Difference between revisions of "Wind Energy Country Analyses Peru"

***** (***** | *****) |

***** (***** | *****) m (Ranisha Basnet moved page Wind energy country analyses Peru to Wind Energy Country Analyses Peru without leaving a redirect) |

(No difference)

| |

Revision as of 14:58, 31 July 2014

Wind energy potential[1]

Due to its geography Peru possesses abundant wind energy potential. Mainly along the coastline and the primary mountain range there are wind speeds of 7.5 m / s and more (at a height of 80 meters) which enable an economically viable utilization. The regions with the most abundant wind energy potential are situated in the North at the coast as well as in the Andes and around Ica south of Lima. In the west of the Andean Mountains and towards the Amazon basin there is hardly any wind potential. The overall potential of onshore wind power is estimated at 77 GW in the wind atlas published at the end of 2008[2].

The technologically feasible potential for electricity generation is officially estimated at 22 GW by the Ministry of Energy and Mining of Peru (MEM[3]). This is based on a study for the Wind Atlas for Peru (Atlas Eólico del Perú) issued in November 2008 which by means of about 30 measuring stations established an overview of the Peruvian wind power potential. Since large scale experience on the utilization of wind power is not existent yet and precise measurements at certain project sites have not been conducted yet, the actual values might differ. The potential for offshore wind power along the Peruvian coast has not been researched yet in depth.

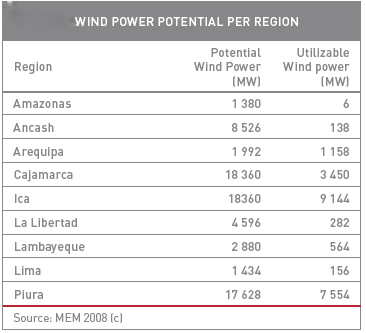

Out of the 25 regions of Peru nine show a wind power potential worth mentioning. The following table shows the regions with a wind power potential of more than 1 000 MW and the respective utilizable wind power. The table clearly shows that the highest yields are achievable at the coastal regions of Piura in the Northwest and Ica in the South of Lima. The third most promising region is Cajamarca in the northern Peruvian Andes.

The wind regime is best during winter with wind speeds dropping in summer. This seasonal variation matches well with availability of water resources for hydro power generation that is highest in summer and low in winter. Therefore, if provisions for an intelligent dispatching system are made, RES could provide a year round supply of electricity.

Framework Conditions for Wind Energy

The general instruments for the promotion of renewable energy sources are defined in the Law N° 1002 as described in chapter 1.5. The major elements of the law can be summarized as follows:

- Share of renewable energy such as wind, solar, tidal, geothermal, biomass and hydro of at least 5 % for the first five years (2008-2012)

- Higher tariff prices that will be set by OSINERG

- Guaranteed and preferential feed-in

In order to promote renewable energy generation, the Peruvian government launched a package of measures to encourage investments in the area. Its main features comprise a guaranteed internal rate of return of 12 % and accelerated depreciation up to 20 % per year.

In order to build a wind farm a temporary license from the Dirección General de Energía of the Ministry of Energy is required, which includes the permission to conduct the Environmental Impact Assessment (EIA), prefeasibility studies and wind measurements. The permanent license will only be issued on basis of an EIA. Once the EIA is approved and a permanent concession is obtained, the wind farm can be erected.

Current Use of Wind Energy and Project Pipeline

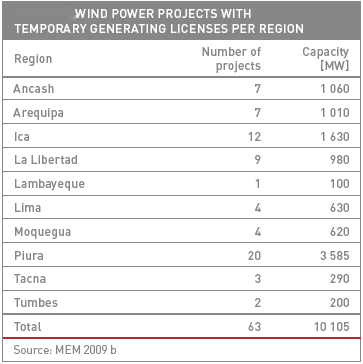

Regarding small scale wind power applications several small wind turbines are in operation mainly in rural areas for water pumping, irrigation and battery charging. The use of wind energy for water pumping has been taking place traditionally in the North of Peru. As far as large scale wind installations are concerned, two turbines were installed in the late 1990s, but there was no further development of wind power utilization until 2007. However, since then a rush for temporary concessions has taken place to secure attractive potential wind farm sites adding up to a total capacity of more than 10 GW[4]. The following Table shows the number of projects with temporary licenses per region.

The planned capacities of the wind parks range from 40 to 300 MW. It is important to emphasize that all the temporary concessions obtained so far are for sites close to the coastline because access is easier and wind turbines can be delivered by sea vessel.

Taking into account the large number of projects and the overall capacity it is interesting to note that the government plans the first tender to be held for a maximum of 500 MW (for all renewable energy sources). Furthermore, the concessions are only valid for two years; this means that there will be fierce competition for the promotional RES contracts. Additionally, the above numbers imply that almost half of the utilizable wind energy potential of 22 GW has already been secured by the temporary license holders.

There are eleven companies holding temporary concessions. The company that has obtained most of them is Ibero Peruana Inversiones (22 contracts). The other concession holders are Norwind, Huayra Kallpa, Energía Eólica, Gaz & L’Energie, Generalima, Inversiones Troy, Petrolera Monterrico, Perú Energía Renovable, Soleol and Sowitec Energías Renovables de Perú. According to the Peruvian Renewable Energy Association (Asociación Peruana de Energías Renovables - Apeger) wind energy could amount to a total investment of over one billion US Dollars in the medium term.

In order to be able to define grid connection and grid integration conditions for wind energy, the Comité de Operación Económica del Sistema Interconectado Nacional (COES) is currently conducting a study which will also define the maximum capacity of wind power which could be connected to the Sistema Eléctrico Interconectado Nacional (SEIN) without disrupting network operations. This is the prerequisite for a possible tender by the government. It is obvious that in a country with a maximum demand of 4 200MW the short term possibilities for the connection of wind turbines to the network are limited.

After several postponements, it is now expected that towards the end of the year 2009 a tender for wind power will be held by Organismo Supervisor de la Inversión en Energía y Minería (OSINERGMIN). In this tender only companies which hold a temporary concession and which can guarantee a certain amount of financing are allowed to take part. However, so far it is not clear how much capacity will be allocated to wind power concessions. The prerequisites, as well as the terms and conditions of the tender will still need to be addressed. It is expected that about half of the projects with temporary concessions will take part in the public RES tender.

Business Climate

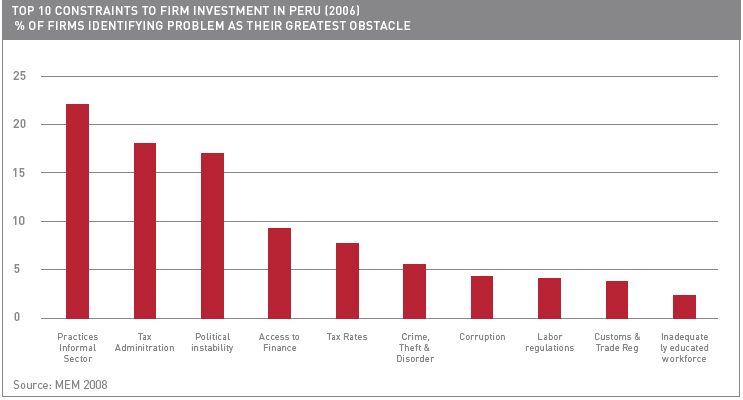

Foreign companies are treated in the same way as Peruvians and there are no restrictions on investments, except commercial operation should not be within 50 km from the national borders. The Foreign Investment Promotion Law of 1991 lays clear rules and therefore ratings of Peru for investments are good (BBB+). Although Peru is very liberal in granting market access to foreign investors, there are still a few obstacles which might hinder investments. The enterprise survey of 2006 by the World Bank shows the Top 10 constraints as perceived by companies investing in Peru (see the following figure).

Regarding electricity generation generally every company can apply for a generation concession according to the LCE. However, since the wind energy market prices are not sufficient to cover the costs, one would need to win the RES support as outlined in Law N° 1002. As stated, renewable energy generation capacity totalling up to 5 % of the overall capacity (~500 MW), which compared to the potential is only a fraction of the possible amount.

Although conditions are very favourable with respect to the wind energy potential and the objectives of the government, many times there have been delays in promised public information such as the wind atlas, the network capabilities and the precise proceedings of the tender. This has created uncertainty among many companies as to whether they should go ahead with their projects. Since temporary concessions are only valid for two years and can only be renewed once for another two years, companies fear that if they cannot go ahead with their plans soon they will lose their capital invested thus far.

Overall there is no experience with large scale utilization of wind power in Peru. However, education levels are higher than the average in Latin America according to the UNESCO. There are several good universities where about one third of school graduates enrol each year, which means there are well educated employees available. However, there is no special education regarding wind energy but rather the conventional courses on engineering and science.

Since there is no large scale utilization of wind power so far there also is no local wind energy industry. Due to that fact there are also no manufacturers, suppliers or service providers. There are a few experts and consultants familiar with that topic and a few local and some subsidiaries of international companies active in project development.

References

- ↑ The contents of this article have been prepared by ECOFYS Germany GmbH and have been edited by Rolf Posorski und Daniel Werner for the study of the German International Cooperation (GIZ 2009): "Energy-policy Framework Conditions for Electricity Markets and Renewable Energies". Originally the contents have been published as: GTZ (2009) Energy-policy Framework Conditions for Electricity Markets and Renewable Energies - 16 country analysis, Eschborn [[1]]

- ↑ Republica del Peru (2008) Atlas Eólico del Peru, retrieved 28.7.2011 [[2]]

- ↑ Homepage of the Ministry of Energy and Mining Peru [[3]]

- ↑ Ministerio de Energia y minas Peru (2009) Perú sector electrico 2009, retrieved 28.7.2011 [[4]]