Difference between revisions of "Fuel Prices India"

***** (***** | *****) m (Text replace - "Fuel Price Exchanre Rate Date" to "Fuel Price Exchange Rate Date") |

***** (***** | *****) m |

||

| (6 intermediate revisions by 3 users not shown) | |||

| Line 1: | Line 1: | ||

| + | |||

{{Fuel Price Factsheet | {{Fuel Price Factsheet | ||

|Fuel Price Country=India | |Fuel Price Country=India | ||

| + | |Fuel Pricing Policies="Pricing policy: Subsidized fuels are provided only through state-owned oil companies. The administered pricing mechanism was dismantled in Apr 2002 except for kerosene and LPG for household use. The price of household kerosene has been set at about Rs 15 (US$0.28)/liter since October 2012, against the average FOB benchmark price in the Arab Gulf of US$0.78/liter. Industrial users of kerosene pay more than triple those paid by households. Although gasoline and diesel prices are meant to be market-based, their prices since fiscal 2004/2005 have been kept lower than what would have prevailed under market conditions. In 2003, government introduced a scheme for allocating price under-recoveries to upstream oil and gas companies, oil marketing companies, and cross-subsidization from gasoline and diesel, but low gasoline and diesel prices have ruled out cross-subsidization since fiscal 2004/2005. Government introduced a price band mechanism with price adjustments every two weeks in 2004, but abandoned it following steady increases in world oil prices. Government in Sep 2012 increased the price of diesel by Rs. 5 (US$0.09)/liter, steepest-ever once-time increase. Retail prices of diesel as charged by India Oil Corporation in New Delhi and benchmark FOB prices relevant to India are shown below. At times retail prices have fallen below the FOB price, signaling a large subsidy. In 2008 and for half of 2012, retail prices were lower than FOB benchmark prices. | ||

| + | Governmetn in Sep 2012 also limited the number of subsidized LPG refills to six a year per household. The price of LPG outside the quota is more than double and that of LPG for commercial use triple the subsidized price. Price differences are considerable. In Jan 2013 in New Delhi, Indian Oil Corporation charged Rs 29 (US$0.53)/kg for refilling 14.2-kg cylinders for the first six refills, Rs 66 (US$1.22)/kg for 14.2-kg cylinders outside of the quota, Rs 81 (US$1.50)/kg for LPG sold in 14.2-kg cylinders to commercial customers, and Rs 83 (US$1.52)/kg for LPG sold in 19-kg cylinders. | ||

| + | |||

| + | Rationing subsidized fuels: Subsidized kerosene is rationed: the central government allocates kerosene to each state based on historical consumption, and each state in turn has its own rules for kerosene allocation to households. Kerosene is sold through the Public Distribution System, the main function of which is to provide subsidized food to the poor. In addition to limiting subsidized LPG to six cylinders a year, the petroleum ministry is piloting a biometric scheme for distribution of subsidized LPG. The 2012/13 budget expands pilot programs, allowing eligible consumers to recoup LPG and kerosene subsidies via the Aadhaar platform (a 12-digit number which the Unique Identification Authority of India will issue for all residents in India). | ||

| + | |||

| + | Social protection: Two separate government committees in 2006 and 2008 recommended moving away from subsidizing the kerosene price to cash transfers to the poor. In 2011, another proposal was made, shifting from a price subsidy to monthly cash transfers of Rs. 300 (about US$6.50) delivered to women. | ||

| + | |||

| + | Consequences of subsidies: Compensation for losses suffered by the three state-owned oil companies marketing subsidized fuels was Rs. 120,000 million (actual, US$2.5 billion) in fiscal 2009/10 (Apr–Mar), Rs. 350,000 million (actual, US$7.7 billion) in fiscal 2010/11, Rs. 650,000 million (revised budget, US$13.6 billion, up from Rs. 200,000 million originally budgeted) in fiscal 2011/12, and Rs. 400,000 million (original budget, US$7.7 billion as of Apr 2012) in fiscal 2012/13, apart from US$0.6 billion set aside for LPG and kerosene in each fiscal year. In addition, oil and gas companies’ contributions have been considerable, amounting, for example, to US$6.6 billion and US$1.5 billion provided by upstream and downstream companies, respectively, in fiscal 2010/11. In the first quarter of fiscal 2012/13, the three downstream state-owned oil companies posted combined losses of Rs. 405 billion (US$7.5 billion) on fuel sales. Lack of timely reimbursement forces oil companies to borrow heavily. Diversion of subsidized kerosene to diesel and other users and of domestic LPG for commercial use has plagued the subsidy program for decades. Points of diversion of subsidized kerosene are well known and investigations have pointed to collusion by civil supplies officials and police. At least three murders, occurring in 2005 and 2011, have been linked to attempts to expose kerosene diversion, including the murder of an investigative journalist publishing a series of articles on diesel adulteration. | ||

| + | |||

| + | Information: State-owned oil companies post detailed information on prices on their Web sites, together with price breakdowns and under-recoveries." | ||

| + | |||

| + | (Source: Kojima, Masami. (2013, forthcoming). “Petroleum product pricing and complementary policies:Experience of 65 developing countries since 2009.” Washington DC: World Bank.) | ||

|Fuel Currency=INR | |Fuel Currency=INR | ||

|Fuel Price Exchange Rate=45.479 | |Fuel Price Exchange Rate=45.479 | ||

| Line 7: | Line 20: | ||

|Fuel Price Composition=GIZ_IFP2012_India.png | |Fuel Price Composition=GIZ_IFP2012_India.png | ||

|Fuel Price Composition Fuel Type=Gasoline 95 Octane | |Fuel Price Composition Fuel Type=Gasoline 95 Octane | ||

| − | |||

|Fuel Price Composition Annotation=For an assumed price of 58.90 INR. | |Fuel Price Composition Annotation=For an assumed price of 58.90 INR. | ||

| − | + | |Fuel Matrix Pricing Mechanism=2 | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |Fuel Pricing | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

|Fuel Matrix Price Level=2.5 | |Fuel Matrix Price Level=2.5 | ||

| − | |||

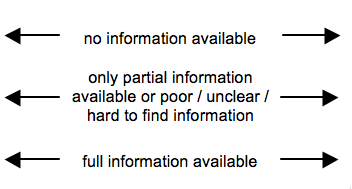

|Fuel Matrix Annotation=Clear information on fuel price breakdown and pricing formula missing. | |Fuel Matrix Annotation=Clear information on fuel price breakdown and pricing formula missing. | ||

|Fuel Transparency Price Composition=2 | |Fuel Transparency Price Composition=2 | ||

|Fuel Transparency Pricing Mechanism=2 | |Fuel Transparency Pricing Mechanism=2 | ||

| − | }} | + | }} {{Fuel Price Factsheet Source |

| − | {{Fuel Price Factsheet Source | ||

|Fuel Price Factsheet Source Type=Pump prices and margins | |Fuel Price Factsheet Source Type=Pump prices and margins | ||

|Fuel Price Factsheet Source Link=http://www.iocl.com | |Fuel Price Factsheet Source Link=http://www.iocl.com | ||

|Fuel Price Factsheet Source Annotation=Indian Oil; retailer | |Fuel Price Factsheet Source Annotation=Indian Oil; retailer | ||

| − | }} | + | }} {{Fuel Price Factsheet Source |

| − | {{Fuel Price Factsheet Source | ||

|Fuel Price Factsheet Source Type=Pump prices and margins | |Fuel Price Factsheet Source Type=Pump prices and margins | ||

|Fuel Price Factsheet Source Link=http://petroleum.nic.in/petstat.pdf | |Fuel Price Factsheet Source Link=http://petroleum.nic.in/petstat.pdf | ||

|Fuel Price Factsheet Source Annotation=Ministry report | |Fuel Price Factsheet Source Annotation=Ministry report | ||

| − | }} | + | }} {{Fuel Price Factsheet Source |

| − | {{Fuel Price Factsheet Source | ||

|Fuel Price Factsheet Source Type=Other Information | |Fuel Price Factsheet Source Type=Other Information | ||

|Fuel Price Factsheet Source Link=http://petroleum.nic.in/ | |Fuel Price Factsheet Source Link=http://petroleum.nic.in/ | ||

| − | |Fuel Price Factsheet Source Annotation=GSI: Lessons Learned from Attempts to Reform India's Kerosene Subsidy | + | |Fuel Price Factsheet Source Annotation=GSI: Lessons Learned from Attempts to Reform India's Kerosene Subsidy |

| − | }} | + | }} {{Fuel Price Factsheet Source |

| − | {{Fuel Price Factsheet Source | ||

|Fuel Price Factsheet Source Type=Other Information | |Fuel Price Factsheet Source Type=Other Information | ||

|Fuel Price Factsheet Source Link=http://www.iisd.org/pdf/2010/lessons_india_kerosene_subsidy.pdf | |Fuel Price Factsheet Source Link=http://www.iisd.org/pdf/2010/lessons_india_kerosene_subsidy.pdf | ||

}} | }} | ||

| + | |||

| + | [[Category:India]] | ||

Latest revision as of 16:04, 15 July 2014

Part of: GIZ International Fuel Price database

Also see: India Energy Situation

Fuel Pricing Policies

| Local Currency: | INR |

| Exchange Rate: | 45.479

|

| Last Update: | 2011/05/01 |

"Pricing policy: Subsidized fuels are provided only through state-owned oil companies. The administered pricing mechanism was dismantled in Apr 2002 except for kerosene and LPG for household use. The price of household kerosene has been set at about Rs 15 (US$0.28)/liter since October 2012, against the average FOB benchmark price in the Arab Gulf of US$0.78/liter. Industrial users of kerosene pay more than triple those paid by households. Although gasoline and diesel prices are meant to be market-based, their prices since fiscal 2004/2005 have been kept lower than what would have prevailed under market conditions. In 2003, government introduced a scheme for allocating price under-recoveries to upstream oil and gas companies, oil marketing companies, and cross-subsidization from gasoline and diesel, but low gasoline and diesel prices have ruled out cross-subsidization since fiscal 2004/2005. Government introduced a price band mechanism with price adjustments every two weeks in 2004, but abandoned it following steady increases in world oil prices. Government in Sep 2012 increased the price of diesel by Rs. 5 (US$0.09)/liter, steepest-ever once-time increase. Retail prices of diesel as charged by India Oil Corporation in New Delhi and benchmark FOB prices relevant to India are shown below. At times retail prices have fallen below the FOB price, signaling a large subsidy. In 2008 and for half of 2012, retail prices were lower than FOB benchmark prices. Governmetn in Sep 2012 also limited the number of subsidized LPG refills to six a year per household. The price of LPG outside the quota is more than double and that of LPG for commercial use triple the subsidized price. Price differences are considerable. In Jan 2013 in New Delhi, Indian Oil Corporation charged Rs 29 (US$0.53)/kg for refilling 14.2-kg cylinders for the first six refills, Rs 66 (US$1.22)/kg for 14.2-kg cylinders outside of the quota, Rs 81 (US$1.50)/kg for LPG sold in 14.2-kg cylinders to commercial customers, and Rs 83 (US$1.52)/kg for LPG sold in 19-kg cylinders.

Rationing subsidized fuels: Subsidized kerosene is rationed: the central government allocates kerosene to each state based on historical consumption, and each state in turn has its own rules for kerosene allocation to households. Kerosene is sold through the Public Distribution System, the main function of which is to provide subsidized food to the poor. In addition to limiting subsidized LPG to six cylinders a year, the petroleum ministry is piloting a biometric scheme for distribution of subsidized LPG. The 2012/13 budget expands pilot programs, allowing eligible consumers to recoup LPG and kerosene subsidies via the Aadhaar platform (a 12-digit number which the Unique Identification Authority of India will issue for all residents in India).

Social protection: Two separate government committees in 2006 and 2008 recommended moving away from subsidizing the kerosene price to cash transfers to the poor. In 2011, another proposal was made, shifting from a price subsidy to monthly cash transfers of Rs. 300 (about US$6.50) delivered to women.

Consequences of subsidies: Compensation for losses suffered by the three state-owned oil companies marketing subsidized fuels was Rs. 120,000 million (actual, US$2.5 billion) in fiscal 2009/10 (Apr–Mar), Rs. 350,000 million (actual, US$7.7 billion) in fiscal 2010/11, Rs. 650,000 million (revised budget, US$13.6 billion, up from Rs. 200,000 million originally budgeted) in fiscal 2011/12, and Rs. 400,000 million (original budget, US$7.7 billion as of Apr 2012) in fiscal 2012/13, apart from US$0.6 billion set aside for LPG and kerosene in each fiscal year. In addition, oil and gas companies’ contributions have been considerable, amounting, for example, to US$6.6 billion and US$1.5 billion provided by upstream and downstream companies, respectively, in fiscal 2010/11. In the first quarter of fiscal 2012/13, the three downstream state-owned oil companies posted combined losses of Rs. 405 billion (US$7.5 billion) on fuel sales. Lack of timely reimbursement forces oil companies to borrow heavily. Diversion of subsidized kerosene to diesel and other users and of domestic LPG for commercial use has plagued the subsidy program for decades. Points of diversion of subsidized kerosene are well known and investigations have pointed to collusion by civil supplies officials and police. At least three murders, occurring in 2005 and 2011, have been linked to attempts to expose kerosene diversion, including the murder of an investigative journalist publishing a series of articles on diesel adulteration.

Information: State-owned oil companies post detailed information on prices on their Web sites, together with price breakdowns and under-recoveries."

(Source: Kojima, Masami. (2013, forthcoming). “Petroleum product pricing and complementary policies:Experience of 65 developing countries since 2009.” Washington DC: World Bank.)

Fuel Prices and Trends

| Gasoline 95 Octane | Diesel | |

|---|---|---|

| in USD* |

|

|

| in Local Currency |

|

|

* benchmark lines: green=US price; grey=price in Spain; red=price of Crude Oil

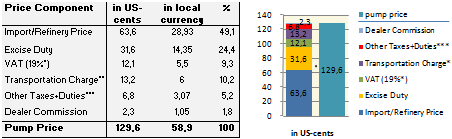

Fuel Price Composition

Price composition for one litre of Gasoline 95 Octane.

For an assumed price of 58.90 INR.

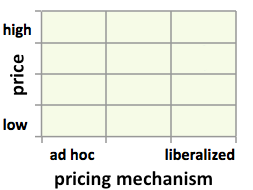

At a Glance

| Regulation-Price-Matrix |

| ||||

|

|

|

| ||

Clear information on fuel price breakdown and pricing formula missing.

Sources to the Public

| Type of Information | Web-Link / Source |

|---|---|

| Other Information | http://petroleum.nic.in/ (GSI: Lessons Learned from Attempts to Reform India's Kerosene Subsidy) |

| Other Information | http://www.iisd.org/pdf/2010/lessons_india_kerosene_subsidy.pdf |

| Pump prices and margins | http://www.iocl.com (Indian Oil; retailer) |

| Pump prices and margins | http://petroleum.nic.in/petstat.pdf (Ministry report) |

Contact

Please find more information on GIZ International Fuel Price Database and http://www.giz.de/fuelprices