Difference between revisions of "Fuel Prices China, P.R."

***** (***** | *****) |

***** (***** | *****) m |

||

| (One intermediate revision by one other user not shown) | |||

| Line 42: | Line 42: | ||

|Fuel Price Factsheet Source Link=http://en.ndrc.gov.cn/ | |Fuel Price Factsheet Source Link=http://en.ndrc.gov.cn/ | ||

}} | }} | ||

| + | {{Fuel Price Factsheet Source | ||

| + | |Fuel Price Factsheet Source Type=Pump prices and margins | ||

| + | |Fuel Price Factsheet Source Link=http://www.bitauto.com/youjia/beijing/ | ||

| + | |Fuel Price Factsheet Source Annotation=Pump prices in Beijing | ||

| + | }} | ||

| + | |||

| + | [[Category:China]] | ||

Latest revision as of 12:46, 23 September 2014

Part of: GIZ International Fuel Price database

Also see: China Energy Situation

Fuel Pricing Policies

| Local Currency: | CNY |

| Exchange Rate: | 6.63

|

| Last Update: | 2011/05/01 |

"Pricing policy: A new mechanism introduced in Jan 2009 bases fuel prices on a 22-day moving average of a basket of crude oil prices. When the average is below US$80/bbl, prices move relatively freely and refiners are expected to earn “normal” margins. Between US$80 and US$130/bbl, domestic prices are responsive but refiners no longer make a profit. Above US$130, tax measures are used to keep domestic prices low. Although price adjustments are triggered if the 22-day moving average changes by more than 4% from the previous price-setting level, concerns about inflation often delay the implementation of price increases. Retail prices were changed only three times in 2008, eight times in 2009, four times in 2010, three times in 2011, and eight times (half of which were price reductions) in 2012. In Jul 2011, government cut or removed import duties: eliminated them for diesel and jet fuel (both previously 6%), and reduced them to 1% for gasoline (5%) and fuel oil (3%). In Aug 2011, government moved to monthly adjustments of jet fuel prices. The price increases in 2011 were fractions of global price increases. The scale of these losses are consistent with government’s own statement that, according to the 4% rule, the prices should have been raised nearly triple the actual increases. Government canceled value-added tax (VAT) on fuel imports in 2008, and announced a 5% sales tax on oil and gas in Oct 2011. The most recent proposal reported for pricing would allow oil companies to set prices as long as world oil prices are between US$40 and US$130 a barrel, while shortening the averaging period to 10 days. Wholesale prices of diesel set by government and FOB benchmark prices relevant to China since 2007 are shown below. Moving to more frequent price adjustments just as world oil prices collapsed at the end of 2008 made moving to formula-based price adjustments easier.

Consequences of subsidies: Refiners have suffered significant losses. Two largest refiners, PetroChina and Sinopec, suffered refining losses of 60.09 billion yuan (US$9.30 billion) and 35.78 billion (US$5.54 billion), respectively, in 2011. In the first half of 2012, their losses were 23.308 billion yuan (US$3.70 billion) and 18.501 billion yuan (US$2.93 billion), respectively. In 2007−08, the losses suffered by PetroChina and Sinopec were so large that government compensated them.

Temporary ban on exports to lower domestic prices: Government imposed a temporary ban on diesel exports in 2011.

Hedging: The extent of losses from hedging has attracted regulatory scrutiny. To lower costs, companies chose options that provided some upside if oil prices remained high but did not protect against a price collapse. China Eastern’s hedging loss of 6.2 billion yuan (US$906 million) by Dec 2008 prompted an investigation by the National Audit Office. After large losses suffered by 68 state-owned companies in 2008, including Air China’s 6.8 billion yuan (US$1 billion), State-Owned Assets Supervision and Administration Commission announced in Sep 2009 that government was investigating the hedging contracts signed. In Oct 2009, government imposed limits on hedging: 50% of fuel for those reporting significant losses previously or those deemed inexperienced, and 90% otherwise. In 2011, airlines received authorization to resume hedging.

Compensation: In Apr 2009, government announced that it would subsidize public transportation, fisheries, and state-owned forestry firms when the state-set ex-refinery prices for gasoline and diesel exceed 4,400 yuan (US$700, or about US$0.94/liter) and 3,870 yuan (US$615, or US$0.73/liter) a tonne, respectively. Central government pays for all fuel costs above the threshold prices for individual fishermen or fishing enterprises operating inshore or inland, as well as state-owned forestry and urban public transportation companies, and half of the surplus costs for rural road and water transportation companies and ocean fishing firms when ex-refinery price for gasoline is between 4,400 and 5,480 yuan (US$870) a tonne and that for diesel between 3,870 yuan and 5,070 yuan (US$805). Above these prices, central government pays all additional costs. In March 2012, the National Development and Reform Commission, which sets fuel prices, said a monthly subsidy of about 300 yuan (US$48) would be given to taxi drivers across the country to compensate for the fuel price increase, and finance ministry said it had earmarked 67.4 billion yuan (US$11 billion) for oil subsidies for fisheries, forestry, public transport, and taxis, as well as 24.3 billion yuan (US$3.9 billion) for agriculture to ensure that farmers’ income is not adversely affected by oil price increases and possible price increases for agricultural materials later in the year."

(Source: Kojima, Masami. (2013, forthcoming). “Petroleum product pricing and complementary policies:Experience of 65 developing countries since 2009.” Washington DC: World Bank.)

Fuel Prices and Trends

| Gasoline 95 Octane | Diesel | |

|---|---|---|

| in USD* |

|

|

| in Local Currency |

|

|

* benchmark lines: green=US price; grey=price in Spain; red=price of Crude Oil

Fuel Price Composition

Price composition.

The costs for transporting fuels from regional storages to service stations amount to maximum 1% of the wholesale price.

The retail margin equals ~4% of the wholesale price.

Information for the city of Beijing; Source: http://www.bjpc.gov.cn/.

Further information on price composition is missing, hints welcome.

At a Glance

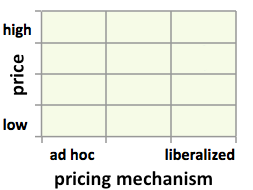

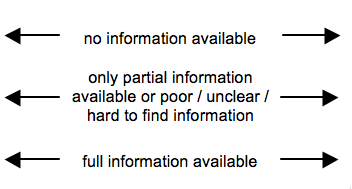

| Regulation-Price-Matrix |

| ||||

|

|

|

| ||

Statistics missing. Pricing formula missing. Detailed fuel price breakdown missing. Hints welcome.

Sources to the Public

| Type of Information | Web-Link / Source |

|---|---|

| Other Information | http://en.ndrc.gov.cn/ |

| Pump prices and margins | http://www.bjpc.gov.cn/syjg/syjg_ggspxxjg/200605/t119702.htm (For Beijing) |

| Pump prices and margins | http://www.bitauto.com/youjia/beijing/ (Pump prices in Beijing) |

| Wholesale Prices | http://www.bjpc.gov.cn/syjg/syjg_ggspxxjg/200605/t119702.htm |

Contact

Please find more information on GIZ International Fuel Price Database and http://www.giz.de/fuelprices