all schools covered. The power supply grid had an extension of about 5284 km in 2010 and has therefore already exceeded the target of 5,000 km to be reached by 2012. There are also targets given for improved cook stoves (from 40 – 100% coverage, currently 60% of the population have been reached) and 20% of cattle farmers using biogas. The Ministry has updated its energy policy 2008 – 2012 covering the EDPRS period with assistance from the EUEI. The policy covers all types of energy: electricity, biomass, petroleum, methane gas, geothermal, wind, PV etc. It was complemented by the 7-year Electricity Development Strategy which has further developed the targets set out within the EDPRS and has adapted them to the time period until 2017. Moreover, an Electricity Law was passed recently that governs activities of electric power production, transmission, distribution and trading. The Law sets the framework for the liberalization of the electricity sector and explicitly aims to promote private investments in the sector. | The EDPRS requires the increase of electricity generation from a variety of sources such as hydro and methane gas. It specifically asks for at least 50 MW of additional hydro power to be installed before 2012. The EDPRS has specific targets for the number of electricity connections to be reached by 2012 (initial target 200,000 but this has been increased to 350,000), 100% of all health and social centres to be connected to the grid or equipped with PV systems and 50% of all schools covered. The power supply grid had an extension of about 5284 km in 2010 and has therefore already exceeded the target of 5,000 km to be reached by 2012. There are also targets given for improved cook stoves (from 40 – 100% coverage, currently 60% of the population have been reached) and 20% of cattle farmers using biogas. The Ministry has updated its energy policy 2008 – 2012 covering the EDPRS period with assistance from the EUEI. The policy covers all types of energy: electricity, biomass, petroleum, methane gas, geothermal, wind, PV etc. It was complemented by the 7-year Electricity Development Strategy which has further developed the targets set out within the EDPRS and has adapted them to the time period until 2017. Moreover, an Electricity Law was passed recently that governs activities of electric power production, transmission, distribution and trading. The Law sets the framework for the liberalization of the electricity sector and explicitly aims to promote private investments in the sector. | ||

| + | |||

| + | [[Rwanda Energy Situation#toc|►Go To Top]] | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | == Biomass Energy Strategy (BEST)<br/> == | ||

In addition, a specific Biomass Energy Strategy (BEST) was developed in 2008 which focuses on sustainable wood supply with specific attention to urban charcoal consumption and to a lesser extent the use of firewood in rural areas. | In addition, a specific Biomass Energy Strategy (BEST) was developed in 2008 which focuses on sustainable wood supply with specific attention to urban charcoal consumption and to a lesser extent the use of firewood in rural areas. | ||

| − | + | [[Rwanda Energy Situation#toc|►Go To Top]] | |

| + | |||

| + | <br/> | ||

| + | |||

| + | == Renewable Energy Feed-in Tariff<br/> == | ||

| + | |||

| + | Furthermore, <span id="yui_3_2_0_1_13314957452531342" lang="EN-US">on February 9th 2012 the Government of Rwanda issued a '''Renewable Energy Feed-in Tariff (REFIT)''' for small and mini-hydropower. The REFIT guarantees access to the grid for renewable energy generators and </span>and obliges the national utility EWSA to purchase the renewable energy generated. <span style="color: black" lang="EN-US">The REFITs are calculated based on a cost plus return basis to ensure sufficient incentives for private investors. They apply to hydropower plants ranging in size from 50 kW to 10 MW. The Rwandan REFITs are valid for a period of 3 years after which they will be subject to review by the Rwanda Utilities Regulatory Authority (RURA).</span><span style="color: black" lang="EN-US"></span><span style="color: black" lang="EN-US">REFITs </span><span style="color: black" lang="EN-US">for other renewable energy technologies, such as solar, wind and geothermal are also planned but have not been issued yet by the regulator. <u>For further information on REFITs in Rwanda, see:</u></span> | ||

| + | |||

| + | *<span style="color: black" lang="EN-US"></span><span style="color: black" lang="EN-US">[http://www.rura.gov.rw/ www.rura.gov] </span><span style="color: black"></span> | ||

| + | *<span style="color: black">[http://www.rura.gov.rw/docs/REGULATIONS_ON_FEED_TARIFFS_HYDRO_POWER_PLANTS.pdf REGULATIONS ON FEED TARIFFS HYDRO POWER PLANTS]</span> | ||

| + | |||

| + | <br/> | ||

| − | + | Planned changes to the regulatory framework include the publication of standardised long-term power purchase agreements (PPAs) to increase security for investments of '''independent power producers (IPPs)''' by the early 2012. By 2012 a Renewable Energy Strategy (REST) will also be developed which will address renewable energy sources other than wood. For the hydro power sector, by the start of 2012 a study will determine specific improvements in the regulatory framework conditions in order to increase private sector engagement in the sub-sector. | |

| − | + | [[Rwanda Energy Situation#toc|►Go To Top]] | |

| − | + | <br/> | |

| − | + | == EnDev-relevant Policy Aspects<br/> == | |

| − | + | <u>Some of the most important aspects of the policies for the EnDev programme are:</u> | |

| − | + | *Electricity tariffs which are currently around 0.21 US$/kWh but are subject to further studies and recommendations in order to reduce the costs to consumers and businesses, | |

| + | *The soon-to-be implemented REFIT scheme for which tariff levels are currently still under discussion and the main problem is the lack of capacity of the relevant public institutions to effectively and successfully implement the emerging and existing policies and strategies. | ||

| + | *The ambitious targets of the Government for the grid connection of households which, even if achieved, will still leave 40% of the population without access to electricity thereby highlighting the need for off-grid supply of electricity. | ||

| + | *The two key interventions of the PSP Hydro project, the development of MHP plants to increase power capacity in the country and the consolidation of the participation of private MHP developers in the energy sector, are in line with the national energy policy and complementary to the Government‘s efforts. | ||

| + | *<u>In the biomass sector a three pronged approach is recommended:</u> | ||

| − | + | #on the supply side, increased wood production through higher yields, | |

| + | #higher efficiency in the value chain through improved legislation, more efficient charcoal techniques and improved cook stoves, and | ||

| + | #Promotion of alternatives such as LPG, kerosene and peat. | ||

| − | + | [[Rwanda Energy Situation#toc|►Go To Top]] | |

| − | + | <br/> | |

| − | |||

| − | = Institutional | + | = Institutional Set-up in the Energy Sector<br/> = |

A number of ministries and agencies play a significant role in the energy sector depending on the type of energy and the nature of activities covered. The most important institutions are listed below with a short description of their role. | A number of ministries and agencies play a significant role in the energy sector depending on the type of energy and the nature of activities covered. The most important institutions are listed below with a short description of their role. | ||

| + | |||

| + | [[Rwanda Energy Situation#toc|►Go To Top]] | ||

== Electricity Sector<br/> == | == Electricity Sector<br/> == | ||

| − | The Ministry of Infrastructure (MININFRA) is responsible for the overall coordination of activities in the energy sector and for the strategies, planning and monitoring of the implementation of the different programmes. The ministry also plays an important role in attracting private sector investment and coordinating support of development partners. The public utility company Reco/ Rwasco was merged and became the Energy, Water and Sanitation Authority (EWSA) which | + | The '''Ministry of Infrastructure (MININFRA)''' is responsible for the overall coordination of activities in the energy sector and for the strategies, planning and monitoring of the implementation of the different programmes. The ministry also plays an important role in attracting private sector investment and coordinating support of development partners. The public utility company Reco/ Rwasco was merged and became the Energy, Water and Sanitation Authority (EWSA) (in 2011 ?) which was responsible for the implementation of programmes. This constituted an important change to the previous institutional set up according to which the tasks of policy making and implementation were undertaken by one single institution, MININFRA. |

| − | & | + | In October 2013 the cabinet approved the reform and transformation of EWSA into two public companies. The Power and Energy Holding Company and the Water and Sanitation Company should operate as commercial companies.<br/><ref>http://www.primature.gov.rw/top/news/news-details.html?tx_ttnews%5btt_news%5d=1062&cHash=d1e3fc9f5cc624df2a2f81a830078106</ref>Rwanda Utilities Regulatory Authority (RURA) is among others responsible for ensuring that electricity tariffs reflect recurrent costs as well as for the approval and registration of all energy activities. The role of the private sector has been limited in the past but the Government is encouraging electricity production through PPPs at a large scale (for example Lake Kivu methane projects) as well as in the hydro power sector to support management and construction. |

| − | + | [[Rwanda Energy Situation#toc|►Go To Top]] | |

| − | + | <br/> | |

| − | + | === Micro Hydropower<br/> === | |

| − | + | ''There are only few private enterprises in the hydro power sector able to produce turbines. Currently three stable workshops are active in the manufacturing of pico-turbines: ASM and Chez Silvere both in Kigali and COFORWA in Muhanga.'' | |

| − | + | ''Apart from these three workshops, the workshop at the Don Bosco School in Kimihurura, Kigali manufactured several pico-turbines in the 70s and 80s when it was managed by a religious institution. In addition, two more workshops ABEM (Kicukiro, Kigali) having experiences with manufacturing components of wind turbines and water pumps and SOTIRU (Musanze/North)) maintaining 3 MHPPs are capable but not manufacturing pico hydro turbines at the moment.'' | |

| − | + | On the governmental level district governments play an important role in the decentralized governance structure in Rwanda and have the capacity to authorize the installation of MHP plants and mini grids in their territory. | |

| − | + | [[Rwanda Energy Situation#toc|►Go To Top]] | |

| − | + | <br/> | |

| − | + | === Biomass Sector<br/> === | |

| − | |||

| − | |||

| − | |||

| − | + | The Ministry of Infrastructure focuses on efficient use of the available biomass resources through improved charcoaling and stove technologies. A number of efficiency programs in the energy sector are being implemented(through contracts with Practical Action and CAMCO from Kenya) and alternatives such as biogas for domestic use and for institutions, LPG, kerosene, peat and papyrus briquettes are being investigated and promoted. The Ministry of Forestry and Mines and its agency NAFA is responsible for the regulations and the management of natural forests, plantations. The Ministry of Agriculture is promoting agro forestry which also is a source of biomass. The Ministry of Local Government, through the district and sector authorities, is responsible for the implementation of forestry laws, the issuance of tree cutting and charcoal production permits and protection of the natural environment. | |

| − | Rwanda | + | [[Rwanda Energy Situation#toc|►Go To Top]] |

| − | + | <br/> | |

| − | + | === <span style="font-size: 17px">Solar Energy Sector</span> === | |

| − | + | Only few companies in Rwanda are active in the field of solar energy. They focus mainly on the market for larger systems for public institutions, e.g. hospitals, schools etc through public tenders. In addition they and others are also trying to sell solar home systems but the market for solar lanterns and small home systems is still in its infancy. Recently, an increasing focus on solar water heating systems has also emerged. | |

| − | + | <u>The most important companies are:</u> | |

| − | + | #Sam Dargan, a young American entrepreneur from Great lakes Energy Solar power who claims to have outlets in most districts through local dealers and is selling maybe 100 units/month or more. He sells products from Barefoot, D-Light and other suppliers that are being tested through Lighting Africa programme | |

| + | #The Koinonia Foundation assembles and sells pico PV lanterns here in Kigali and is selling in the regions. | ||

| + | #Lights for Life which is promoting the nURU head lamps which are strapped to the head. They are working with UOMB micro finance | ||

| + | #There are suppliers/shops in town which are selling portable lamps of all different sizes and qualities. For instance Davis and Shirliff which is a company which has been trading in Eastern Africa for decades in similar products. | ||

| − | + | [[Rwanda Energy Situation#toc|►Go To Top]] | |

| − | + | === <br/>Sector-comprehensive Organizations and Institutions<br/> === | |

| − | + | '''Rwanda Environment Management Authority (REMA)''': this institution has to approve the environmental suitability of all projects including the electricity and electricity distribution activities in the country. | |

| − | + | '''Private Sector Federation (PSF)''': most of the private companies in Rwanda are registered at the PSF. This institution guarantees the application of good practices within the private sector. The Rwandan Development Board is promoting foreign (and local) investment and plays an intermediary role in many large investments. | |

| − | + | PSP Hydro works in coordination with all these institutions. Their collaboration is essential in order to obtain the necessary permissions. In addition, PSP Hydro advises these institutions whenever this is required and keeps them informed about the progress of the ongoing activities. | |

| − | + | [[Rwanda Energy Situation#toc|►Go To Top]] | |

| − | + | <br/> | |

| − | + | = Activities of Other Donors and Implementing Agencies in the Energy Sector<br/> = | |

| − | + | In March 2009 the Ministry entered into a sector wide programme with the developing partners that are involved in the energy sector. This has resulted in a large scale programme for the roll out of the electricity network and the increase of household connections from currently over 200.000 to 350.000 by 2012. The costs of this programme are estimated at US$ 380 million and will be implemented mainly through EWSA. The Government and EWSA are contributing 20% of the budget while the balance is provided by the donors including the WB, ADB, Arab Funds, EU, BTC, DGIS, JICA and others. The implementation started in 2009. | |

| − | a | + | <u>There are a few programmes in the energy sector that are more directly related to the EnDev programme as these are activities in the hydro and biomass sector but none directly engaged in the biogas area. The most relevant programmes are:</u> |

| − | + | *GVEP is working with MININFRA to implement projects under the WB funded ESME programme which supports the renewable energy sector in particular hydro power, pico solar, and institutional capacity building. In order to do so GVEP and MININFRA will copy the PSP Hydro approach. | |

| + | *DFID has developed a results based financing scheme to support renewable energy enterprises in the solar PV, micro hydro and institutional biogas sector. The programme will be implemented by GIZ. | ||

| + | *In collaboration with UNIDO, the GoR executed four micro hydro power plants namely: Nyamyotsi I, Nyamyotsi II, Mutobo and Agatobwe. .One of the projects: Nyamyotsi I, a 100 KW micro hydro power plant was inaugurated and became operational in 2007. Two others started operating in 2010 and the last one became operational in early 2011. Close to 2000 households have been connected to the grid there and small and medium enterprises are developing their businesses using the new power. | ||

| + | *8 Government funded hydro power plants which are in in various stages of progress. These will constitute a total production capacity of 6.4 MW. | ||

| + | *BTC programme funding the construction of 5 SHPPs out of which 3 had been completed by mid 2011 and are currently being commissioned. Costs of the construction are supported by BTC, however, the management of the plants remains unclear. They will be handed over to MININFRA after being commissioned and are likely to be privatized. In addition, BTC participates in rural electrification based on photovoltaic systems through EPRER and is currently in the process of establishing a Wind Atlas. Basic data for the latter became available at the end of 2010. | ||

| + | *The EC supports in particular two areas: i) energy solutions for off-grid public institutions such as health centers, schools, ii) micro hydro plants (total budget is € 50 million). The aim of electrifying public institutions is to equip around 350 schools, hospitals, and district offices with PV systems. For micro-hydro the objective is to develop through private sector intervention about 3 MW capacities of micro-hydro electricity plants in 3 to 15 sites serving up to 70 villages. Two of these sites are established in cooperation with BTC, Rukarara II which is operational and Ntaruka A which is soon to be constructed. The idea is to build on the current GIZ initiative. | ||

| + | *Forestry programmes by BTC (with additional funding of the Netherlands and agro forestry programmes (MINAGRI/IFDC with Netherlands funding) to increase supply of (fire) wood. | ||

| + | *The Ministry of Infrastructure has a number of programmes to support the efficient production and use of biomass focusing on regulation, cookstoves and charcoal kilns. These programmes are funded through the Government budget and implemented through contracts with Practical Action and CAMCO. | ||

| + | *The WB/GEF prepared a programme of US$ 5m to support the energy sector. <u>The programme works in a number of areas including:</u> | ||

| − | + | #private sector development and entrepreneurship development through an incubation approach, | |

| + | #support to the private sector in the micro hydro area, | ||

| + | #promotion of PV and stand alone renewable energy systems, | ||

| + | #support to the biomass sector through promotion of improved stoves and charcoal kilns. | ||

| − | + | *The WB also supports the national electricity access roll out programme that focuses on grid extension and intensification. | |

| + | *USAID support to the energy sector is mostly indirect by financing health sector infrastructure as part of the PEPFAR programme. PEPFAR has identified energy supply to health centers as a major bottleneck for delivering quality health services. | ||

| + | *The French Development Agency through its debt relief programme for Rwanda is providing support to the national electricity access programme. | ||